1. Forex Market Insight

EUR/USD

Euro declined. Russia’s main pipeline supplying gas to Europe will stop for three days at the end of this month, state energy giant Gazprom said on Friday, 19th August 2022. Investors fear that the suspension could exacerbate the energy crisis that has put pressure on the euro in recent months.

German central bank governor Nager told the Rheinische Post that the German economy is one of the countries most vulnerable to disruptions in Russian gas supplies and that the German economy “could” suffer a recession in the winter if the energy crisis continues to worsen.

The euro briefly fell below $1 for the first time since 14th July 2022, ending the session down 1.1% at $0.99345.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9938 and 09864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

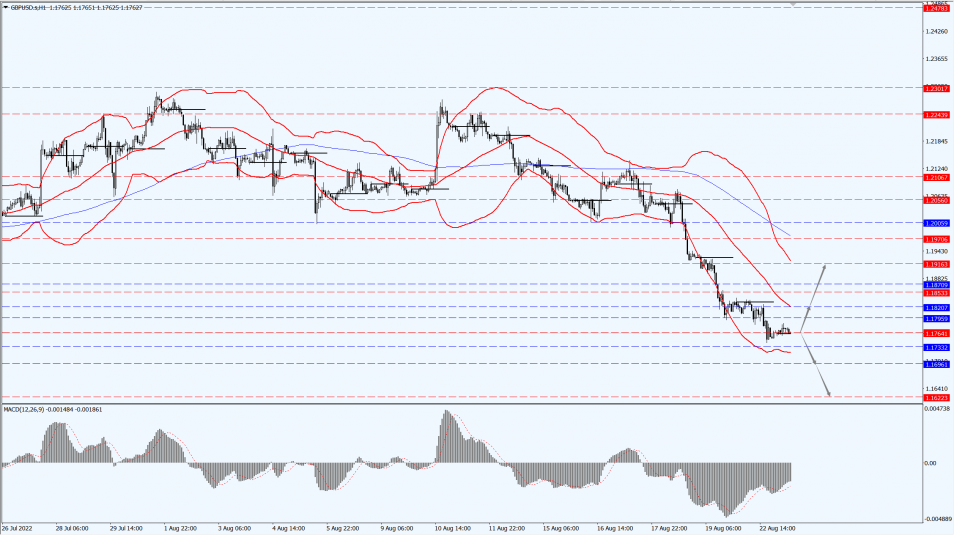

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound fell to its lowest against the dollar since mid-July on Monday, 22nd August 2022, with soaring energy costs and summer strikes highlighting Britain’s cost-of-living crisis and fuelling fears of a further economic slowdown.

The pound was down 0.64% at $1.17565 , just a stone’s throw from the almost two-and-a-half-year low of $1.17435 touched in mid-July.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1764-line today. If GBP runs below the 1.1764-line, it will pay attention to the suppression strength of the two positions of 1.1696 and 1.1622. If GBP runs above the 1.1764-line, then pay attention to the suppression strength of the two positions of 1.1820 and 1.1916.

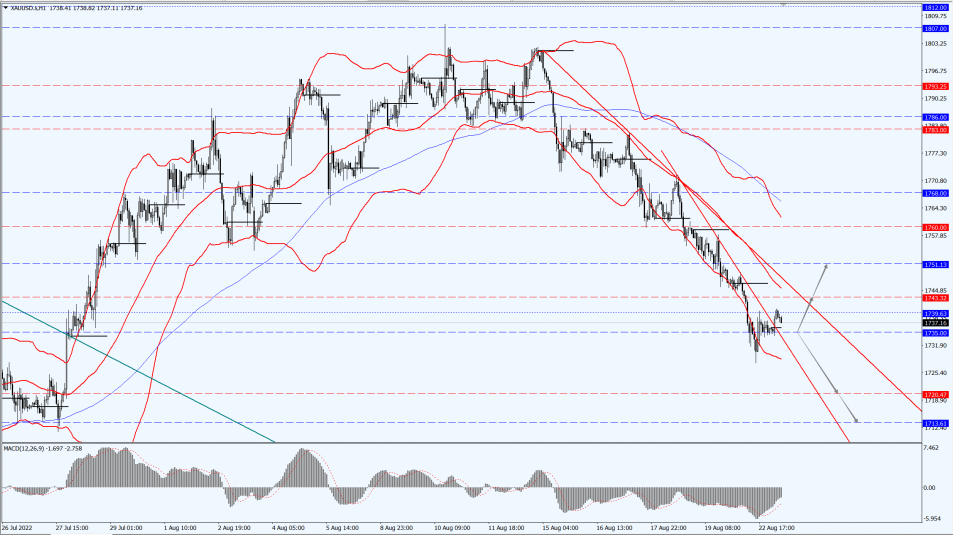

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell to their lowest in nearly a month on Monday, 22nd August 2022, with the precious metal falling sharply as the dollar strengthened and the Federal Reserve’s impending interest rate hike weakened the appeal of gold.

Gold came under pressure on the dollar and market expectations, with markets expecting Fed Chairman Jerome Powell to reinforce the Fed’s hawkish stance when he speaks at the central bank’s meeting in Jackson Hole, Wyoming, later this week.

Economists interviewed by Reuters said the Federal Reserve is likely to cut interest rates by 50 basis points in September in anticipation of US inflation having peaked and growing concerns about a recession

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1735-line today. If the gold price runs steadily below the 1735-line, then it will pay attention to the support strength of the 1720 and 1713 positions. If the gold price breaks above the 1735-line, then pay attention to the suppression strength of the two positions of the 1743 and 1751.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rebounded from session lows on Monday, 22nd August 2022, and were almost flat in choppy trading as the market weighed Saudi Arabia’s warnings about possible production cuts by the Organization of Petroleum Exporting Countries (OPEC) and its allies that make up OPEC+, and the possibility that a nuclear deal could bring sanctioned Iranian oil back into the market.

Saudi Arabia’s Energy Minister Prince Abdulaziz, speaking to Bloomberg News, was quoted by Saudi state news agency SPA on Monday, 22nd August 2022, as saying that OPEC+ has the means and flexibility to meet the challenge, including through cuts in oil production.

Meanwhile, the White House said Sunday, 21st August 2022, that the leaders of the United States, Britain, France and Germany discussed efforts to revive the 2015 Iran nuclear deal, which could bring sanctioned Iranian oil back to global markets.

The US State Department says it is closer to a nuclear deal now than it was a fortnight ago.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 91.54-line today. If the oil price runs above the 91.54-line, then focus on the suppression strength of the two positions of 93.57 and 95.05. If the oil price runs below the 91.54-line, then pay attention to the support strength of the two positions of 88.02 and 85.72.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.