1. Forex Market Insight

EUR/USD

EUR rose 0.2%, hitting an intraday high of 1.0581 to close at $1.0532.

This comes after ECB Executive Committee member Lien said that the ECB would raise interest rates by 25 basis points at its July meeting.

However, the magnitude of the September rate hike is still to be decided, which suggests a 50 basis point hike is possible.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD rose 0.25% to close at 1.2274, helped by hawkish comments from Bank of England.

Bank of England Chief Economist Huw Pill said on Tuesday that the central bank needs to raise interest rates further to curb surging inflation.

Technical Analysis:

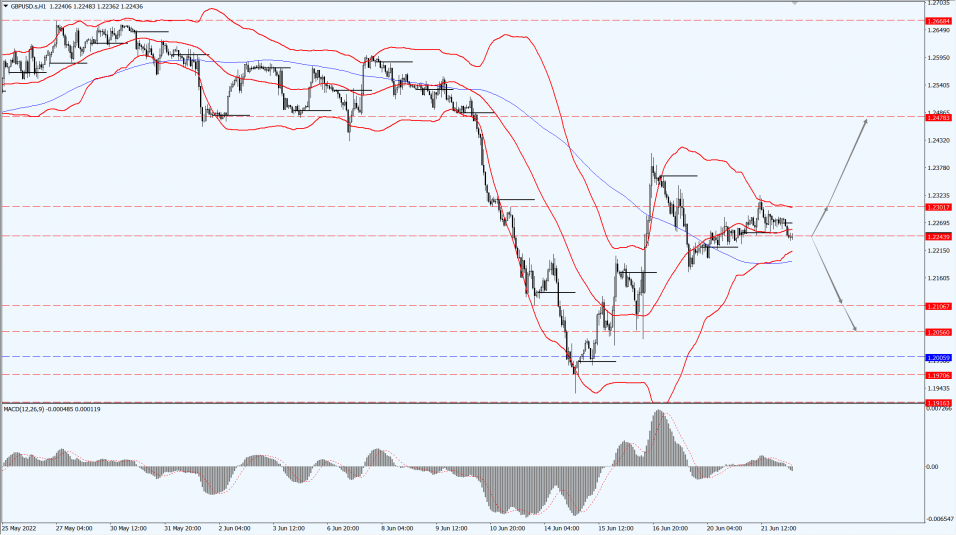

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2243-line today. If GBP runs below the 1.2243-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2243-line, then pay attention to the suppression strength of the two positions of 1.2301 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fluctuated slightly lower, once hitting a four-day low of $1826.45 per ounce.

Fed’s Balkin backs 50 or 75 bps rate hike in July, US Treasury Secretary Yellen downplays recession expectations

Slightly higher U.S. Treasury yields and a modest rally in U.S. equities both put some pressure on gold.

However, the relatively tense geopolitical situation and the poor performance of U.S. home sales data still provided some support to gold prices.

Markets are generally watching Fed Chairman Jerome Powell’s semi-annual testimony before Congress for clues about future rate hikes and his latest views on the economy.

Powell will testify before the Senate Banking Committee on the semi-annual monetary policy report at 21:30 GMT.

The bias is more likely to be hawkish and bearish for gold prices.

Technical Analysis:

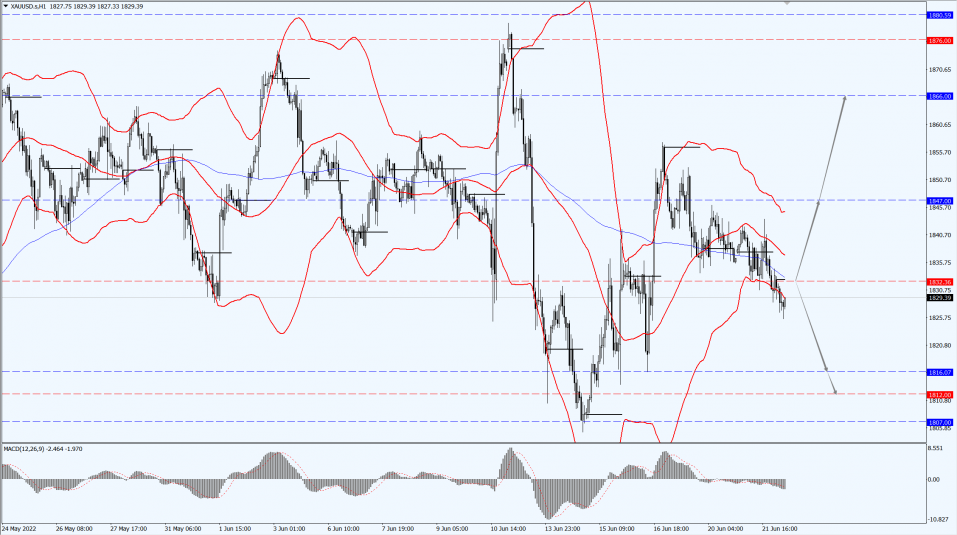

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily below the 1832-line, then it will pay attention to the support strength of the 1816 and 1812 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of the 1847 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Brent crude futures settled up 52 cents, or 0.5%, at $114.65 a barrel.

The market believes that tight supply will support higher oil prices even if the global economy is in contraction.

Anti-inflationary actions by the Fed and other central banks have exacerbated market turmoil and increased the likelihood of slower economic growth.

The idea of a possible U.S. recession within a few months has markets showing nervousness.

But for now, it appears that the recent sell-off may have been overdone as short-term demand remains strong.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 105.01-line today. If the oil price runs above the 105.01-line, then focus on the suppression strength of the two positions of 107.52 and 109.62. If the oil price runs below the 105.01-line, then pay attention to the support strength of the two positions of 102.52 and 99.50.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.