1. Forex Market Insight

EUR/USD

The European Central Bank took another small step yesterday in withdrawing crisis-era stimulus measures, but pledged to keep borrowing costs low next year and even kept open the possibility of restarting emergency support.

The rapid spread of the new Omicron variant of the coronavirus, a new lockdown and ongoing supply chain bottlenecks have also made the outlook extraordinarily uncertain, limiting the ECB’s ability to act.

The ECB will end emergency bond purchases next March but will temporarily double the pace of its longer-term asset purchase program (APP) purchases for a smooth transition, a decision that leaves ample room for policymakers to change course.

The ECB will also extend the duration of the pandemic emergency purchase program (PEPP) for reinvestment of maturing bond repatriation funds and commit to using the PEPP as a backup plan that can be re-instated at short notice in the event of future turbulence.

Technical Analysis:

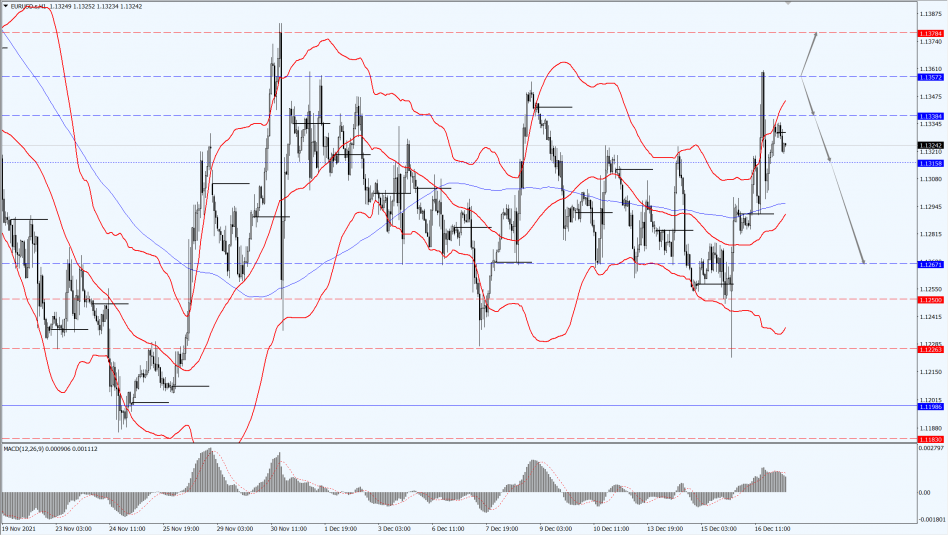

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the suppression of the 1.1357-line. If the euro runs stably below the 1.1357-line, then pay attention to the support at the lower 1.1315 and 1.1267 positions. If the euro breaks the 1.1357-line, then pay attention to the 1.1378-line of suppression.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England raised interest rates for the first time since the outbreak of the Covid-19 outbreak. Despite the threat to the economy posed by the record number of Covid-19 infections, the country is still taking the lead in the world to fight soaring inflation.

The rate hike is the Bank of England’s response to the risks posed by soaring prices. A report this week showed U.K. inflation jumped to 5.1 percent in November, more than twice the central bank’s target.

A separate report on Tuesday, 14th December 2021, showed that British companies added a record number of jobs. The decision to act now is all the more extraordinary given that the Omicron variant of the virus has brought a new wave of outbreaks, leading to the highest number of new cases in the U.K. in a single day since the outbreak of the pandemic.

Technical Analysis:

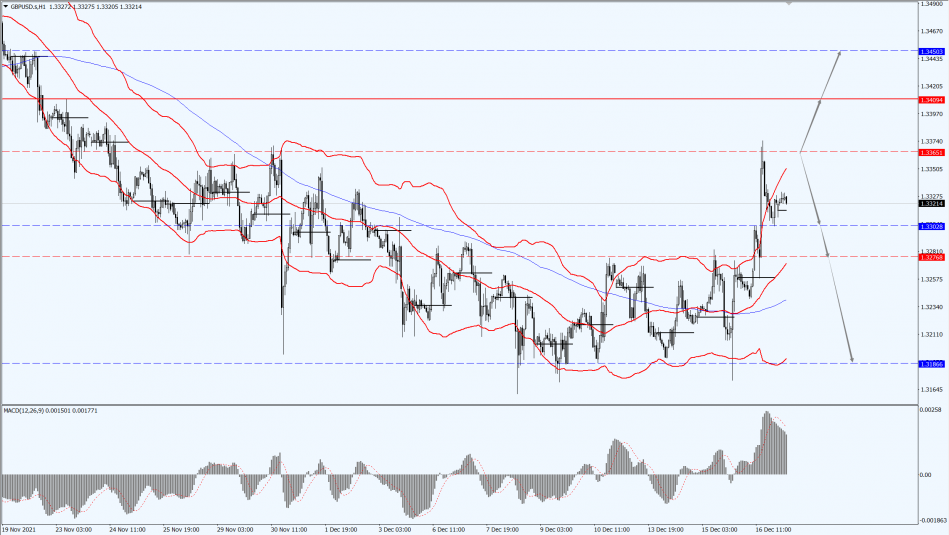

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3365-line. If the pound runs below the 1.3365-line, pay attention to the support at 1.3302 and 1.3276. If the pound rebounds to above the 1.3365-line, then pay attention to the suppression at 1.3409 and 1.3450.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose sharply yesterday as the dollar was weakened for a second consecutive day by the U.K. rate hike. At the same time, the U.S. stocks weakened to provide more support to gold prices. Intraday, focus on the Bank of Japan resolution and Fed officials’ speeches.

Technical Analysis:

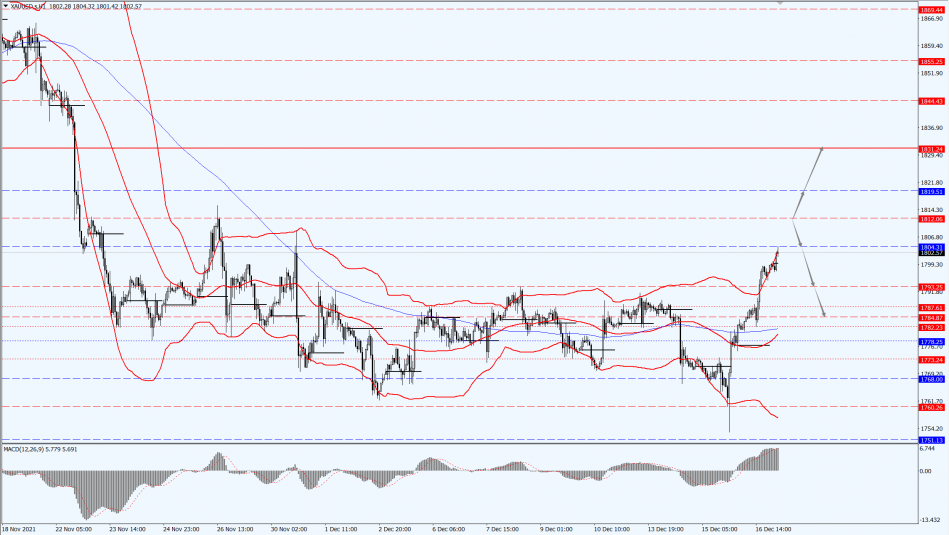

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the first line of 1812. If the price of gold runs below the first line of 1812, then pay attention to the support at the positions of 1793 and 1784. If the price of gold once again breaks through the line of 1812, it will open up a further upside space. At that time, pay attention to the suppressive strength of each position at 1819 and 1831.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose for a second straight day on Thursday, with falling inventories and a weaker dollar helping to boost the commodity’s appeal, but gains were limited by the ongoing epidemic. Intraday, focus on Saturday, 18th December 2021, at 2:00 Fed Governor Waller speech on the U.S. economic outlook, Fed’s Daley speech, and release of U.S. drilling rigs totals for the week ending 17th December 2021.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are still paying attention to the 72.77-line. If oil prices run below the 72.77-line, then pay attention to the support at 71.13 and 69.37 in turn. If the oil price breaks above the 72.77-line, it will open up a further upside space. At that time, pay attention to the suppressive strength of each position at 73.52 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.