1. Forex Market Insight

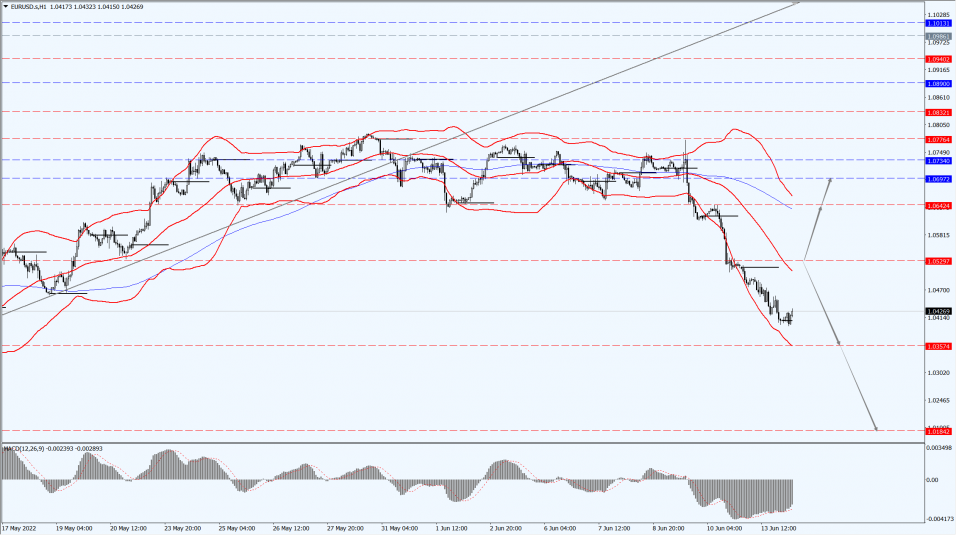

EUR/USD

The plan of the European Central Bank (ECB) to open interest rate hikes after July reflects their slow response to tightening monetary policy.

At the same time, the crisis in Ukraine has exposed energy, refugees and food crises as obstacles to economic recovery.

Therefore, the short-term rebound space for the euro is limited.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

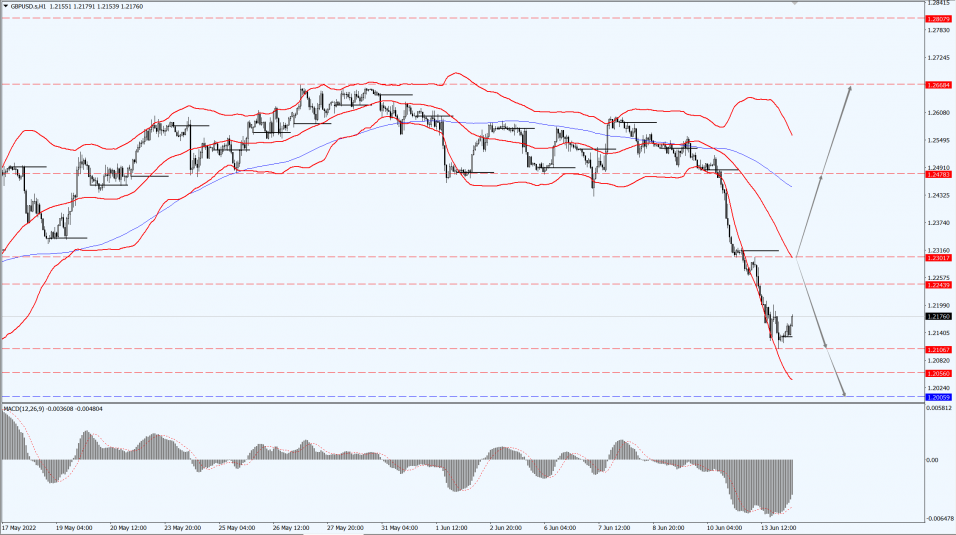

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD fluctuated and fell last week, as a result of strong dollar and pressure put on by the U.K. political crisis.

But expectations of a rate hike by the Bank of England next week could help limit the pound’s decline.

Despite the unstable economic situation, the market expects the Bank of England to continue tightening policy, announcing a 25 basis point rate hike at its monetary policy meeting on 16th June 2022.

Additionally, some analysts expect that the Bank of England benchmark interest rate increase to 1% will stop raising interest rates, as market participants remain concerned about the outlook for the British economy.

Inflationary fever exacerbates the risk of stagflation.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2301-line today. If GBP runs below the 1.2301-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2005. If GBP runs above the 1.2301-line, then pay attention to the suppression strength of the two positions of 1.2478 and 1.2668.

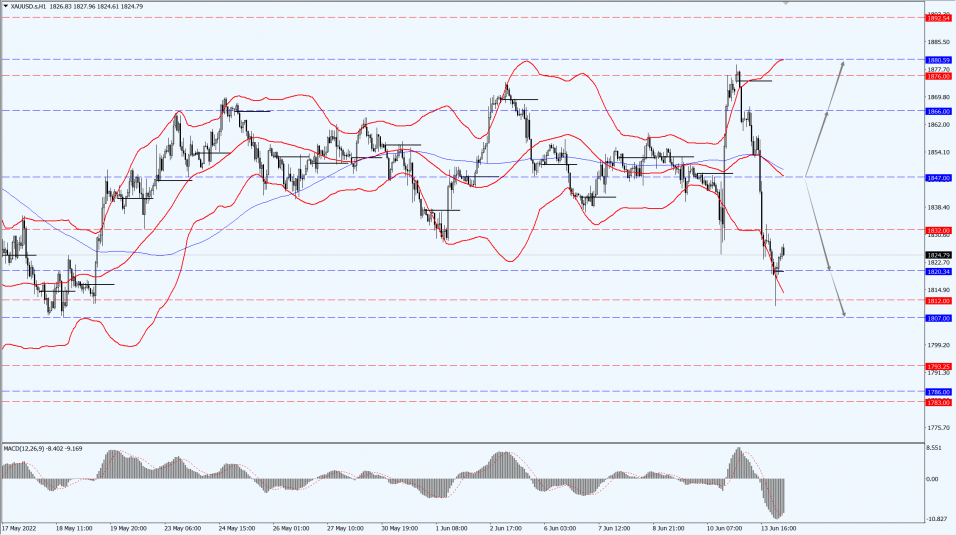

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

The gold market is under pressure again.

It is currently below $1,850 an ounce and trading near $1,823.

As rising Fed rate hike expectations push the dollar index to a 20-year high, Bond yields rose to 11-year high.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily above the 1832-line, then it will pay attention to the support strength of the 1880 and 1892 positions. If the gold price breaks below the 1832-line, then pay attention to the suppression strength of the two positions of the 1820 and 1807.

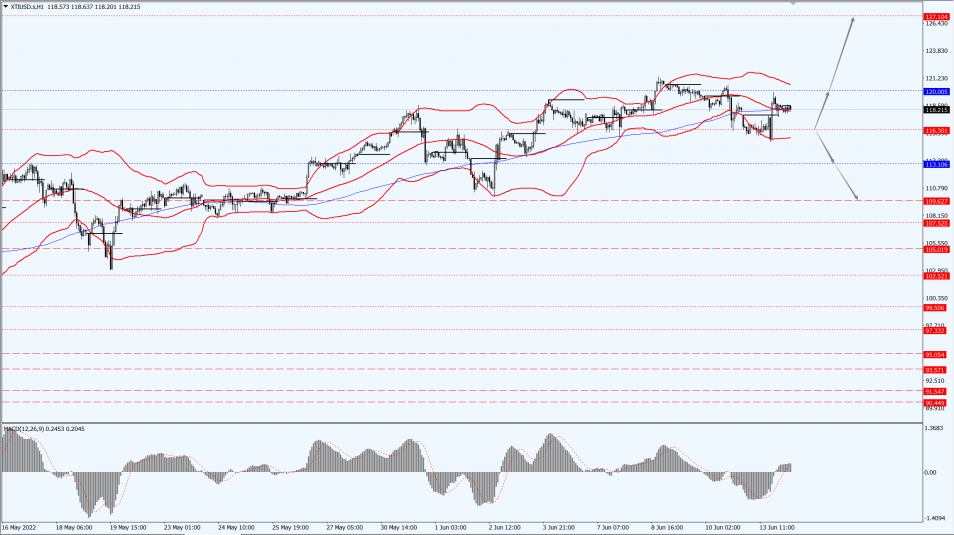

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Russia’s main pipeline gas deliveries to Europe remain stable and 20-year cooperation agreements were signed over the weekend between Iran and Venezuela.

Involving the energy field, helping the bears,

Oil prices hovering below the $120 again.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 116.30-line today. If the oil price runs above the 116.30-line, then focus on the suppression strength of the two positions of 120.06 and 127.10. If the oil price runs below the 116.30-line, then pay attention to the support strength of the two positions of 113.10 and 109.62.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.