1. Forex Market Insight

EUR/USD

The recovery in business activity in October was driven by the service sector. The service industry PMI rose to 58.2 in October from 54.9 in September. Additionally, analysts had previously forecast that the preliminary services PMI for October was expected to be 55.1.

With this, the services sector accounted for more than two-thirds of U.S. economic activity. The initial value of manufacturing PMI fell to 59.2 in October from 60.7 in September, the lowest in seven months, compared with the estimate of 60.3. Through this, manufacturing accounted for 12 percent of economic activity.

Separately, initial jobless claims fell by 6,000 to a seasonally adjusted 290,000 in the week ended on 16th October, the lowest level since mid-March 2020, when the U.S. was in the early stages of the Covid-19 pandemic. Initial jobless claims fell to a 19-month low and remained below 300,000 for a second straight week, indicating a tightening labor market. However, a shortage of workers will likely keep the pace of hiring moderate in October. Thus, this marks the most timely data available on the health of the economy.

Also, there is cautious optimism that federal subsidies expire on 6th September and that the labor force will grow in the coming months. Initial jobless claims have fallen from a record 6.149 million in early April 2020. In a healthy labor market, the number of claims should be between 250,000-300,000. Continuing jobless claims fell by 122,000 to 2.481 million in the week ended on 9th October, also the lowest level since mid-March 2020.

Against this background, the dollar index fell by 0.34% this week to 93.62, the second consecutive weekly decline, as investors took profits after the index hit a one-year high last week. Additionally, the dollar’s decline was also due to investor expectations of faster interest rate hikes in other currencies, which also led to a strong rebound in the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1666-line. If the strength of the euro breaks through the 1.1666-line, it will open up a further upside potential. At that time, pay attention to the suppression of the 1.1708-line. Once the euro falls under the pressure of the 1.1666-line, pay attention to the support at the 1.1622 and 1.1554 positions at that time.

GBP Intraday Trend Analysis

Fundamental Analysis:

The data shows that the British public, who believes inflation will accelerate in the next 12 months, set a record, which could further boost expectations for a Bank of England interest rate hike next month.

Specific data show that about 48% of those surveyed by consumer research firm GfK this month expect prices to rise at a faster pace over the next 12 months, up from 34% in the September survey. This marks the highest percentage since records began in January 1985.

Prior to the surge in inflation expectations, natural gas prices have soared in the past month, leading to the closure of several energy suppliers in the UK, and British households may face high bills in 2022. The global supply chain issues that have emerged as the world economy restarts from the pandemic blockade, and the increasing labor shortage due to Brexit, have fueled the recent inflationary trend in the UK.

The Bank of England has said it expects inflation to exceed 4%, more than twice the target, before falling back soon. Economists increasingly expect the BoE to be the first major central bank to raise interest rates, likely to be announced at its next policy meeting on 4th November 2021.

Bank of England Governor Tony Blair said Sunday that the BOE will have to act if it sees a surge in inflation expectations in the medium term. The central bank last month defined medium-term inflation expectations as five to 10 years from now.

Another survey showed the U.K. economy unexpectedly regained momentum in October, with cost pressures rising the most in more than 25 years, which could likewise encourage the Bank of England to carry out its first interest rate hike since the pandemic.

Additionally, the IHS Markit/CIPS preliminary U.K. composite purchasing managers’ index (PMI) rose to 56.8 in October from 54.9 in September, the highest level since May. The rise in the PMI was mainly boosted by the service sector, as consumers and businesses accelerated spending. Also, the tourism industry has benefited from the easing of pandemic travel restrictions.

Ultimately, the service sector activity surpassed the manufacturing activity by the largest margin since 2009, as the manufacturing sector was again trapped by the supply and staffing shortages and almost stagnant.

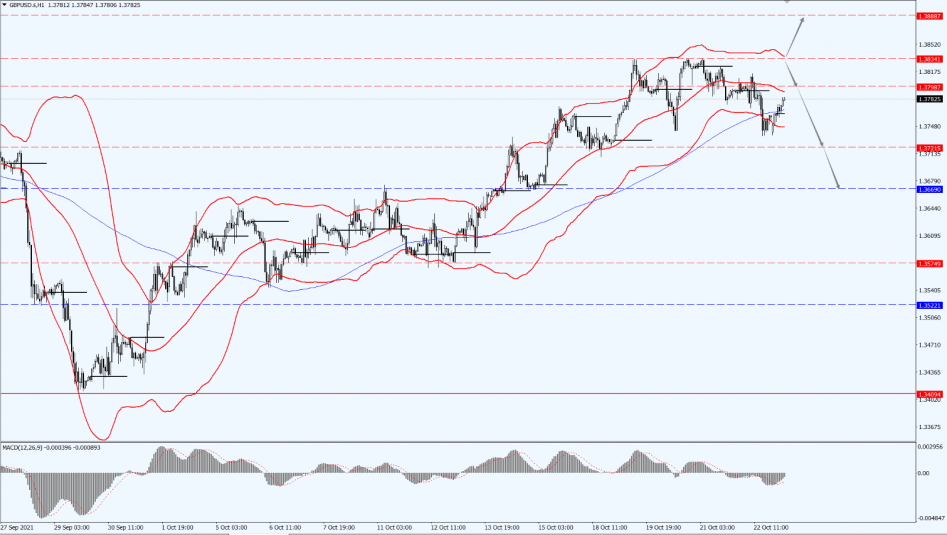

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is mainly focused on the 1.3834-line. If the pound is under pressure to fall, then pay attention to the support of the 1.3721 and 1.3669 positions. Once the pound strength breaks through the 1.3834-line, then focus on the suppression of the 1.3888-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

On Friday, 22nd October 2021, gold prices shot up and down after Fed Chairman Jerome Powell said he expects inflation to ease next year and the Fed is poised to start tapering its stimulus program. However, the weakness in the dollar and U.S. bond yields still supported gold prices to close slightly higher.

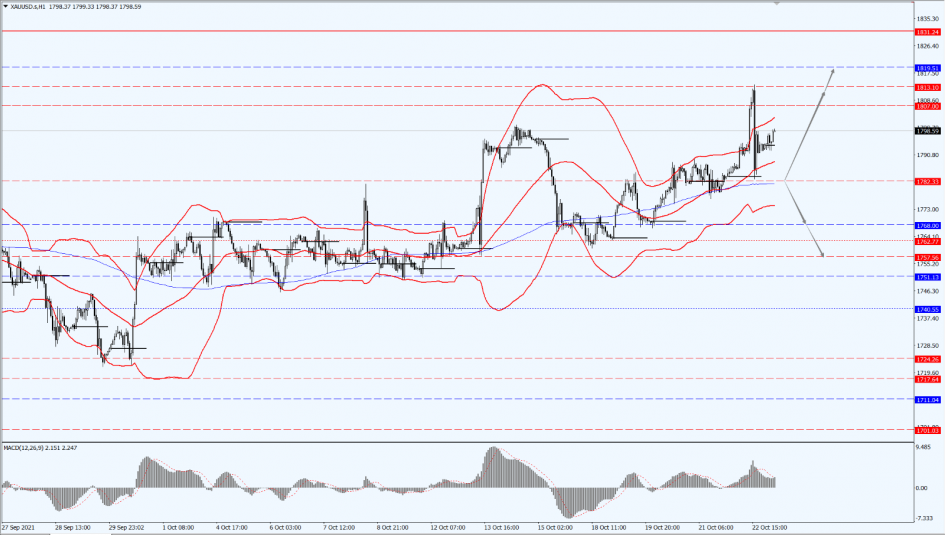

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1782-line today. If it is above the 1782-line, pay attention to the suppression of the 1807 and 1820 positions. Once the price of gold breaks below 1782, it will open up a further downside space. At that time, pay attention to the support of the 1768 and 1757 positions.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil extended its rally, having continued to hit a seven-year high of $84.28 per barrel in the morning, as market concerns about crude oil consumption growing faster than supply and shortages of natural gas and coal are triggering additional demand for petroleum products.

As the OPEC+ coalition of oil-producing countries is supplying the market only moderately, falling U.S. inventories are helping oil prices approach the 85-mark. As for intraday, focus on the U.S. Chicago Fed National Activity Index for September.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 81.33-line. If the oil price is above the 81.33-line, keep maintaining the bullish trend. Then, pay attention to the suppression of the 85-line in turn. If the oil price falls below the 81.33-line, it will open up further downside space. At that time, pay attention to the support strength in two positions at 80 and 76.89.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home