1. Forex Market Insight

EUR/USD

The euro continued to fall and was the worst performing G -10 currency of the day. It fell by 0.16% in late trading to 1.1580, having earlier touched its lowest since July 2020 at 1.1563.

The euro was weighed down by cross-selling pressure from the pound, the yen, and the monthly hedging transactions. In September, the euro fell by 1.94% against the dollar and 2.34% in the third quarter.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1622-line. If it runs stably below the 1.1622-line, pay attention to the support of the 1.1554-line. If the euro rises above the 1.1622-line again, it will open up further room for rebound. At that time, pay attention to the suppression of the 1.1663 and 1.1708 positions.

GBP Intraday Trend Analysis

Fundamental Analysis:

Even if the dollar retreats further in the near term, it is expected to regain its recent gains in due course. While long bond yields have risen in most major economies, U.S. bond yields have risen more than most public bonds. And importantly, their gains have been driven in large part by higher real yields, reflecting expectations of tighter monetary policy. With this, the market is digesting expectations of a rate hike by the Bank of England.

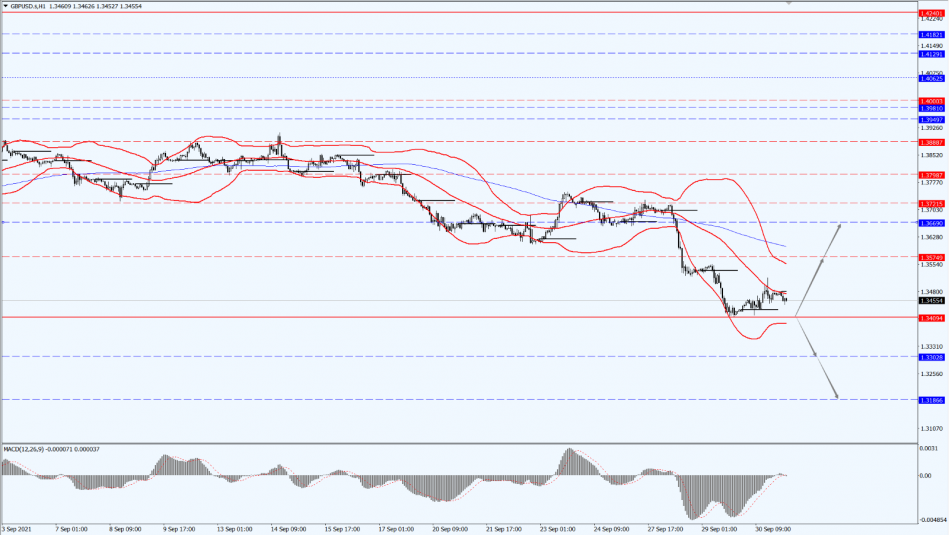

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today pays attention to the 1.3409-line. If it falls below the 1.3409-line, it will remain bearish. At that time, pay attention to the support at 1.3302 and 1.3186. If it is above the 1.3409-line, pay attention to the strength of its rebound. With this, pay attention to the suppressive strength in two positions at 1.3574 and 1.3669.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose more than 2% yesterday. Earlier, the dollar fell owing to discouraging weekly U.S. jobs data. However, the Federal Reserve will soon begin to taper its expectations of economic support, driving gold prices to fall recently, which is set to record a quarterly decline.

The data released yesterday showed an increase in initial jobless claims last week, potentially raising concerns about a weaker labor market. In return, this has also led to uncertainty about the Fed tapering its bond purchases as they look to the possibility of delaying in tapering could be beneficial to gold prices.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is paying attention to the 1760-line today. If the price of gold breaks through the 1760-line, it will open up room for further upside for the price of gold. At that time, pay attention to the suppression of the two positions of 1768 and 1782.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices hovered around 75.45 yesterday. The oil prices closed up by nearly 10% in September, after a turbulent final trading session. The U.S. oil was down by 0.3% and Brent was down by 0.2%.

On that basis, news emerged during the session that Asian powers had ordered several of the country’s largest state-owned energy companies to secure supplies this winter. Meanwhile, the White House reiterated concerns about rising prices, offsetting prices from an unexpected rise in U.S. crude inventories and a stronger dollar pressure.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 75.69-line. If the oil prices are running below the 75.69-line, pay attention to the support at the 75.04 and 73.90 positions. Once the oil price breaks through the 75.69-line, it will open up further upward potential. At that time, pay attention to the suppression at the 76.89-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.