1. Forex Market Insight

EUR/USD

The spread of the Delta variant continues to pose challenges to the U.S. economy, fueling the notion that the Federal Reserve may delay tapering its bond purchases. This potential delay could put pressure on the dollar in the short term. However, the dollar will gradually strengthen as global economic growth slows down, while the Fed moves toward normalization.

With the pandemic, the recent challenges in the U.S. have been significant, and the Fed believes that this is a near-term downside risk. In fact, the U.S. economic recovery is slowing. These factors are fueling the idea that the Fed may delay tapering its bond purchases, which will test the dollar. Once the spread of the Delta variant shows signs of topping out, then the Fed will presumably resume its gradual normalization path, putting non-U.S. currencies such as the euro under pressure to the downside.

Technical Analysis:

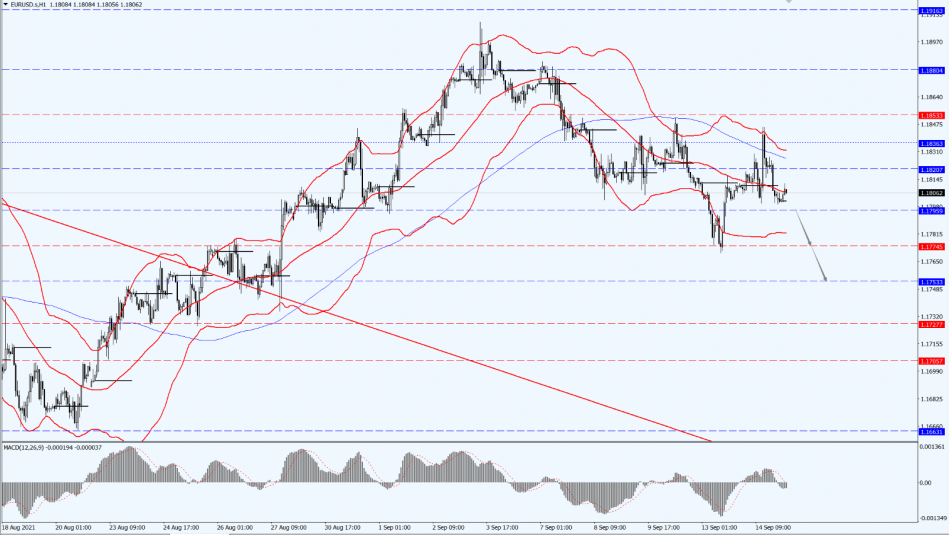

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro pays attention to the 1.1795-line. Once the strength of the euro breaks below the 1.1795-line, it will open up a greater downside potential. At that time, pay attention to the support at 1.1774 and 1.1753.

GBP Intraday Trend Analysis

Fundamental Analysis:

The upside risks of sterling inflation will prompt the Bank of England to signal policy normalization. These inflation risks are currently underestimated, and over time, it could drive the pound higher.

Policy normalization refers to the return of interest rates and broader monetary policy leverage (such as quantitative easing) to pre-crisis levels. Central banks that restore their policy to normal levels ahead of their peers will typically have an advantage for their respective currencies.

Last week’s U.K. tax increase was not expected to put pressure on the pound going forward. Also, the proposed increase in National Insurance tax basically has no impact on growth as the money will be used to fund additional public spending. Meanwhile, the bank expects the October 27th budget to add up to £15 to £20 billion to public spending.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is focused on the Bollinger Band Middle Rail Line. As long as the British pound runs below the Bollinger Band Middle Rail Line, it will remain the bearish trend. Below, we will focus on the support of 1.3771. Once the British pound sits on the Bollinger Band Middle Rail, it will test the upper pressure of 1.3878 again.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold rose on Tuesday, 14th September 2021, as the weaker-than-expected U.S. inflation data eased investor concerns that the Federal Reserve will soon be forced to taper its bond purchases.

U.S. consumer prices rose less than expected in August, ending a streak of sharp gains, indicating that some of the upward pressure on inflation is beginning to wane. After the data was released, the dollar fell and U.S. Treasury yields slipped, boosting the demand for interest-free gold.

Against this background, gold prices are under pressure this year as markets worry that the pandemic-era stimulus package will soon be scaled back as the global economy recovers.

Technical Analysis:

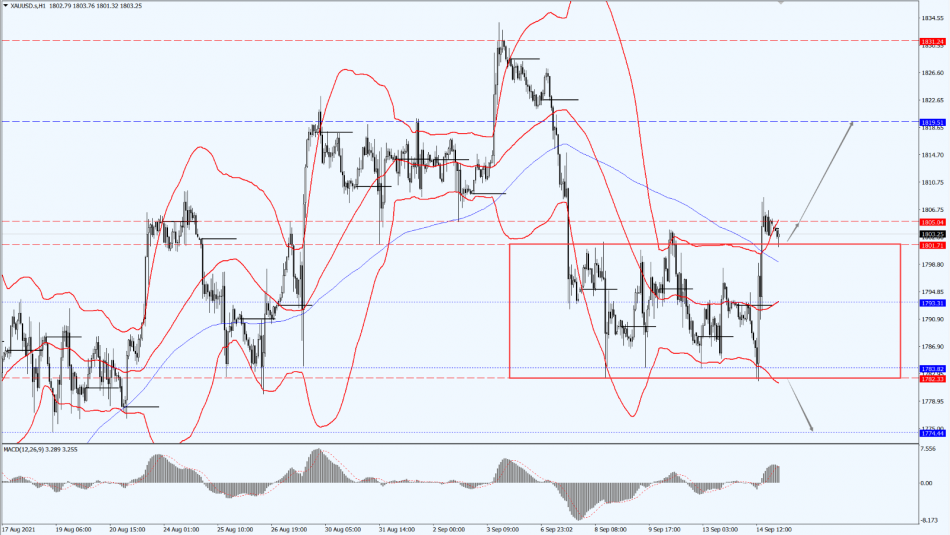

(Gold 1-hour chart)

Trading Strategies:

On gold, pay attention to the 1805-line today. As long as the price of gold stays above the 1805-line, it will open up a greater upside potential. Once the price of gold drops below the 1801-line and falls below the 1801-line, it will open up a greater downside potential. At that time, pay attention to the support of the 1793-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

The U.S. API stocks fell, as the oil prices fluctuated strongly in the short term. The impact of another storm, Nicholas, in the Gulf of Mexico on oil and gas production was much lower than expected. With the International Energy Agency lowering its oil price forecast for this year, international oil price gains have slowed down.

According to the data from the American Petroleum Institute, the U.S. crude oil inventories decreased by 5.4 million barrels to 407.4 million barrels in the week ended on September 10th. Meanwhile, gasoline inventories decreased by 2.8 million barrels and distillate inventories decreased by 2.9 million barrels.

Technical Analysis:

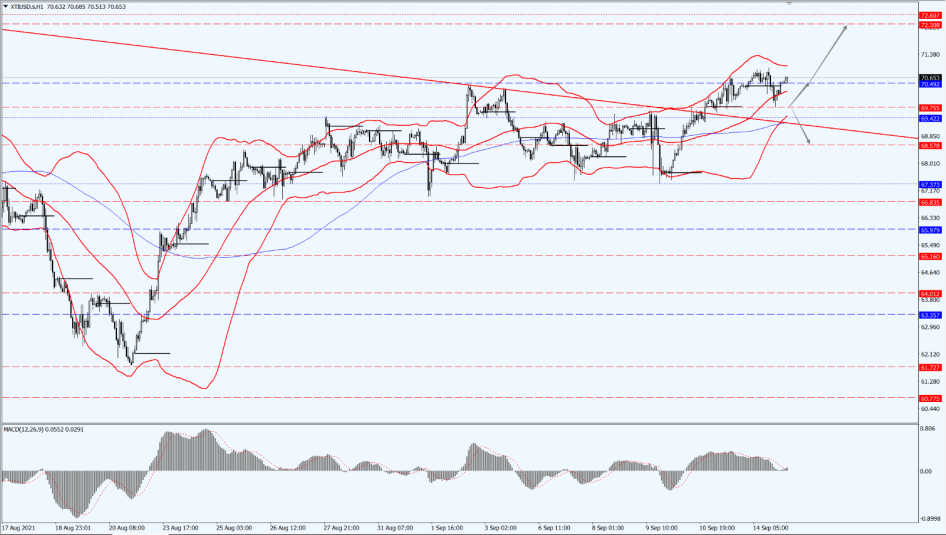

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 69.75-line. As long as the oil prices run above the 69.75-line, they will maintain the bullish trend. Once the oil price drops below the 69.75-line, there is a possibility of it opening up a greater downside potential. At that time, focus on the 68.57-line support.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home