1. Forex Market Insight

EUR/USD

The dollar hit a new high since July last year and rose against most major developed market currencies after a series of U.S. economic data were released.

Data showed that U.S. first-time jobless claims fell to their lowest level since 1969. By the same token, the euro weakened amid options-related selling.

Through this, the dollar touched a 16-month high against the euro as investors bet the Federal Reserve will tighten monetary policy sooner than other central banks.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1183-line. If the euro runs steadily above the 1.1183-line, look at the strength of the euro’s rebound. At that time, pay attention to the suppression of the upper 1.1223 and 1.125 positions. If the euro’s strength drops below the 1.1183-line, then pay attention to the support strength at the positions of 1.1143 and 1.1096.

GBP Intraday Trend Analysis

Fundamental Analysis:

The dollar index rose by 0.38% to 96.86. Data released earlier showed that U.S. consumer spending rose more than expected in October, and price pressures also heated up.

The minutes of the Federal Reserve’s last policy meeting released on Wednesday, 24th November 2021, showed that several policymakers said they were open to accelerating the end of the bond purchase program and speeding up the move toward higher interest rates if inflation remains high. Against this background, the strong rise in the dollar caused pressure on the pound to the downside.

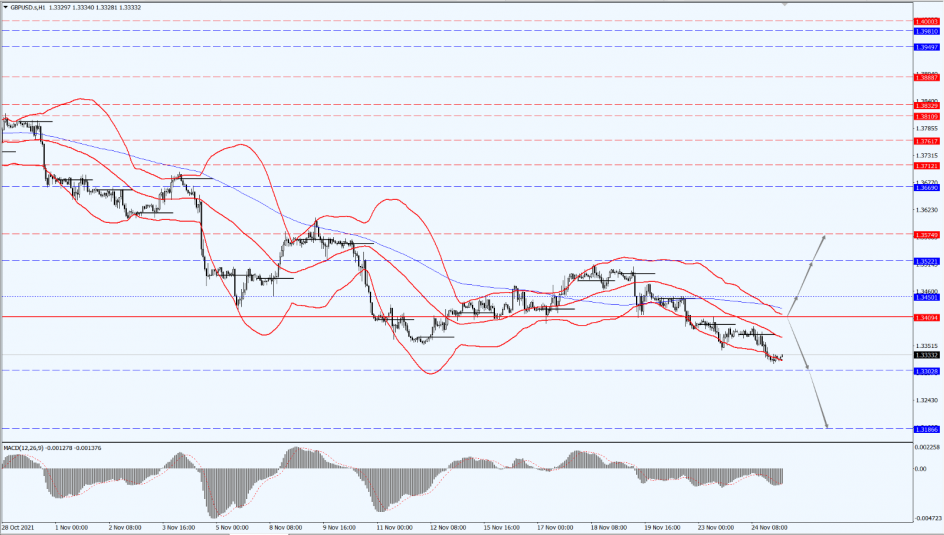

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3409-line. If the pound runs below the 1.3409-line, pay attention to the 1.3302-line of support. If the pound strength rises above the 1.3409-line, then pay attention to the suppression at the 1.3450 and 1.3522 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fell to a three-week low on Wednesday, 24th November 2021, having fallen earlier in the day to its lowest level since 4th November 2021, at $1,778.70 per ounce.

Pessimism was exacerbated by market concerns about an earlier-than-expected Fed rate hike as strong U.S. economic data boosted the dollar and higher U.S. bond yields.

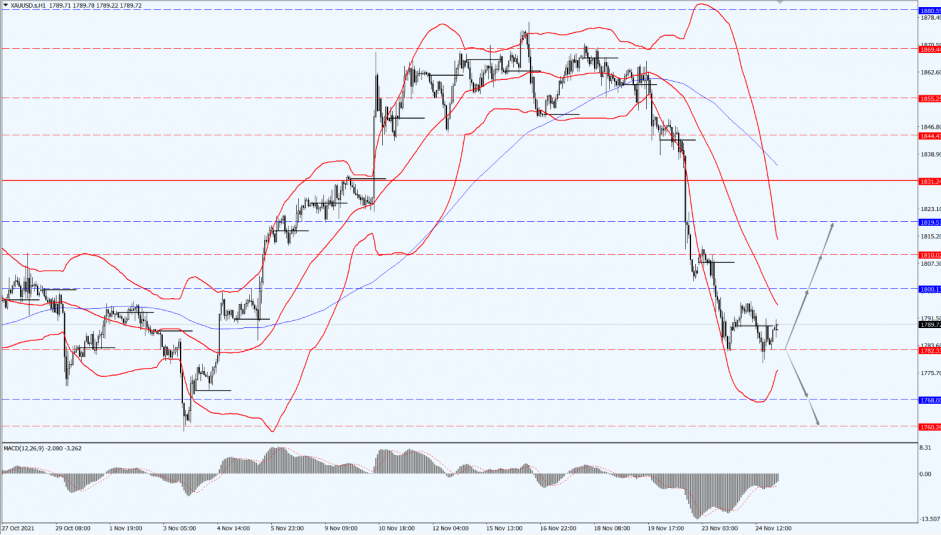

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold is likely to come out of the previous substantial downside of the restorative market. Therefore, pay attention to 1782-line. If the price of gold continues to run steadily above 1782, then pay attention to the two positions of 1800 and 1810. If the price of gold plunges below 1782, it will open up a further downside. At that time, focus on the supporting strength at 1768 and 1760.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, the futures of crude oil fell slightly by 0.1% to settle at $82.25 per barrel.

Earlier, EIA data showed that crude oil inventories increased by 1.017 million barrels in the week ended 19th November 2021, with oil prices under pressure to move slightly lower.

However, gasoline stocks fell by 603,000 barrels to their lowest level since November 2017, refinery stocks fell by 1.968 million barrels and U.S. Strategic Petroleum Reserve (SPR) stocks fell to their lowest level since June 2003, allowing oil prices to gain some support.

The U.S. announced on Tuesday, 23rd November 2021, that tens of millions of barrels of oil will be released from the Strategic Petroleum Reserve, joining India, South Korea, Japan and the United Kingdom to cool oil prices.

This comes after the Organization of the Petroleum Exporting Countries (OPEC) and its allies in the OPEC+ alliance of oil-producing countries repeatedly ignored calls to increase crude supplies.

Japan will release hundreds of thousands of kiloliters of oil from its national reserves, but the timing is to be determined, Japanese Economy, Trade and Industry Minister Koichi Hagiota said Wednesday.

According to a document obtained, if 66 million barrels of crude oil were released over a two-month period, excess supply in the global market would increase by 1.1 million barrels per day in January and February to 2.3 million barrels per day and 3.7 million barrels per day, respectively.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 76.89-line. If oil prices run above the 76.89-line, focus on the suppression of the 78.92 and 80 positions in turn. If the oil price drops below 76.89, it will open up further downward space. At that time, focus on the strength of support at 75.69 and 75.04 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.