1. Forex Market Insight

EUR/USD

European Central Bank President Lagarde said last week that the ECB is very unlikely to raise interest rates next year because inflation is still too low. This has overturned market expectations for a rate hike as early as October next year.

In addition, the ECB officials have echoed Lagarde’s words. ECB executive member Schnabel said Thursday, 4th November 2021, that the ECB is well aware of the public’s concerns about high inflation, but the likelihood of a rate rise next year is unlikely. Also, the fear that excessive criticism of its policies could jeopardize its independence.

Greek media on Friday, 5th November 2021, quoted European Central Bank Management Board member and Bank of Greece governor Stournaras as saying that the ECB’s accommodative monetary policy is still appropriate and that the rise in inflation is a short-term phenomenon.

Except for the United States, the world has not seen signs of inflation-related payroll pressure. Central Bank of Spain President de Cos said the ECB is unlikely to raise interest rates in the third quarter of 2022, as the market is beginning to expect, or soon thereafter.

Meanwhile, Bank of France President de Gallo also reiterated that there is no need for the ECB to raise interest rates next year. With inflation at a 13-year high, markets are increasingly confident that the ECB will exit its ultra-loose monetary policy and raise interest rates next year for the first time in more than a decade.

Nevertheless, the ECB has kept its interest rate policy unchanged last week, and President Lagarde did not strongly refute market prices recently reflecting expectations of two rate hikes next year, leaving investors’ expectations unfulfilled.

The ECB and financial investors have been diverging on the possible path of inflation, in part because the ECB itself is uncertain about inflation. Ultimately, inflation is the most important guiding policy indicator.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1535-line. If the euro runs steadily above the 1.1535-line, then pay attention to the suppression of the two positions 1.1583 and 1.1622 in turn. If the strength of the euro drops below the 1.11535-line, it will open up a further downside space. At that time, pay attention to the support of the 1.1501-line.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound closed by 1.41% lower against the dollar last week at 1.3493 and hit a new low since 30th September 2021 at 1.3423.

In a surprise move, the Bank of England left interest rates unchanged, placing more importance on dealing with slowing economic growth than expectations of soaring inflation.

Officials also downplayed market expectations that interest rates will rise multiple times and reach 1% next year, noting that if such a policy path is taken, inflation will be below target at the end of the bank’s forecast period.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3409-line. If the pound runs above the 1.3409-line, then pay attention to the suppression of the upper 1.3522 and 1.3574 positions in turn. If the pound strength falls below the 1.3409-line, pay attention to the support of 1.3302-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Today, spot gold fluctuated within the narrow range above 1810, holding most of last week’s gains.

Last week’s dovish signals from the Federal Reserve, Bank of England and European Central Bank helped gold top the 1800 mark and hit a near two-month high of $1818.38/oz.

Surveys show that both institutional investors and retail investors tend to be bullish, and gold prices are expected to further test the resistance around the 1834 high since mid-June this week.

On 15th July and 3rd September, gold prices have twice failed to rush the resistance. Once gold prices topped the resistance, it will increase the medium and long term bullish signal.

In addition, over the weekend, the United State passed a total size of more than 1 trillion infrastructure bill, meaning that the market will inject more liquidity, and is expected to provide further upward momentum for gold prices.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the 1831-line. If the price of gold runs stably below the 1831-line, then pay attention to the support at 1810 and 1800. If the price of gold breaks the 1831-line, it will open up further upside space. At that time, pay attention to the suppressive strength of each position at 1844 and 1855.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Today, the U.S. oil rose slightly and is now at $81.61/barrel. Oil prices closed with over 2% higher on Friday.

The better-than-expected U.S. non-farm payrolls data released on Friday, 5th November 2021 also boost the oil prices. In addition, OPEC+ producers rejected calls from the U.S. to accelerate production increases, sparking a new round of supply concerns.

Technical Analysis:

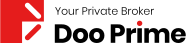

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 78.92-line. If the oil price runs stably above the 78.92-line, pay attention to the suppression of the 82.83-line. If the oil price falls below the 78.92-line, a further downside space will be opened. At that time, pay attention to the support at the 76.89 and 75.69 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home