1. Forex Market Insight

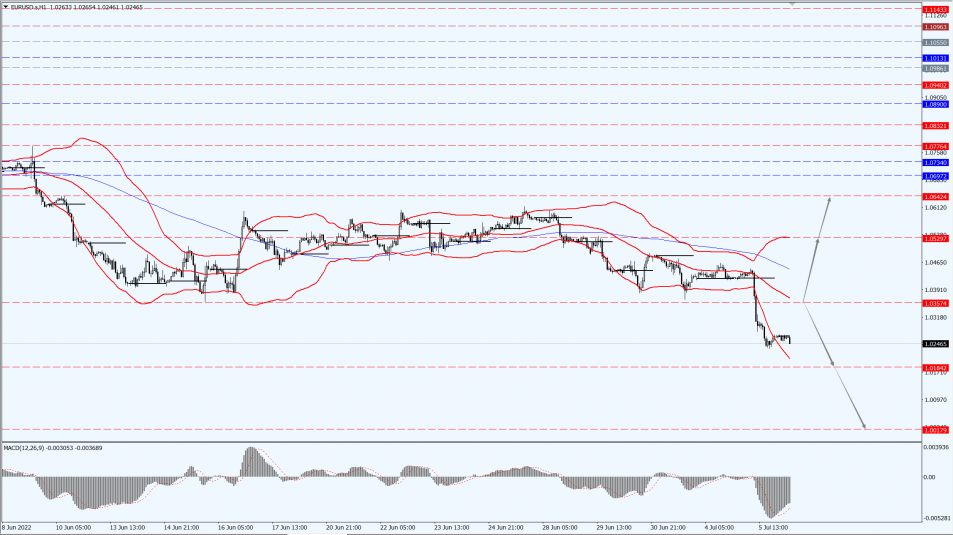

EUR/USD

EUR fell sharply by 1.75%, touching its lowest since late 2002.

EUR suffered its biggest one-day drop since the coronavirus pandemic hit markets in March 2020.

The yuan posted its biggest one-day gain since then.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0357-line today. If EUR runs steadily below the 1.0357-line, then pay attention to the support strength of the two positions of 1.0184 and 1.0017. If the strength of EUR breaks above the 1.0357-line, then pay attention to the suppression strength of the two positions of 1.0529 and 1.0642.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD touched its lowest in two years on Tuesday, 5th July 2022.

The crisis in British Prime Minister Boris Johnson’s government has added pressure to a pound already mired in recession fears and a recovering dollar.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1970-line today. If GBP runs below the 1.1970-line, it will pay attention to the suppression strength of the two positions of 1.1870 and 1.1820. If GBP runs above the 1.1970-line, then pay attention to the suppression strength of the two positions of 1.2056 and 1.2106.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold is considered to be a hedge against inflation.

However, the increase in interest rates to ease price pressures has reduced the demand for interest-free gold.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1760-line today. If the gold price runs steadily below the 1760-line, then it will pay attention to the support strength of the 1751 and 1740 positions. If the gold price breaks above the 1760-line, then pay attention to the suppression strength of the two positions of the 1783 and 1793.

3. Commodities Market Insight

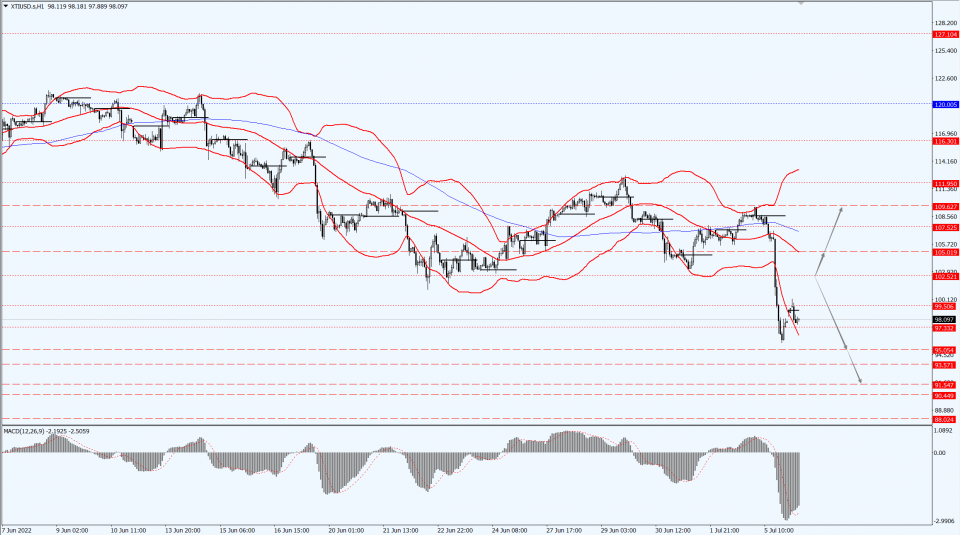

WTI Crude Oil

Fundamental Analysis:

Oil prices tumbled nearly $12 on Tuesday, 5th July 2022, their biggest one-day drop since March.

The decline spread to other energy products amid concerns about the global recession.

Both crude benchmarks posted their biggest one-day percentage declines since 9th March 2022, and shares of major oil and gas companies also took a hit.

Oil prices hit their lowest since late April.

Technical Analysis:

Trading Strategies:

Oil prices focus on the 102.52-line today. If the oil price runs above the 102.52-line, then focus on the suppression strength of the two positions of 105.01 and 109.62. If the oil price runs below the 102.52-line, then pay attention to the support strength of the two positions of 95.05 and 91.54.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.