1. Forex Market Insight

EUR/USD

The dollar fell as the euro surged, driven by expectations of the ECB rate hike. The dollar underperformed all G-10 currencies as U.S. data showed a sluggish economic recovery.

The U.S. stocks rose and the long end of the Treasury yield curve inverted as economic growth is facing concerns. The euro posted its biggest gain since May as traders increased bets on the ECB rate hike, despite the latter’s attempts to dampen such expectations.

The dollar spot index fell below its 50-day moving average to hit a 1-month low. Adding to this, the month-end rebalancing models showed strong selling of the dollar against other currencies. The long end of the U.S. bond yield curve flattened, with the 30-year yield falling below the 20-year yield for the first time.

Meanwhile, the euro rose by 0.7% after a speech by ECB President Lagarde failed to dampen the market expectations for a rate hike after Spanish data showed the biggest price increase in 30 years.

Technical Analysis:

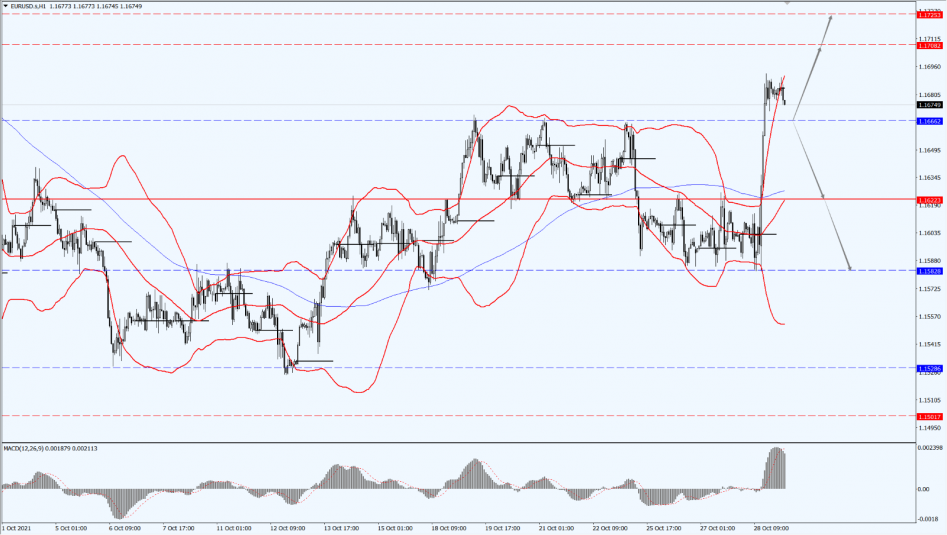

(EUR/USD 1-hour chart)

Execution Insight:

Today pay attention to the 1.1666-line. If the euro remains stable above the 1.1666-line, then pay attention to the suppression of the 1.1708 and 1.1725 lines. Once the euro falls below the 1.1666-line again, then pay attention to the support at the 1.1582 and 1.1622 positions.

GBP Intraday Trend Analysis

Fundamental Analysis:

The dollar index fell by 0.52% to 93.37, breaking below its 50-day moving average and hitting a 1-month low. Plus, the month-end rebalancing models showed strong selling in the dollar against other currencies.

With this, the long end of the U.S. bond yield curve flattened, as the 30-year yield fall below the 20-year yield for the first time. Thus, the decline in U.S. indices led to a shock upside in the pound.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the direction of the breakthrough in the range of 1.3721 to 1.3834. If it breaks upwards through the 1.3834-line, it will open up further upside, and then pay attention to the 1.3888-line. If it falls below the 1.3721-line, it will open up a further downside space. Then, pay attention to the support strength of the two positions of 1.3574 and 1.3669.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, gold prices were slightly higher, mainly due to the European Central Bank’s switch to hawkish. The dollar weakened and data showed that the U.S. economic growth fell to the slowest in more than a year, boosting demand for safe-haven gold.

However, the U.S. stocks and U.S. bond yields rose sharply, limiting the gold price gains. Intraday focus on the U.S. PCE price index in September, the September personal spending, and the October Chicago PMI are worth pay attention to.

Technical Analysis:

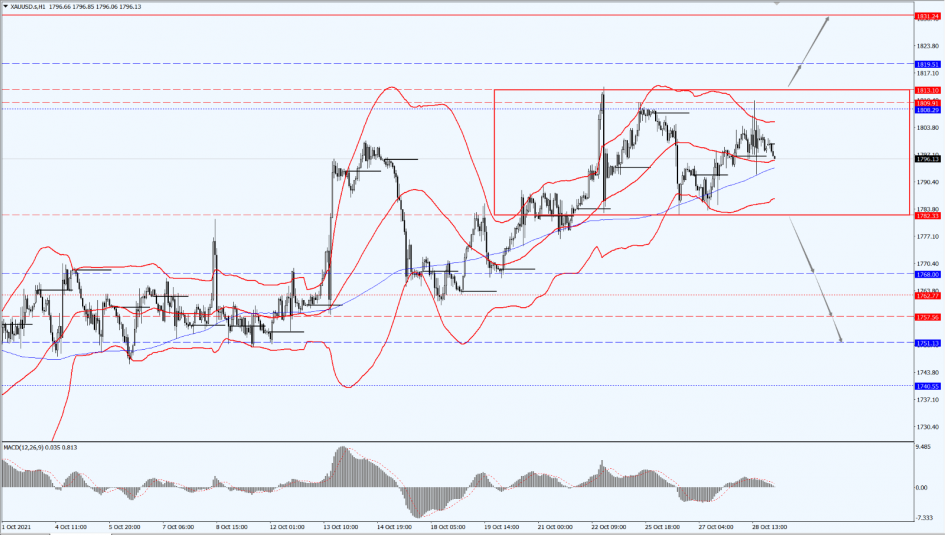

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the direction of the breakthrough of the range from 1782 to 1813. If it breaks upwards through the 1813-line, then pay attention to the suppression of the 1819 and 1831 positions. If it falls below the 1782-line, then pay attention to the support of the 1768 and 1752 positions.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices touched a two-week low of $80.58 per barrel on Thursday, 28th October 2021, so before Iran said it would resume talks with world powers on its nuclear program by the end of November and U.S. crude inventories increased. But the U.S. oil closed up by more than 1% as OPEC and its allies expect the global oil market to tighten in the fourth quarter.

For Intraday, we will focus on the U.S. September PCE price index annual rate, the U.S. September monthly personal spending rate, the U.S. October University of Michigan consumer confidence index final value, and the G20 finance ministers meeting held on Saturday at 1:00 as announced by the U.S. on 29th October.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 83.04-line. If the oil price runs below the 83.04-line, we will maintain the bearish mindset. With this, we will pay attention to the support at the 80 and 76.89 positions. If the oil price rises above the 83.04-line again, it will test the first-line suppression at 85.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.