1. Forex Market Insight

EUR/USD

In line with general market expectations, Germany’s IFO Business Climate Index rose to 91.1 in February, with a mixed composition, and further normalization of the index is expected.

However, the current conditions index deteriorated for the second consecutive month, contrasting with the more positive German PMI released this week, German GDP is likely to contract in the first quarter of 2023, mainly because higher energy costs actually paid by households are likely to weigh on consumption early in the year.

The German IFO Business Expectations Index improved in February, but this mainly reflects a rebound after a sharp decline between March and September 2022.

As a result, the gap between the current and expected indices is narrowing. The euro was down 0.45% against the dollar late on Friday at $1.0549, having fallen to a seven-week low of $1.0536 earlier in the session; the euro accumulated a 1.39% decline against the dollar last week, its biggest weekly loss since the end of September.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0529 line today. If the EUR runs below the 1.0529 line, then pay attention to the support strength of the two positions of 1.0485 and 1.0440. If the strength of EUR rises over the 1.0529 line, then pay attention to the suppression strength of the two positions of 1.0613 and 1.0655.

GBP Intraday Trend Analysis

Fundamental Analysis:

The United Kingdom announced a sharp rise in consumer confidence in February, with the GFK consumer confidence index rising 7 points to 38 in February, the highest level since April of 2022.

The data raised the expected value of the Bank of England to continue to raise interest rates, once also stimulated the pound slightly higher, however, in the performance of strong data in the United States, the pound fell 0.62% against the dollar on Friday, 24th February 2023, to $1.1944.

Technical Analysis:

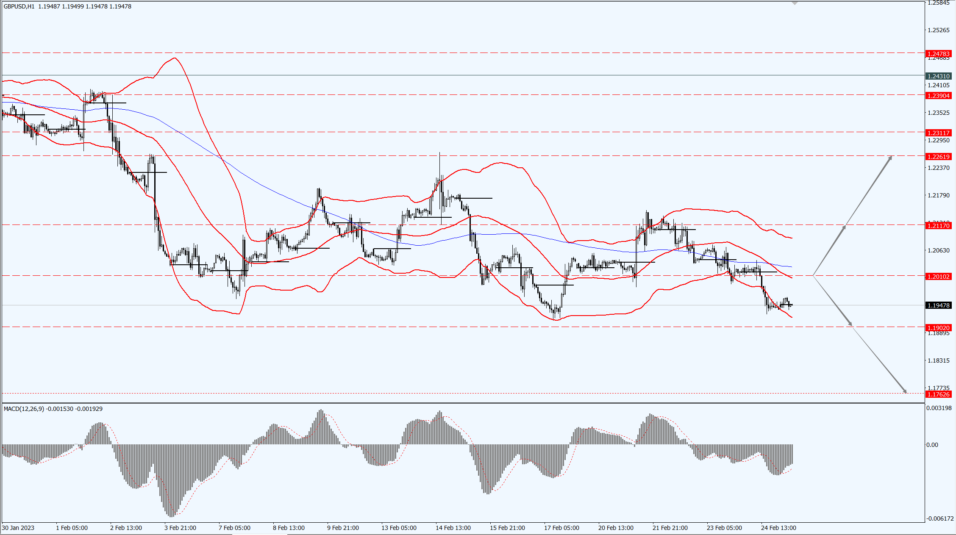

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2010-line today. If GBP runs below the 1.2010-line, it will pay attention to the suppression strength of the two positions of 1.1902 and 1.1762. If GBP runs above the 1.2010-line, then pay attention to the suppression strength of the two positions of 1.2117 and 1.2261.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices hit an eight-week low last week, weighed down by a climb in the dollar and U.S. bond yields as the market braced for further interest rate hikes by the Federal Reserve in the coming months.

U.S. inflation accelerated and consumer spending rebounded sharply by 1.8% in January, reinforcing expectations that the Fed will remain hawkish.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1820-line today. If the gold price runs below the 1820-line, then it will pay attention to the support strength of the 1808 and 1793 positions. If the gold price breaks above the 1820-line, then pay attention to the suppression strength of the two positions of 1832 and 1845.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices moved higher in last week’s volatile session. The prospect of lower Russian exports supported oil prices, but higher U.S. inventories and concerns about global economic activity kept prices under pressure.

Lower trading volumes led to volatility, with Brent crude trading at 58 percent of the previous session and U.S. crude futures trading at 90 percent of the previous session.

Both indicators were up about 2% in the previous session as Russia plans to cut oil exports from its western ports by as much as 25% in March, which exceeds its announced 500,000 barrels per day cut.

But the market appears to be well supplied, with U.S. inventories at their highest since May 2021, according to the U.S. Energy Information Administration (EIA). There are signs that tankers floating at sea are holding large amounts of Russian crude and refined products, which also hints at increased supply.

JPMorgan Chase in a report expects that short-term oil prices are more likely to move closer to $ 70 rather than rise. The Organization of the Petroleum Exporting Countries (OPEC) is expected to cut production to limit the decline in oil prices.

Minutes from the Federal Reserve’s most recent meeting show that most officials remain hawkish on inflation and labor market strains, foreshadowing further monetary tightening.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices today focus on 76.89- line, if oil prices run at 76.89 – line above, then pay attention to 78.14 and 78.93 two positions of suppression strength; if oil prices run at 76.89 – line below, then pay attention to 75.04 and 73.52 two positions of support strength.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.