1. Forex Market Insight

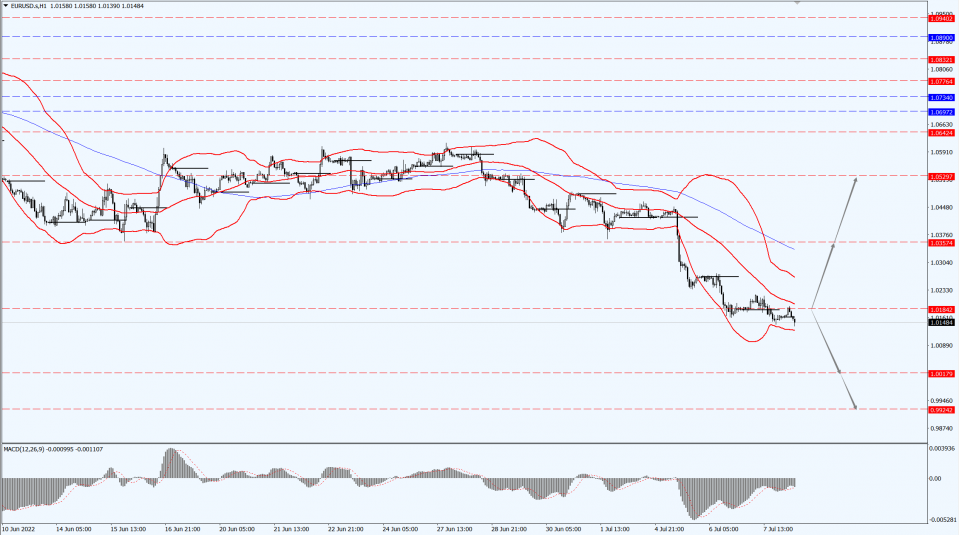

EUR/USD

EUR was down 0.26% at $1.0157, having earlier hit a fresh 20-year low of $1.01445.

If Europe and the U.S. slide into recession in the third quarter while the Fed is still raising interest rates, the euro will likely plummet further.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0184-line today. If EUR runs steadily below the 1.0184-line, then pay attention to the support strength of the two positions of 1.0017 and 0.9924. If the strength of EUR breaks above the 1.0184-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

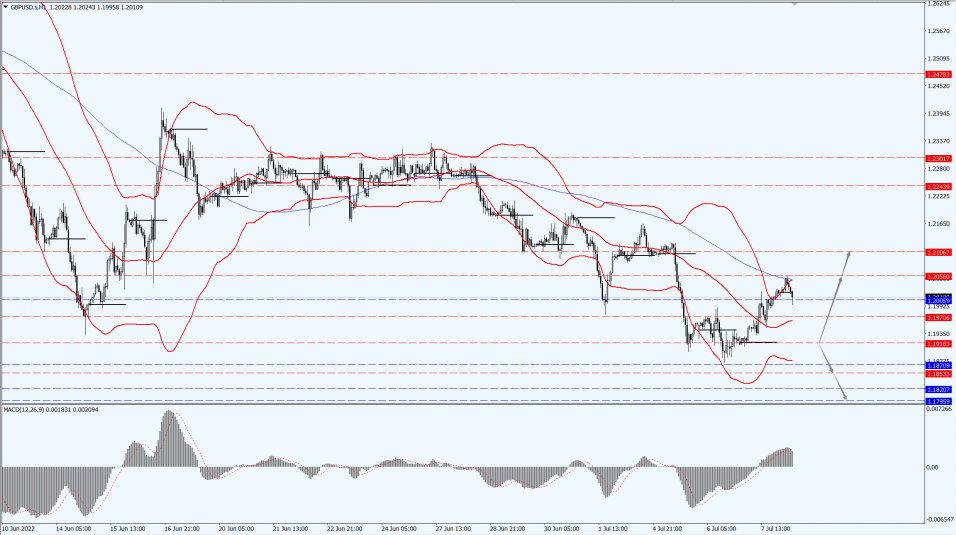

GBP Intraday Trend Analysis

Fundamental Analysis:

Markets are weighing the risk of a recession and whether interest rate hikes will be suspended as global demand weakens.

GBP held on to gains after Johnson said he would resign as UK prime minister.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1916-line today. If GBP runs below the 1.1916-line, it will pay attention to the suppression strength of the two positions of 1.1853 and 1.1795. If GBP runs above the 1.1916-line, then pay attention to the suppression strength of the two positions of 1.2056 and 1.2106.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold has fallen more than $300 since the Federal Reserve began raising interest rates in March to curb disorderly inflation, increasing the opportunity cost of holding non-yielding gold.

The next catalyst for the market is likely to come today, when the U.S. government will release its labor market report.

Earlier data showed that the number of U.S. initial jobless claims unexpectedly increased last week.

Layoffs surged to the most in 16 months in June amid growing signs that demand for labor is cooling.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1740-line today. If the gold price runs steadily below the 1740-line, then it will pay attention to the support strength of the 1722 and 1701 positions. If the gold price breaks above the 1740-line, then pay attention to the suppression strength of the two positions of the 1760 and 1783.

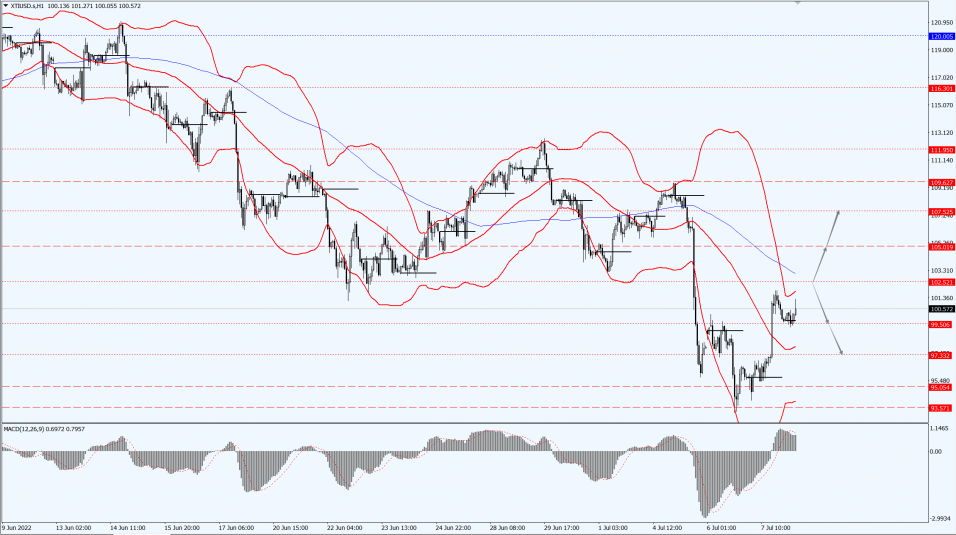

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices settled sharply higher on Thursday, 7th July 2022, rebounding from sharp losses in the previous two sessions.

As despite lingering concerns about a potential global recession, investors are refocusing their attention on tightening supply.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 102.52-line today. If the oil price runs above the 102.52-line, then focus on the suppression strength of the two positions of 105.01 and 107.52. If the oil price runs below the 102.52-line, then pay attention to the support strength of the two positions of 99.50 and 97.33.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.