1. Forex Market Insight

EUR/USD

EUR/USD dipped 0.15% to $1.0511 after rising as much as 0.5% to $1.0577.

Officials with knowledge of the matter revealed that European Central Bank (ECB) policymakers are increasingly inclined to raise interest rates above zero by the end of the year.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the position of 1.0357. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0776.

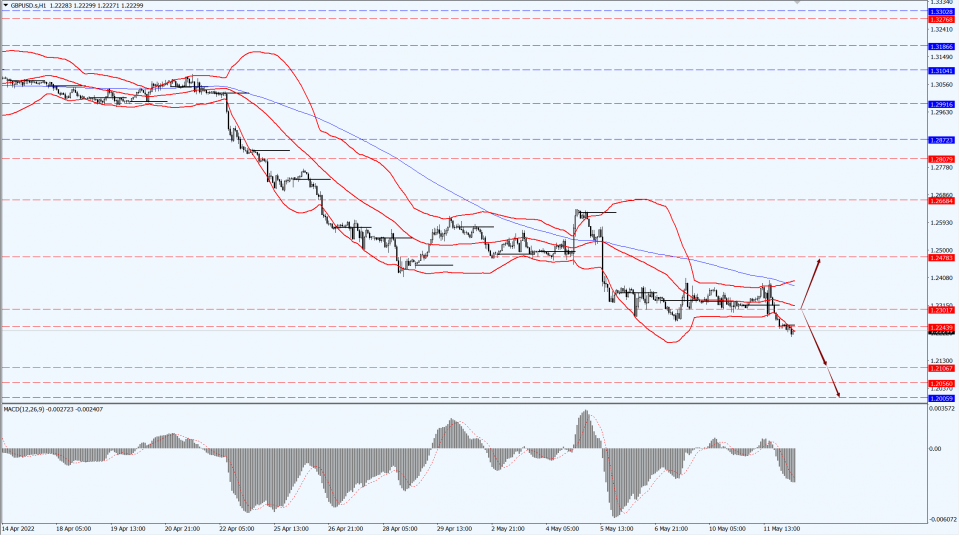

GBP Intraday Trend Analysis

Fundamental Analysis:

The U.S. Department of Labor announced on Wednesday, 11th May 2022, that the Consumer Price Index (CPI) rose 0.3% in April, the smallest increase since August. On the other hand, the CPI rose 1.2% in March from a year earlier, the largest increase since September 2005.

The CPI rose 8.3% year-on-year, above expectations of 8.1%, but down from 8.5% in March. Inflation may have peaked, but it is unlikely to cool down quickly or disrupt the Fed’s current plans to tighten monetary policy, the data showed.

The U.S. dollar index hit a four-day low of 103.37 ahead of the data and strengthened to a session high of 104.13 after the data, just below the near 20-year high of 104.19 hit on Monday, 9th Monday 2022.

The continued strength of the US index and strong interest rate hike expectations further weighed on GBP, resulting in continued weakness in the pound.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2301-line today. If GBP runs below the 1.2301-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2005. If GBP runs above the 1.2301-line, then pay attention to the support strength of the position of 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rebounded on Wednesday, 11th May 2022, with spot gold up 0.79% to around $1,850.

USD fell after the U.S. inflation data was released earlier, as the market focused on a slight cooling of the rise in consumer prices.

U.S. gold futures settled 0.7% higher at $1,853.70 an ounce.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1853-line today. If the gold price runs steadily above the 1853-line, then it will pay attention to the support strength of the 1866 and 1880 positions. If the gold price breaks below the 1853-line, then pay attention to the suppression strength of the two positions of the 1844 and 1830.

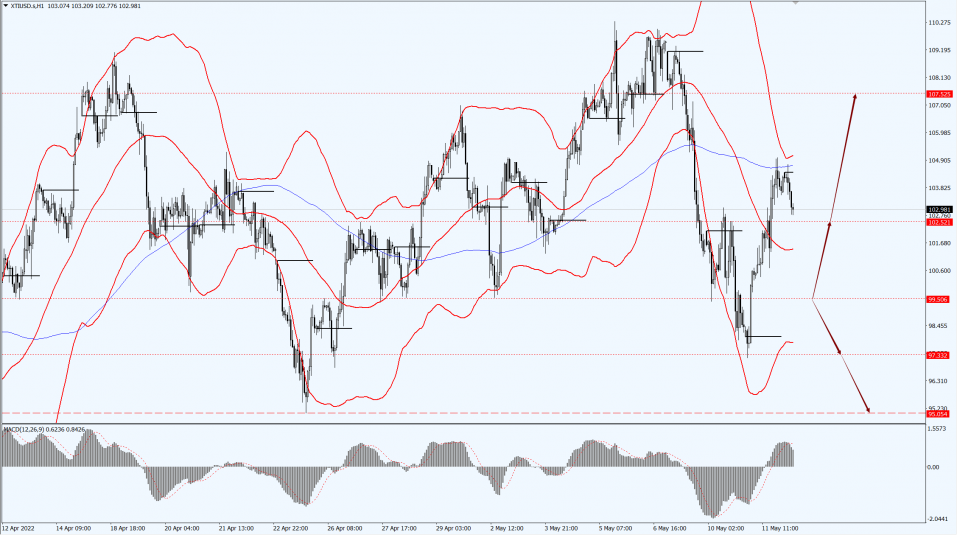

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices surged on Wednesday, 11th May 2022, with U.S. crude oil jumping about 6% after Russia sent less natural gas to Europe and the announcement of Russian sanctions against some European gas companies increased uncertainty in the global energy market.

Oil and gas prices have risen since Russia’s invasion of Ukraine in February and the subsequent imposition of tough sanctions on Russia by the United States and its allies.

Crude oil trade has been cut and Russia has threatened to cut off gas supplies to Europe, although no such action has been taken.

Russian gas deliveries to Europe via Ukraine fell by a quarter on Wednesday after Ukraine shut down a major gas pipeline, blaming it on the intervention of Russian occupation forces.

This is the first interruption of gas deliveries to Europe via Ukraine since the conflict began.

The action has raised concerns that similar disruptions could occur in the future, at a time when prices have already soared.

On Wednesday, 11th May 2022, Russia announced sanctions against 31 companies based in countries that have imposed sanctions on Russia.

Brent crude futures settled up $5.05, or 4.9%, at $107.51 a barrel;

U.S. crude futures settled up $5.95, or 6%, at $105.71 a barrel.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 99.50-line today. If the oil price runs above the 99.50-line, then focus on the suppression strength of the two positions of 102.52 and 107.52. If the oil price runs below the 99.50-line, then pay attention to the support strength of the two positions of 97.33 and 95.05.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.