1. Forex Market Insight

EUR/USD

The dollar held modest gains against the euro on Friday, 27th January 2023, after data showed a drop in U.S. consumer spending and cooling inflation, as markets await a series of central bank meetings next week.

Technical Analysis:

We focus on the 1.0871 line today. If the EUR runs below the 1.0871 line, then pay attention to the support strength of the two positions of 1.0832 and 1.0776. If the strength of EUR rises over the 1.0871 line, then pay attention to the suppression strength of the two positions of 1.0940 and 1.0986.

GBP Intraday Trend Analysis

Fundamental Analysis:

On Friday, 27th January 2023 the pound slipped 0.12% against the dollar to $1.2397 as markets worried that a slowdown in the U.K. economy could prompt the Bank of England to end its tightening cycle soon, a move that could weaken the pound in the short term.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2311-line today. If GBP runs below the 1.2311-line, it will pay attention to the suppression strength of the two positions of 1.2222 and 1.2147. If GBP runs above the 1.2311-line, then pay attention to the suppression strength of the two positions of 1.2478 and 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold was steady on Friday, 27th January 2023, with gains capped by a stronger dollar, but it remains on track for a sixth straight week of gains ahead of the Federal Reserve’s interest rate resolution this week.

Spot gold rose 0.1% to $1,931.61 per ounce, however, gains earlier in the session were retraced after data showed a decline in U.S. consumer spending in December, although the core personal consumption expenditures (PCE) price index rose month-on-month.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1932-line today. If the gold price runs below the 1932-line, then it will pay attention to the support strength of the 1919 and 1909 positions. If the gold price breaks above the 1932-line, then pay attention to the suppression strength of the two positions of 1944 and 1955.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed lower on Friday, bringing the weekly line to a flat to lower as signs of strong Russian oil supplies offset better-than-expected U.S. economic growth data, strong middle distillate refining margins and hopes for a rapid recovery in Chinese demand.

OPEC+ representatives meet next week to review crude production levels, and sources from the group of oil-producing countries expect no changes to current production policies.

Technical Analysis:

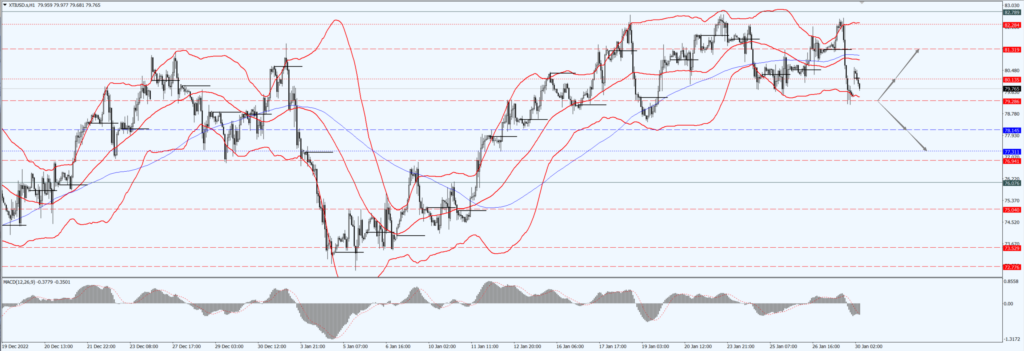

(Crude Oil 1-hour Chart)

Oil prices focus on the 79.28 – line today. If the oil price runs above the 79.28 -line, then focus on the suppression strength of the two positions of 80.13 and 81.31. If the oil price runs below the 79.28 -line, then pay attention to the support strength of the two positions of 78.14 and 77.31.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.