1. Forex Market Insight

EUR/USD

The euro ended the session at $1.1073 against the dollar, rising up by 1.62%, having hit a 22-month low of $1.0806 on Monday, 7th March 2022.

The ECB will meet on Thursday, 10th March 2022, but in the shadow of stagflation, money markets expect policymakers to delay raising interest rates until the end of the year.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today we focus on the 1.0940-line today, if the euro runs steadily above the 1.0940-line, then pay attention to the suppression strength of the 1.1096 and 1.1143 positions. If the euro strength breaks below the 1.0940-line, then pay attention to the support strength of the 1.0890 and 1.0832 positions.

GBP Intraday Trend Analysis

Fundamental Analysis:

The ECB will meet on Thursday, 10th March 2022, but in the shadow of stagflation, money markets expect policymakers to delay raising interest rates until the end of the year.

The market indicators for the measuring of inflation expectations have risen sharply in recent days. With the 5-year break-even inflation rate, U.K. top 5% for the first time since data became available in 1996.

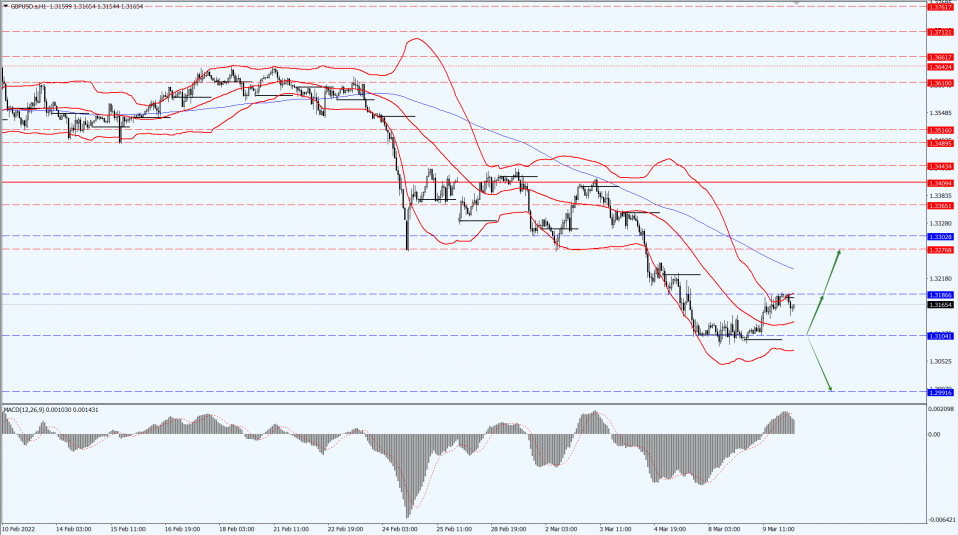

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3104-line today. If the pound runs above the 1.3104-line, it will pay attention to the suppression strength of the two positions of 1.3186 and 1.3276. If the pound runs below the 1.3104-line, it will pay attention to the support strength of the 1.2991-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fluctuated and fell, extending the overnight decline and now falling back to around $1,970.

Commodities generally fell after Ukraine’s top think tank said it was open to discussing Russia’s demands for neutrality. Spot gold followed the decline by falling more than 3% yesterday.

During the day, investors need to continue to pay attention to further news of the situation in Russia and Ukraine.

Besides, investors should also focus more on a change in the number of U.S. initial jobless claims and U.S. CPI data for February in the evening.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 2002-line today. If the gold price runs steadily below the 2002-line, then it will pay attention to the support strength of the two positions of 1976 and 1960. If the gold price breaks above the 2002-line, it will open up further upward trend. At that time, pay attention to the suppression strength of the 2020-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, Brent oil futures tumbled 13.2% to settle at $111.14 per barrel. It fell 17% during the session, the largest drop since the beginning of the global epidemic.

Ukrainian President Volodymyr Zelensky reiterated his willingness to consider some compromises to end the war with Russia.

Meanwhile, oil prices suffered a heavy setback after the UAE said it would encourage OPEC+ members to increase production speed.

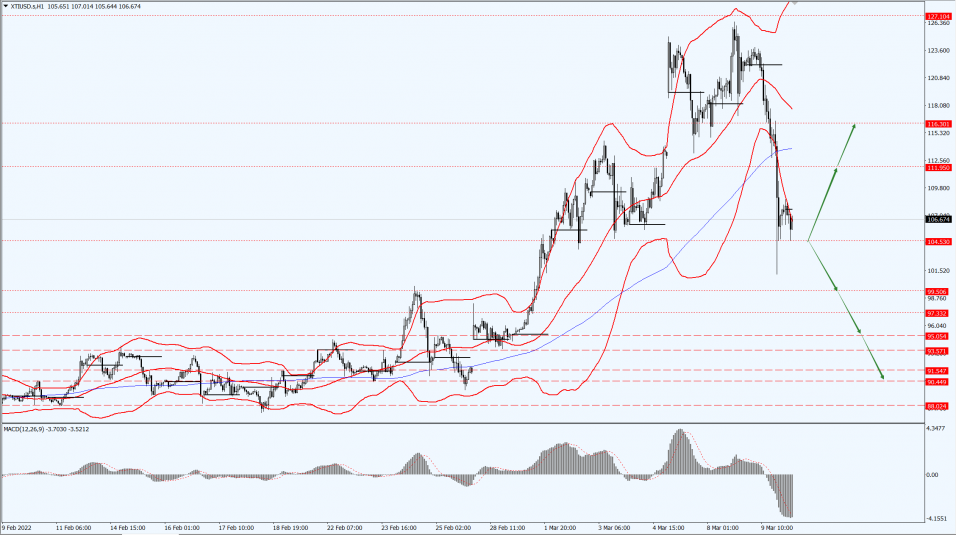

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 104.53-line today. If the oil price runs above the 104.53-line, then focus on the suppression of the 111.95 and 116.30 positions. If the oil price breaks below the 104.53-line, then pay attention to the support strength of the 99.50 and 95.05 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.