1. Forex Market Insight

EUR/USD

EU ministers will meet on Friday, 9th September 2022, to discuss urgent measures to deal with soaring gas and electricity prices.

Soaring energy costs are hitting European industry and driving up household bills after Russia restricted gas deliveries to the EU.

EUR/USD was down 0.18% at 0.9908, continuing to move away from parity levels.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9864 and 0.9810. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 0.9999 and 1.0116.

GBP Intraday Trend Analysis

Fundamental Analysis:

Britain’s new Prime Minister Liz Truss is considering freezing household energy bills in an attempt to avoid a cost-of-living crisis for millions of families over the winter.

Truss took over an economy in crisis, and she vowed to tackle a daunting set of challenges, including soaring energy bills, a looming recession and industrial woes.

GDP/USD rose at one point, but was little changed at the end of the session, edging up 0.01% to $1.1524.

Technical Analysis:

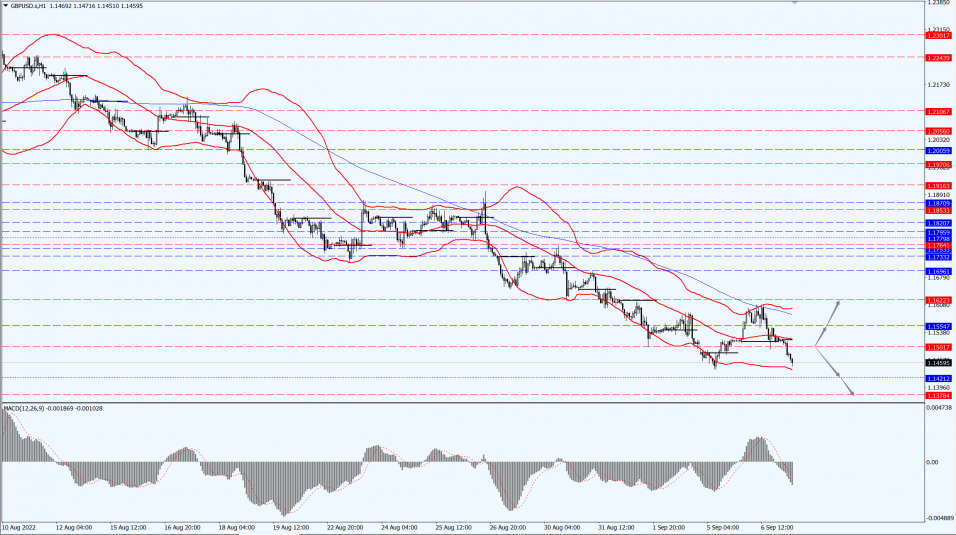

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two positions of 1.1421 and 1.378. If GBP runs above the 1.1501-line, then pay attention to the suppression strength of the two positions of 1.1622 and 1.1696.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices retreated from one-week highs touched earlier in the session on Tuesday, driven by expectations that major central banks will tighten monetary policy aggressively as the dollar and U.S. bond yields climbed.

The focus this week will be on Thursday’s ECB meeting, where the central bank is expected to raise rates by 75 basis points.

USD jumped to a 20-year high after data showed the U.S. service sector rebounded for a second straight month in August due to order growth and strong employment, while supply bottlenecks and price pressures eased.

Indicator U.S. Treasury yields rose to the highest since June on expectations that the Federal Reserve will continue to raise interest rates.

Higher U.S. bond yields have raised the opportunity cost of holding gold.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1693-line today. If the gold price runs steadily below the 1693-line, then it will pay attention to the support strength of the 1680 and 1671 positions. If the gold price breaks above the 1693-line, then pay attention to the suppression strength of the two positions of the 1700 and 1720.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell on Tuesday, 6th September 2022, as the prospect of more interest rate hikes and new crown sealing measures that will weaken fuel demand reignited market concerns, reversing two days of gains from OPEC+’s first production cut target since 2020.

USD rose about 0.6% on better-than-expected U.S. services data, which also put pressure on oil prices.

The service sector activity data fueled expectations that the Federal Reserve will continue to raise interest rates, which could trigger a recession and bring down fuel demand.

The foreign policy chief of the European Union (EU) said on Monday, 5th September 2022, that he is not hopeful of a swift resumption of the Iran nuclear deal.

OPEC+ decided on Monday, 5th September 2022, to cut its October production target by 100,000 bpd.

Oil prices rose on last Friday, 2nd September 2022, ahead of the meeting and also moved higher after the results were released.

Due to the Labor Day holiday, the weekly inventory reports from the American Petroleum Institute (API) and the Energy Information Administration (EIA) will be released on Wednesday and Thursday, one day later than usual.

Technical Analysis:

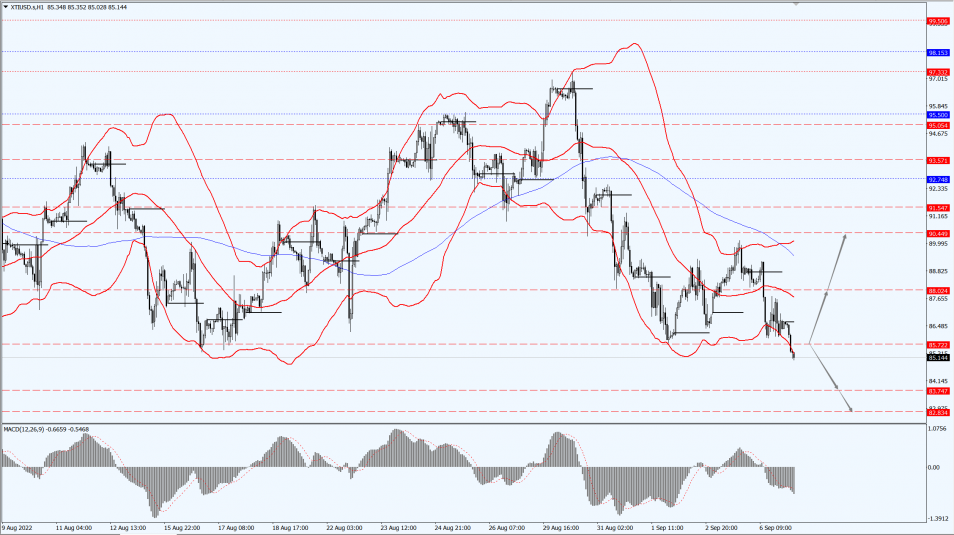

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85.72-line today. If the oil price runs above the 85.72-line, then focus on the suppression strength of the two positions of 88.02 and 90.44. If the oil price runs below the 85.72-line, then pay attention to the support strength of the two positions of 83.74 and 82.83.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.