1. Forex Market Insight

EUR/USD

EUR/USD closed up 0.01% at 1.0166 on Wednesday, 3rd August 2022, with the gas crisis and recession still the two biggest downsides facing EUR.

An earlier survey showed that business activity in the euro zone contracted slightly in July for the first time since the beginning of last year as consumers cut back on spending in the face of a cost-of-living crisis, with a gloomy economic outlook.

The data showed that the final Markit composite PMI for the eurozone fell to 49.9 in July from 52.0 in June, a 17-month low; although higher than the initial value of 49.4, it was still below the Rongkou line of 50.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0116-line today. If EUR runs steadily below the 1.0116-line, then pay attention to the support strength of the two positions of 0.9999 and 0.9938. If the strength of EUR breaks above the 1.0277-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD closed down 0.14% at 1.2144 on Wednesday, 3rd August 2022.

The Bank of England (BoE) will hold a policy meeting on 4th August 2022, is expected to raise interest rates for the sixth consecutive time, but institutions have different views on the magnitude of the rate hike, if only 25 basis points, rather than 50 basis points fears lead to a decline in the pound.

Some leading economists warned that it is reasonable to expect the Bank of England to maintain its preference for a 25 basis point rate hike rather than a 50 basis point hike, suggesting downside risks to the pound.

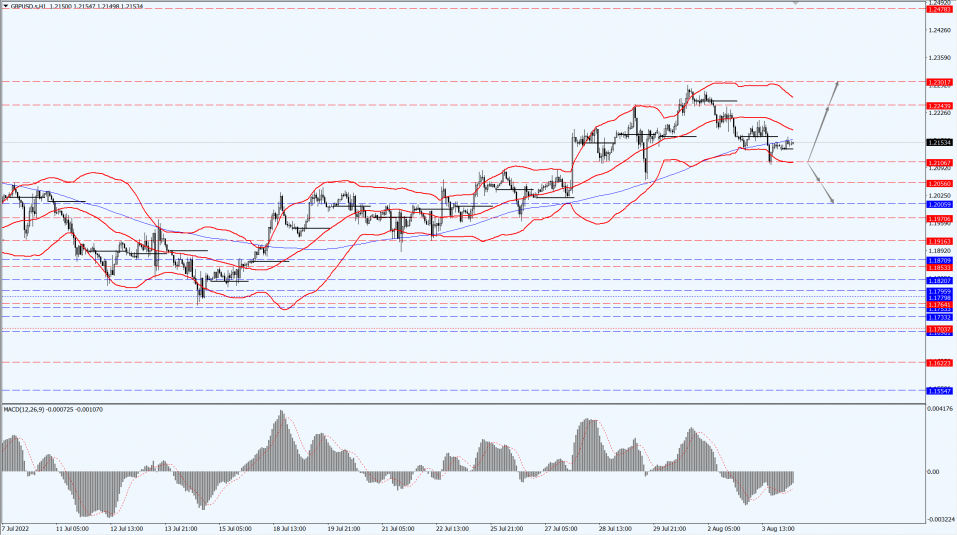

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices were stuck in a narrow range on Wednesday, 4th August 2022, under pressure from the rising dollar and Treasury yields, with hawkish statements from Federal Reserve officials taking gold prices further off the one-month highs touched in the previous session.

St. Louis Fed President Bullard said Wednesday, 3rd August 2022, that the Fed will be steadfast in raising interest rates to bring inflation, which is at a four-decade high, back to the 2% target.

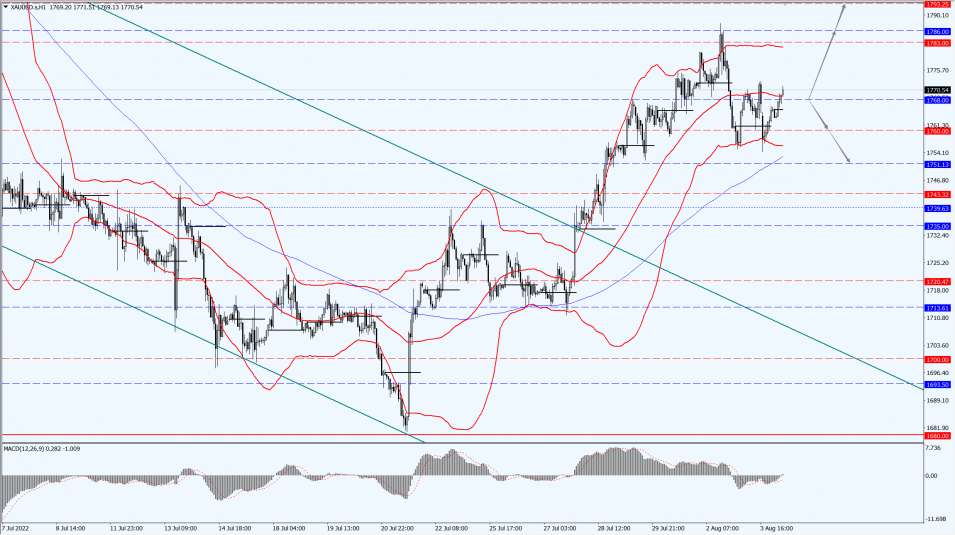

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1768-line today. If the gold price runs steadily below the 1768-line, then it will pay attention to the support strength of the 1760 and 1751 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of the 1786 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices slid more than 3% on Wednesday, 3rd August 2022, accelerating after U.S. data showed an unexpected surge in crude and gasoline inventories last week and after OPEC+ said it would raise its oil production target by 100,000 barrels per day.

The U.S. Energy Information Administration (EIA) said Wednesday, 3rd August 2022, that U.S. crude oil inventories unexpectedly increased last week as exports fell and refineries refined less oil, and gasoline stocks also unexpectedly rose as demand slowed.

Crude oil inventories increased by 4.5 million barrels last week, compared to analysts’ forecasts for a decrease of 0.6 million barrels.

Gasoline inventories increased by 0.2 million barrels versus expectations of a 1.6 million barrel decrease.

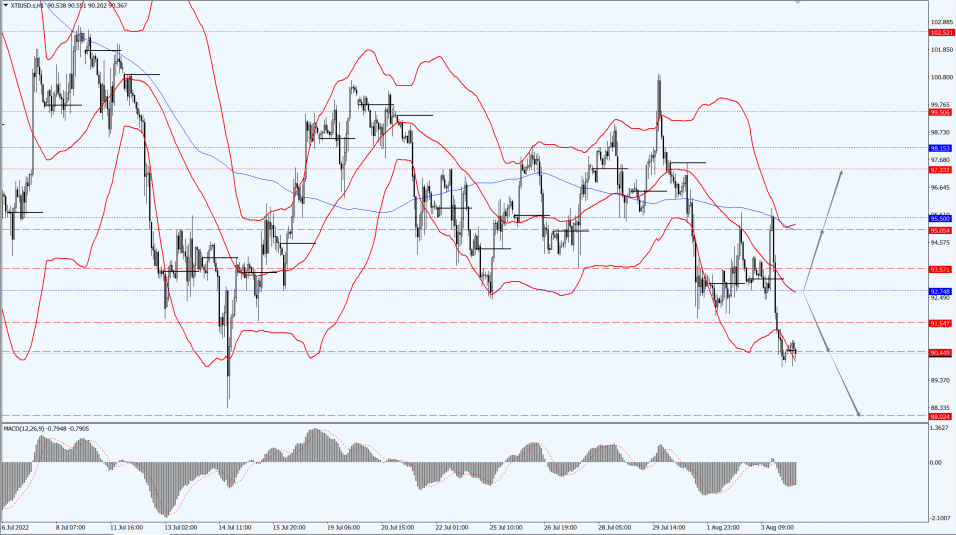

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 92.74-line today. If the oil price runs above the 92.74-line, then focus on the suppression strength of the two positions of 95.05 and 97.33. If the oil price runs below the 92.74-line, then pay attention to the support strength of the two positions of 90.44 and 88.02.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.