1. Forex Market Insight

EUR/USD

EUR/USD declined 0.59% on Friday, 12th August 2022, at 1.0256.

The data showed that prices in France rose 6.8% year-on-year in July, while inflation in Spain was 10.8%, the highest since 1984.

The war in Ukraine, Europe’s search for non-Russian energy sources, and the lack of rainfall hit the German economy hard, leaving Europe struggling and the euro under pressure.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0277-line today. If EUR runs steadily below the 1.0277-line, then pay attention to the support strength of the two positions of 1.0190 and 1.0116. If the strength of EUR breaks above the 1.0277-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

USD/EUR closed down 0.52% on Friday, 12th August 2022, at 1.2134.

UK GDP fell 0.1% in the second quarter from a year earlier, the first contraction since the epidemic blockade in early 2021, but the contraction was less than the 0.2% expected by the market.

However, the British economy is struggling under the weight of soaring gas costs and rising interest rates, which are also weighing on the pound.

For the United Kingdom, the fourth quarter will be a “dangerous phase”. The Bank of England previously expected that the British economy will enter recession in the fourth quarter, the same period CPI will exceed 13%.

Technical Analysis:

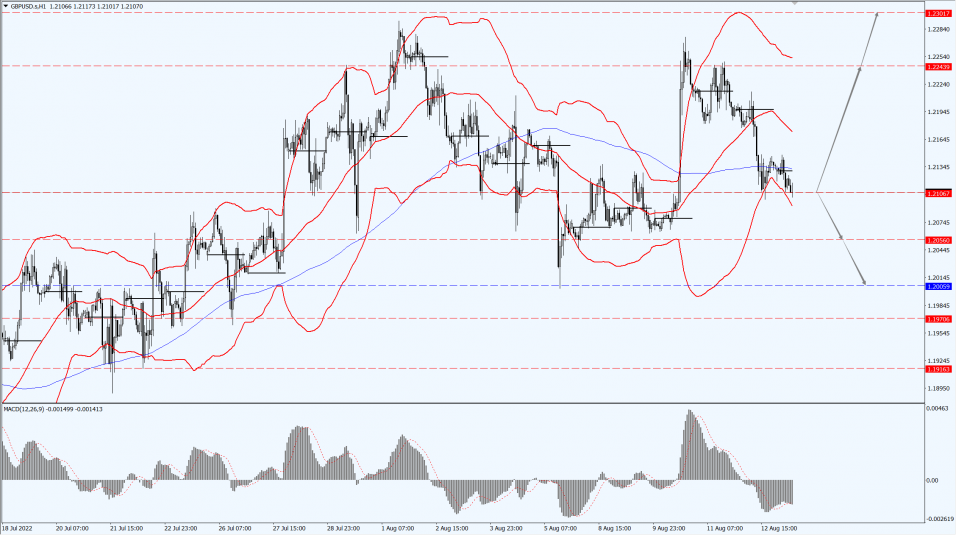

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices advanced on Friday, 12th August 2022, with the help of falling U.S. Treasury yields and are poised for a fourth straight week of gains as investors assess recent U.S. inflation data.

U.S. Treasury yields slipped after a tumultuous week, as investors assessed whether the apparent slowdown in inflation would reduce the pace of interest rate hikes by the Federal Reserve.

Market participants lowered expectations for an aggressive Fed rate hike after data released earlier last week showed that inflation in the U.S. had cooled.

However, the tone of recent speeches by Fed officials remains hawkish and has prevented gold prices from breaking through the $1,800 level.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1783-line today. If the gold price runs steadily below the 1783-line, then it will pay attention to the support strength of the 1768 and 1760 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of the 1793 and 1807.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices plunged more than 2% on Friday, 12th August 2022, on expectations that supply disruptions in the U.S. Gulf of Mexico will be short-term, while recession fears overshadowed the demand outlook.

Brent crude futures jumped 3.4% last week after a Louisiana port official said crews are expected to replace a damaged oil pipeline fragment by the end of last Friday, 12th August 2022, allowing seven U.S. offshore rigs in the Gulf of Mexico to resume production.

The market also digested widely different demand outlooks from the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA).

In its monthly report released last Thursday, 11th August 2022, OPEC said it expects oil demand to increase by 3.1 million barrels per day, or 3.2%, in 2022, down 260,000 barrels per day from its previous forecast.

This contradicts the view of the IEA, which raised its forecast for demand growth to 2.1 million barrels per day due to soaring natural gas prices that will cause power plants to switch from using natural gas to oil.

Technical Analysis:

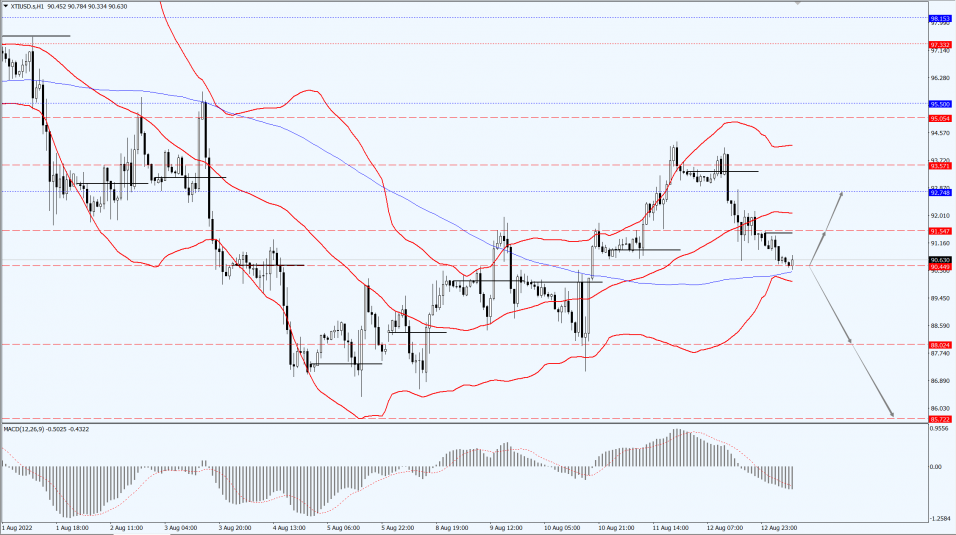

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 90.44-line today. If the oil price runs above the 90.44-line, then focus on the suppression strength of the two positions of 91.54 and 92.74. If the oil price runs below the 90.44-line, then pay attention to the support strength of the two positions of 88.02 and 85.72.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.