1. Forex Market Insight

EUR/USD

European Central Bank Executive Board Member Isabel Schnabel said on Monday, September 20, 2021, that the pace of the ECB’s bond purchases has become “less important” as the economic outlook improves and the money printing program becomes a tool to guide interest rate expectations.

Schnabel also welcomed the recent surge in inflation. Her speech may be seen as preparation for a further reduction in the pace of bond purchases. At present, the eurozone economy from the pandemic-induced recession recovery, and inflation is expected to rise.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro pays attention to the suppression of the 1.1753-line. If the euro stands above the 1.1753-line, it can open up a further upside potential. At that time, focus on the suppression of the 1.1779 and 1.1795 positions.

GBP Intraday Trend Analysis

Fundamental Analysis:

It is highly difficult for the Bank of England (BoE) to launch a tough policy which could help to suppress the pound’s further upward movement in the near term. However, the BoE has been cautious about chasing the pound higher in the short term. Thus, the risk of disappointment is greater and could trigger a temporary pullback lower in the pound.

The BoE is expected to stick mainly to its policy from August, when they formally adopted a gradual tightening trend. It is also expected that the BoE will acknowledge that third-quarter GDP growth is likely to be lower than the expected 2.9%.

Adding to that, there are more concerns that supply constraints from Brexit and the Covid-19 pandemic will put a bigger dent in the recovery. With the combination of slower growth and rising inflation creating a less favorable combination for the pound, and the expectations of a BoE rate hike already well reflected in the market, the BoE will need to send a stronger signal for the pound to break through key resistance levels.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is focused on the strength of 1.3601 first-line support, and the top is focused on the suppression of the two positions 1.3669 and 1.3721 in turn.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

The dollar rose to its highest level in nearly a month, while the U.S. Treasury yields slipped. Gold prices received some support as Fed Chairman Jerome Powell will face challenge at the central bank meeting starting Tuesday, 21st September 2021, leaning toward tapering stimulus but hoping to avoid sparking speculation that the action signals higher interest rates.

In addition, the markets expect Fed officials to signal a tapering of bond purchases, and economists expect the Fed to formally announce the cut in November.

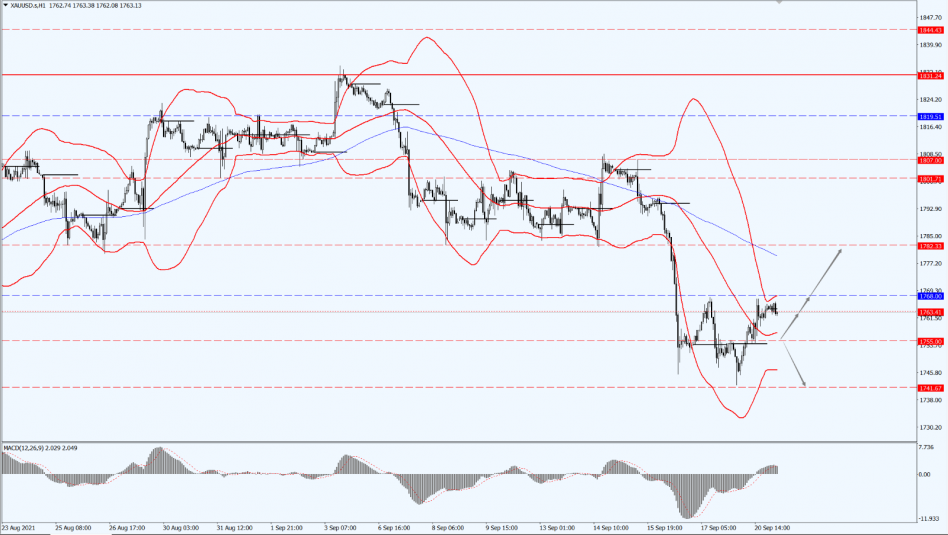

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the support of the 1755-line. If the price of gold remains above the 1755- line, it will maintain the bullish trend. On the top, pay attention to the suppression of the 1768 and 1782 positions. Once it falls below 1755, look at the support of the 1741 line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. crude oil futures fell by 2.3% to close at a more than one-week low as investor concerns about demand for crude oil from Asian countries intensified. In addition, a stronger dollar has reduced the attractiveness of dollar-denominated commodities.

Crude oil prices have performed well so far this month, with the U.S. crude futures up about 4% in September, partly due to storms that still shut down some oil production capacity in the U.S. Gulf of Mexico.

Although the fundamentals point to higher oil prices, this week’s Federal Reserve meeting could hint at an imminent tapering of the Fed’s asset purchases, which could drag down oil prices.

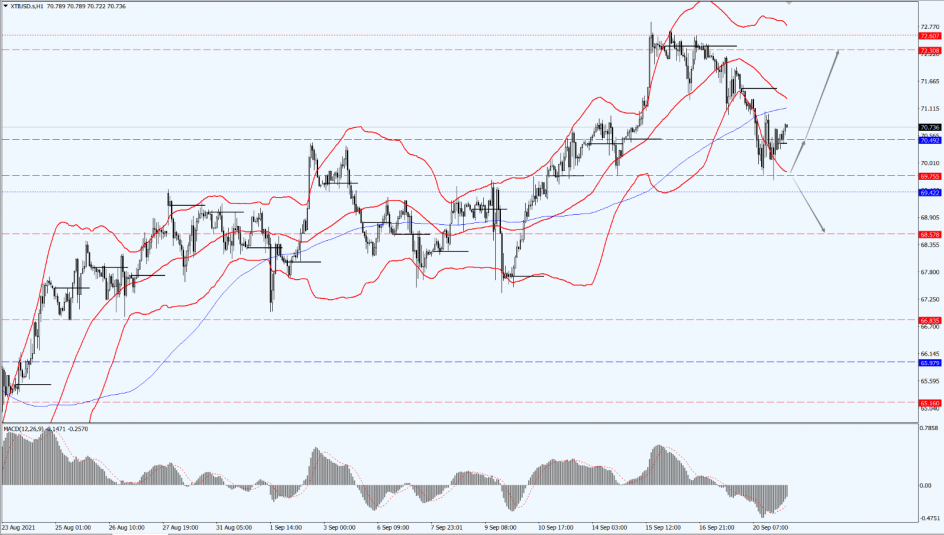

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are still maintaining the bullish trend. On the bottom line, focuses on the support at 70.49 and 69.75, and the top line focuses on the suppression at 72.60. Once it breaks through 72.60, it will open up a further upside potential. Only if it falls below the 69.75-line, oil prices might see the possibility of opening up the space for further correction.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.