1. Forex Market Insight

EUR/USD

The ECB is expected to remain “dovish” at its upcoming meeting, and short-term Eurozone government bond yields are likely to remain at current levels. As a result, the ECB and the Fed are now expected to maintain an extremely accommodative stance on interest rate hikes.

MFS Investment Management (MFS) expects that the European Central Bank will reduce the rate of bond purchases for the Pandemic Emergency Purchase Program (PEPP) from 80 billion euros/month to around 60-65 billion euros/month. Meanwhile, it is expected that Lagarde will say: “This adjustment does not represent a scaling back of bond purchases, but only an adjustment based on the economic situation and extremely accommodative financing conditions. ”

Technical Analysis:

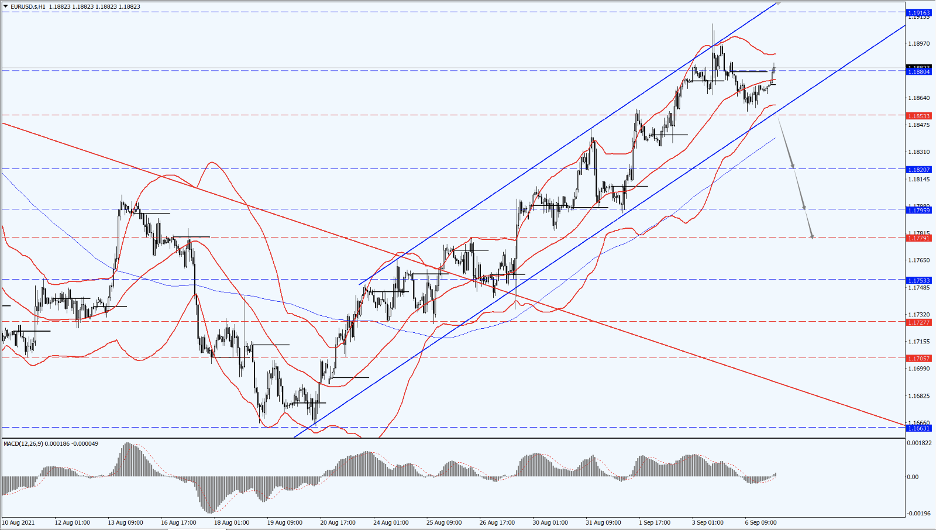

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro pays attention to the 1.1853-line. Once the euro falls below the 1.1853 line, it will open up a greater downside potential. At that time, pay attention to the support at 1.1820 and 1.1795. If the euro fails to fall below 1.1853, it will still maintain the bullish trend.

GBP Intraday Trend Analysis

Fundamental Analysis:

The market traded lightly yesterday as the U.S. market was closed for Labor Day. The pound retreated from a nearly one-month high against the dollar as there were growing signs that the economic growth was beginning to fade after the economy restarted from the anti-epidemic embargo.

The pound strengthened against the dollar on Friday, 3rd September 2021, after data showed that the U.S. Non-Farm Payrolls rose much lesser than expected in August. However, the subsequent move was listless as the market await further clues about the U.K. economy and the future policy direction of the Bank of England.

Technical Analysis:

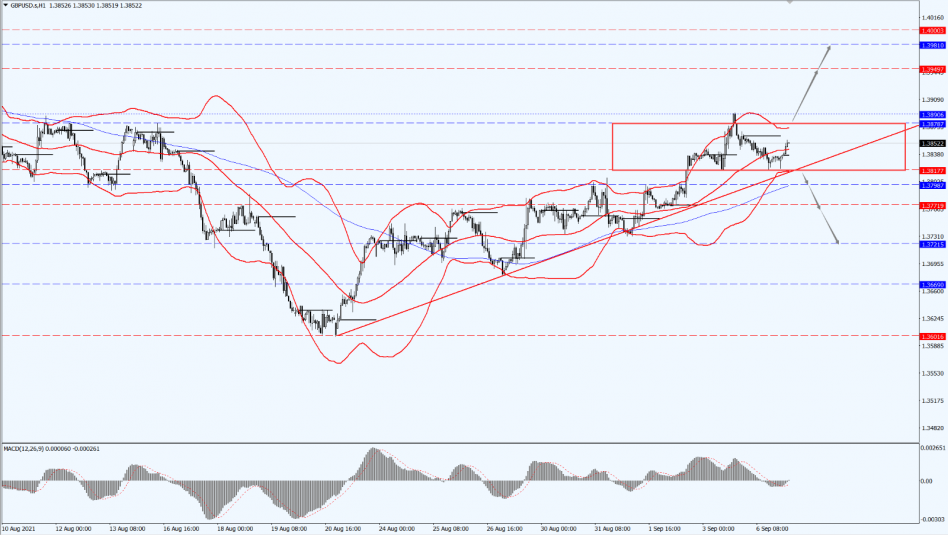

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is focused on the direction of its breakthrough from the 1.3817 to 1.3878 range. If it breaks through the 1.3878-line and sits above 1.3890, it will open up a greater upside potential. At that time, pay attention to the suppression of the 1.3949-line. If it falls below the 1.3817-line and the strength drops below 1.3798, it will open up a greater downside potential. With that, pay attention to the support of the two positions at 1.3771 and 1.3721.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold prices retreated slightly from their near seven-week highs yesterday as the dollar rebounded from its lows following Friday’s poor U.S. jobs report.

The jobs data lowered the market’s fears that the Fed will soon scale back its bond purchases. With that said, the U.S. Non-Farm Payrolls rose by 235,000 in August, the smallest gain in seven months and well below economists’ expectations. Thus, the weak report may prompt Fed policymakers to delay consideration of tapering asset purchases at the September meeting, which also indicates that the current economic slowdown and rising price pressures are a difficult period.

Technical Analysis:

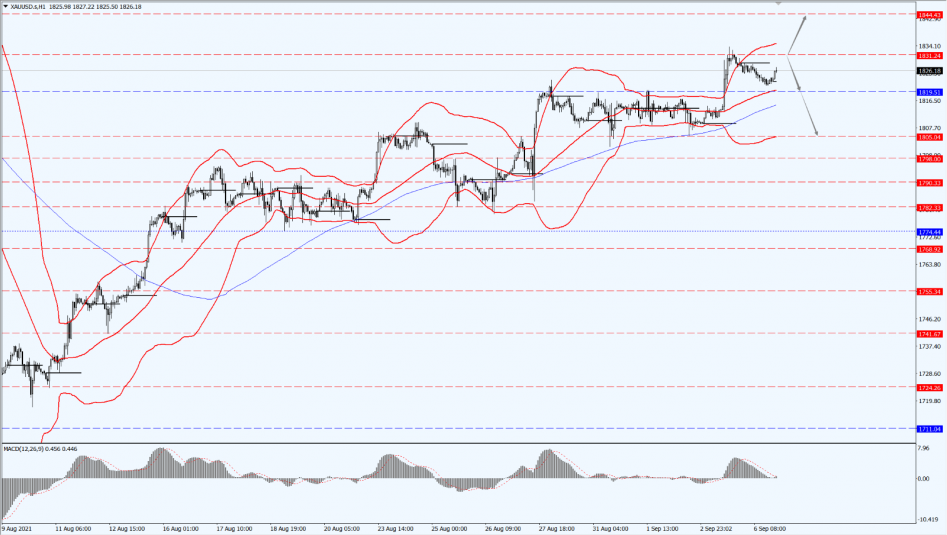

(Gold 1-hour chart)

Trading Strategies:

Today, gold is still paying attention to the 1831-line. If the price of gold pierces 1831 or runs below the line of 1831, then pay attention to the support at 1819 and 1805. If the price of gold breaks above 1831, it will open up a greater upside potential. At that time, pay attention to the 1844-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Crude oil extended its losses yesterday after Saudi Arabia’s move to cut prices to Asian buyers, raised the possibility of fierce competition among oil-producing countries. At the same time, the resurgence of the Covid-19 pandemic continued to cloud the demand outlook.

WTI crude futures fell by 0.6% to less than $69 per barrel. Adding on to that, Saudi Arabia cut the price of its oil sales to Asia next month just days after OPEC+ left its resolution to increase production unchanged. The move has caught traders off guard as they believed the Saudis are aiming to increase competition and retain market share.

Technical Analysis:

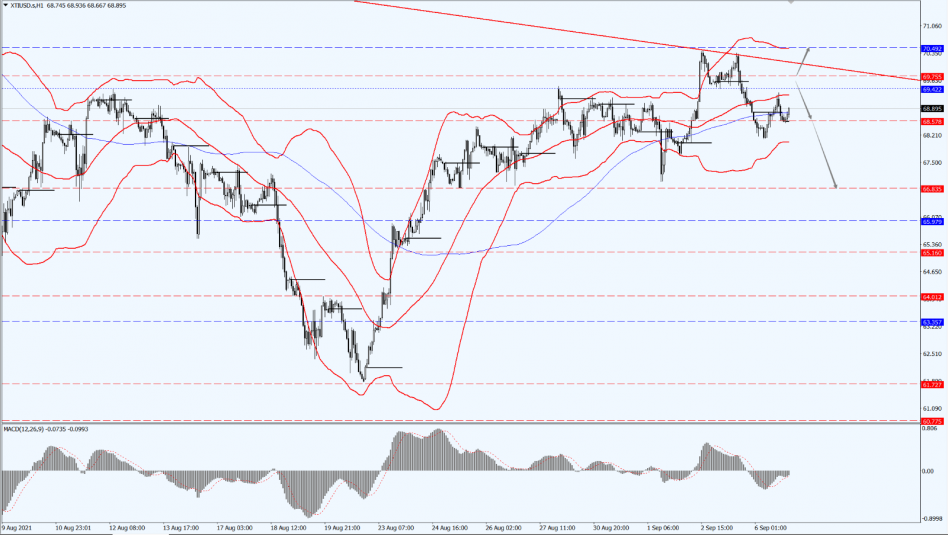

(Crude oil 1-hour chart)

Trading Strategies:

Today, the oil prices pay attention to the 69.75-line. If the oil price runs below the 69.75-line, then pay attention to the support at 68.57 and 66.83. If the oil price breaks above the 69.75-line, the pressure on the 70.49 line will be tested again.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.