1. Forex Market Insight

EUR/USD

The dollar index rose by 0.17% to 93.76 after falling to 93.49. Last week, the index rose to a one-year high of 94.56, as more and more people bet that the Fed will need to raise interest rates early to stabilize price pressures.

Data showed that U.S. initial jobless claims fell to a 19-month low last week, indicating a tightening job market, but a labor shortage may keep job growth moderate in October. Meanwhile, U.S. home sales also soared to an eight-month high in September, but rising home prices are pushing first-time buyers out of the housing market as supply remains tight.

The dollar’s overall uptrend remains intact and is expected to continue to rise slowly in the coming months. With this, the Fed does not expect the dollar to strengthen significantly, but with the U.S. growth and yield expectations relatively stronger than in most of Europe, an overall higher dollar is the likely outcome.

Technical Analysis:

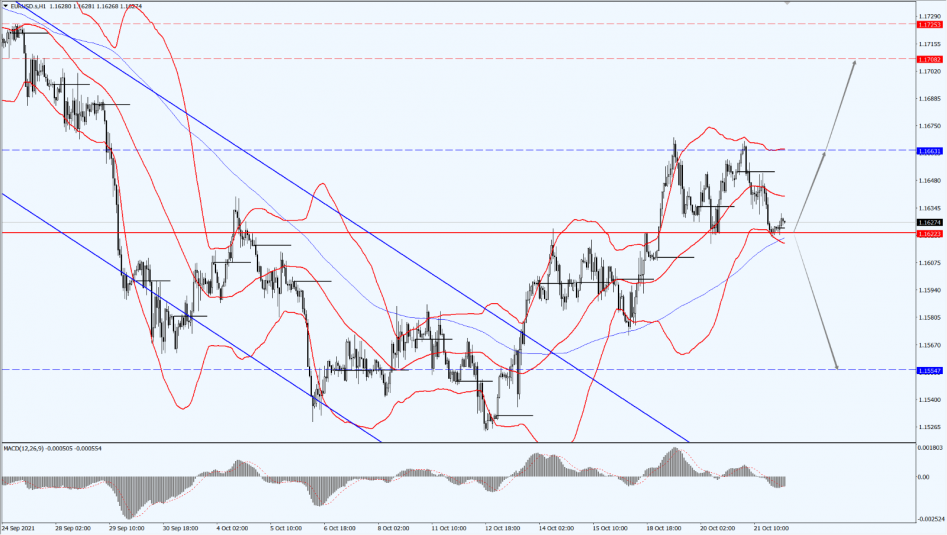

(EUR/USD 1-hour chart)

Execution Insight:

Today, we still pay attention to the 1.1622-line. If the euro is suppressed by the 1.1622-line, it will test the 1.1554-line of support again. If the euro breaks through 1.1622 and stabilizes above the 1.1622-line, it will open up a further upside space. Then, pay attention to the suppression strength of the two positions of 1.1663 and 1.1708 in turn.

GBP Intraday Trend Analysis

Fundamental Analysis:

Three former Bank of England Monetary Policy Committee members, Andrew Sentance, David Miles, and John Gieve said that the BoE could defy investor expectations for a sudden rate hike next month because the central bank rarely changes policy in such a dramatic way.

Driven by the remarks from the Bank of England Governor Tony Blair and others, the markets expect the BoE to begin an aggressive cycle of rate hikes on 4th November, with rates rising to nearly 1.25% by the end of 2022 from the current 0.1%. Additionally, the three former BoE officials also said the BoE is unlikely to make such a shift. However, none of the committee’s nine members voted for higher borrowing costs since the outbreak.

Technical Analysis:

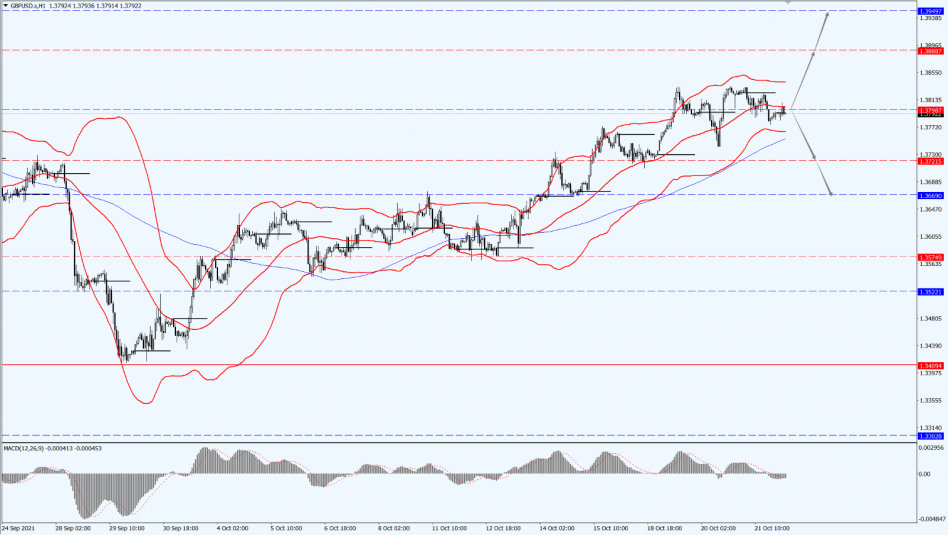

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3798-line today. If the pound runs stably above the 1.3798-line, it will still maintain its bullish trend. At that time, pay attention to the suppression of the 1.3888-line. If the pound strength drops below 1.3798, it will open up further room for correction. At that time, pay attention to the support strength of the two positions of 1.3721 and 1.3669.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold was steady yesterday as the market weighed on the statements of some Federal Reserve officials suggesting that a rate hike was not imminent. As gold is a long-term hedge against inflation, so its price is negatively correlated with the Fed’s interest rate.

Cleveland Fed President said on Wednesday, 20th October 2021, that the United States will not raise interest rates “soon”, but if inflation fails to slow as expected, the Fed will take action. Additionally, the Fed governor said he favored starting to slow monetary stimulus measures next month and expressed concern about the expansion of inflationary pressures that may require a policy response.

Gold prices have begun to fluctuate as markets assess the pace of central bank contraction of the pandemic stimulus measures. Meanwhile, rising energy and commodity costs and supply chain disruptions have inflicted inflationary pain on the global economy, boosting expectations of an early interest rate hike that could dampen the appeal of non-interest-free gold.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, the gold pays attention to the 1788-line. If it is under pressure on the 1788-line, it will pay attention to the support at the two positions of 1782 and 1768. If it breaks through 1788 and stands above the 1788-line, it will test the suppression of the 1801-line again.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices hit the biggest drop in two weeks, with U.S. oil ending by nearly 1% lower to close at $82.62 per barrel. At the same time, concerns about global growth sent oil prices back from the overbought area, and remained their near highest levels since 2014 until this week.

Due to the increase in the number of new crown cases, Eastern Europe and Russia re-imposed the blockade, threatening the global economic recovery. The possibility of being under a global economic embargo this winter complicates expectations of a positive economic outlook with weakening momentum. This is the real sore point for the global economy.

Dwindling oil supplies are keeping oil prices at their highest levels since 2014 as coal and natural gas shortages drive up crude consumption. Saudi Arabia noted that any additional crude from OPEC+, the group of oil-producing countries, would do nothing to curb soaring gas costs, and predicted that oil demand could rise by as much as 600,000 barrels a day if the northern hemisphere’s winter is colder than usual.

With this, the oil market is tightening, but neither the additional supply from OPEC+ nor the release of U.S. strategic oil reserves can meet the growing demand for low-sulfur crude.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices are still paying attention to the 80-line today. If the oil price is above the 80-line, maintain the bullish trend. Then, pay attention to the suppression of the 84.23-line in turn. If the oil price falls below the 80-line, it will open up a further downside space. At that time, pay attention to the support strength of 78.25 and 76.89.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.