1. Forex Market Insight

EUR/USD

The growing unease in the market may support the dollar as we will see the U.S. economy remain in a favorable position in the short term. This is because the U.S. is less dependent on Russian energy supplies than Europe.

Also, this could benefit the dollar in the short term, leading to a weaker euro to the downside. With the EUR/USD volatility indicator climbing to its highest level since March 2020 following the Russia-Ukraine conflict.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today we focus on the 1.0832-line, if the euro runs steadily above the 1.0832-line, then pay attention to the suppression strength of the two positions of 1.0986 and 1.1031. If the strength of the euro breaks below the 1.0832-line, then pay attention to the support strength of the two positions of 1.0776 and 1.0697.

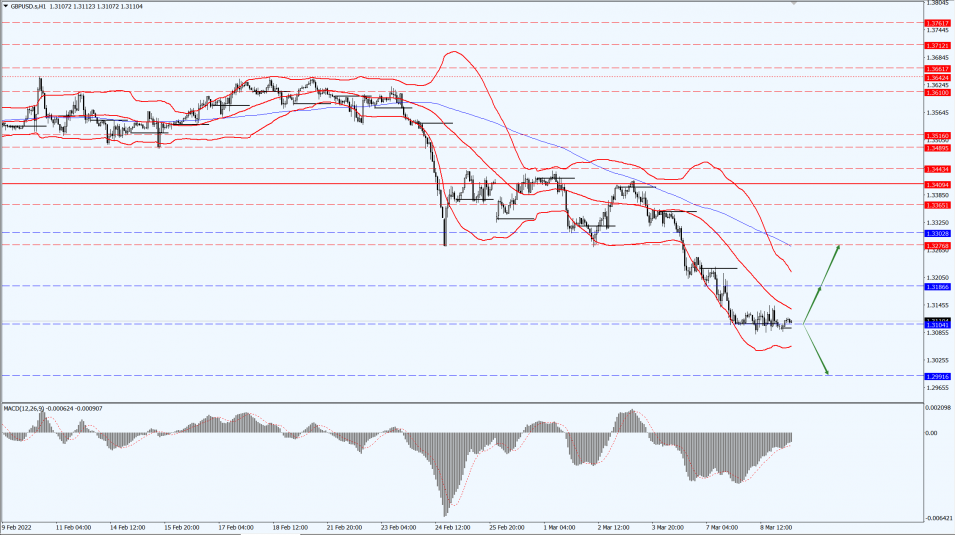

GBP Intraday Trend Analysis

Fundamental Analysis:

Due to rumors of an export embargo against Russia, the commodity market has moved higher again, and concerns about stagflation in Europe will continue to increase. For this reason, the pound continues to be suppressed by selling in the market.

During this interval, it fell to as low as 1.31 against the dollar, hitting a new low in nearly two months.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3104-line today. If the pound runs above the 1.3104-line, it will pay attention to the suppression of the 1.3186 and 1.3276 positions. If the pound runs below the 1.3104-line, it will pay attention to the support strength of the 1.2991-line.

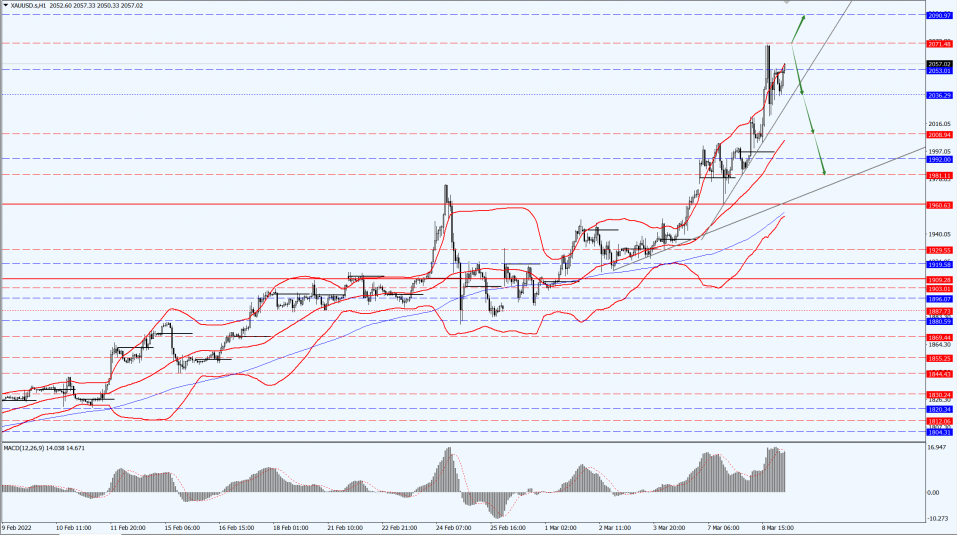

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold was up by 2.4% at $2,046.49 an ounce, having risen to $2,069.89 earlier in the session, just shy of its August 2020 peak of $2,072.50.

The surge in energy prices, grain prices and base metal prices ultimately led to increased inflationary pressures, which continue to be the main supporting factor behind higher gold prices.

In addition, affected by the situation in Ukraine and Russia, there was a lot of safe-haven buying in the gold market, which further pushed up the price of gold.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 2071-line today. If the gold price runs steadily below the 2071-line, then it will pay attention to the support strength of the two positions of 2036 and 2008. If the gold price breaks above the 2071-line, it will open up further upward space. At that time, pay attention to the suppression strength of the 2090-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Crude oil prices rose on Tuesday, 8th March 2022, after U.S. President Joe Biden announced the United States would ban Russian energy imports and Britain said it would phase out Russian oil imports by the end of the year.

West Texas Intermediate rose by 3.6% to settle at more than $123 per barrel and Brent rose by 3.9%. The surging oil prices pushed up retail fuel prices worldwide.

According to the American Automobile Association, U.S. gasoline prices are at an all-time high. Diesel prices also soared in Europe, highlighting the inflationary impact of rising energy costs.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 127.10-line today. If the oil price runs below the 127.10-line, then focus on the support strength of the 116.30 and 111.95 positions. If the oil price breaks above the 127.10-line, then pay attention to the suppression of the 133.81-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home