The euro was down 0.9% at $0.9794, after the European Central Bank earlier released minutes from its meeting last month, showing that policymakers appear increasingly concerned that high inflation could become entrenched.

Separately, two sources told Reuters on Thursday, 6th October 2022, citing preliminary data, that the German government expects Europe’s largest economy to fall into recession next year, with the economy shrinking by 0.4% due to the energy crisis, rising prices and supply bottlenecks.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9770-line today. If EUR runs steadily below the 0.9770-line, then pay attention to the support strength of the two positions of 0.9701 and 0.9559. If the strength of EUR breaks above the 0.9770-line, then pay attention to the suppression strength of the two positions of 0.9852 and 0.9909.

GBP Intraday Trend Analysis

Fundamental Analysis:

High inflation means the UK economy will fall into recession, but rising interest rates due to global factors and market reactions to the “mini-budget” will exacerbate the scope of the recession.

The British pound was down 1.5% against the dollar at $1.1151.

Technical Analysis:

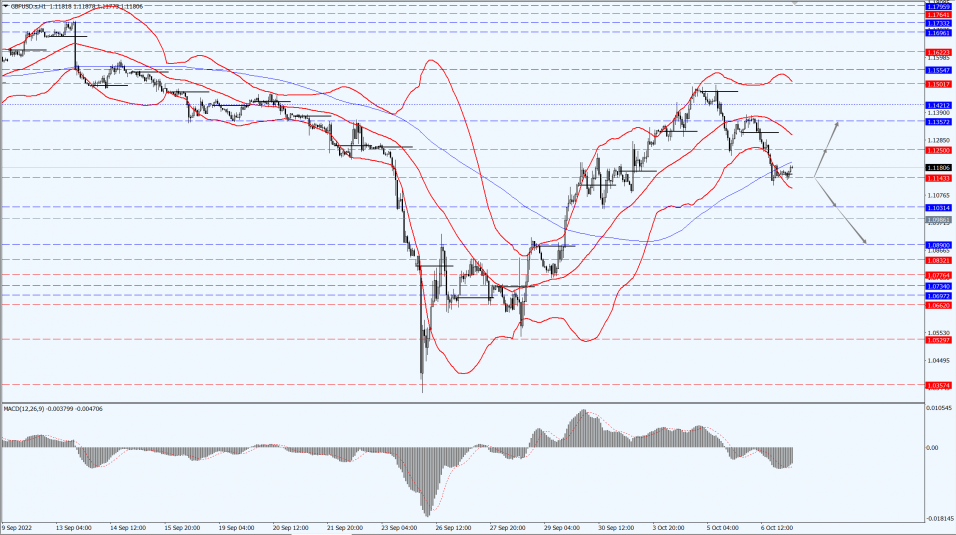

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1143-line today. If GBP runs below the 1.1143-line, it will pay attention to the suppression strength of the two positions of 1.1031 and 1.0890. If GBP runs above the 1.1143-line, then pay attention to the suppression strength of the two positions of 1.1250 and 1.1357.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell Thursday, 6th October 2022, weighed down by a climbing dollar and U.S. bond yields as the market prepares for a jobs report that could influence the path of the Federal Reserve’s monetary policy.

The U.S. Department of Labor will release September nonfarm payrolls data today, 7th October 2022. The ADP national employment report released on Wednesday was better than expected.

Earlier, the Institute for Supply Management’s (ISM) U.S. non-manufacturing purchasing managers’ index (PMI) was also slightly higher than expected, indicating that despite rising interest rates, the economy still has potential strength.

The upbeat data, and Wednesday’s, 5th October 2022, hawkish statement by San Francisco Fed President Daley threw cold water on any hopes of a policy shift.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1713-line today. If the gold price runs steadily below the 1713-line, then it will pay attention to the support strength of the 1693 and 1686 positions. If the gold price breaks above the 1713-line, then pay attention to the suppression strength of the two positions of the 1720 and 1735.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose about 1% Thursday, 6th October 2022, holding at a three-week high, after the OPEC+ alliance agreed to cut oil production by 2 million barrels per day, the steepest cut since 2020, a move that would lead to a tightening of global supply.

The OPEC+ agreement to cut production will further squeeze an already tight supply market, thus increasing inflation. Soon after, the EU will begin imposing an embargo on Russian oil.

Technical Analysis:

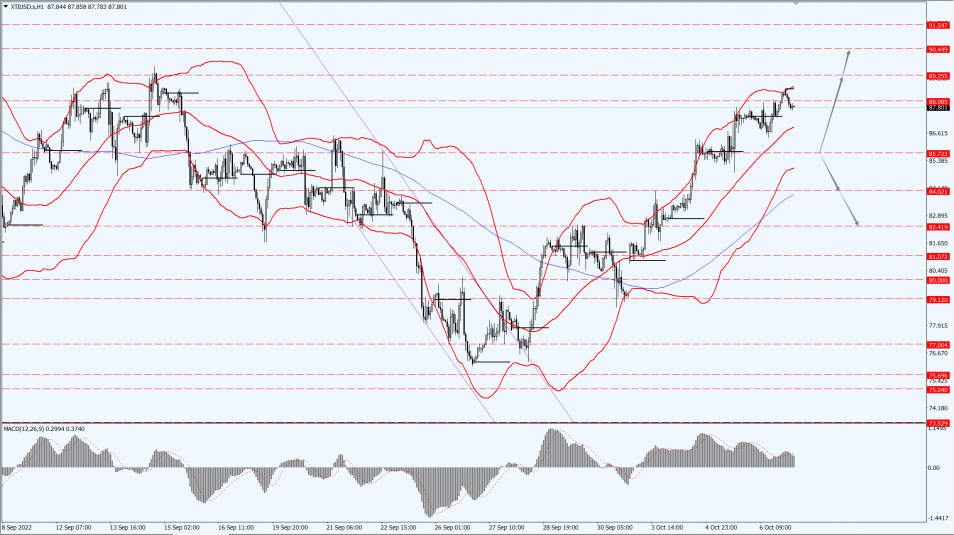

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85.72-line today. If the oil price runs above the 85.72-line, then focus on the suppression strength of the two positions of 88.08 and 89.25. If the oil price runs below the 85.72-line, then pay attention to the support strength of the two positions of 84.02 and 82.41.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home