1. Forex Market Insight

EUR/USD

The euro slipped 0.6% against the dollar to $1.0724, the lowest since Jan. 9, after having fallen 1% on Friday, 3rd February 2023.

Last week’s strong U.S. jobs report raised the likelihood that the Federal Reserve will continue to raise interest rates for a longer period to fight inflation, causing the euro to come under pressure to the downside.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0729 line today. If the EUR runs below the 1.0729 line, then pay attention to the support strength of the two positions of 1.0697 and 1.0642. If the strength of EUR rises over the 1.0729 line, then pay attention to the suppression strength of the two positions of 1.0776 and 1.0802.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound was down 0.2% at $1.20245, a one-month low, as markets await U.K. economic growth data and statements from Bank of England policymakers on the pace of interest rate hikes for clues on the pound’s outlook.

Technical Analysis:

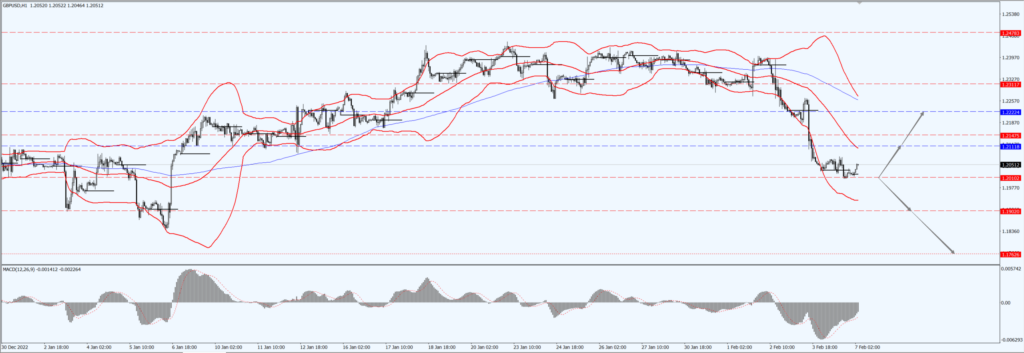

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2010-line today. If GBP runs below the 1.2010-line, it will pay attention to the suppression strength of the two positions of 1.902 and 1.782. If GBP runs above the 1.2010-line, then pay attention to the suppression strength of the two positions of 1.2111 and 1.2222.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose on Monday, 6th February 2023 the market valued gold’s safe-haven appeal amid lingering concerns about an economic slowdown, after a stronger dollar and rising U.S. bond yields once dragged gold prices to a one-month low.

Spot gold rose 0.2% to $1,868.96 an ounce, after touching $1,860 earlier in the day, the lowest since Jan. 6.

Technical Analysis:

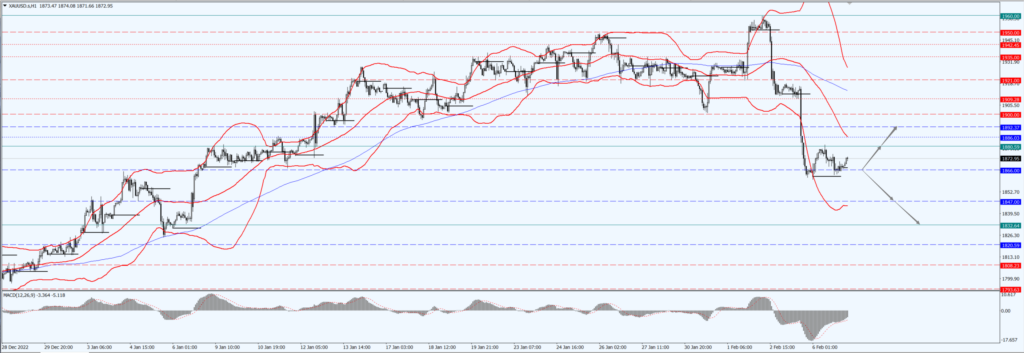

(Gold 1-hour Chart)

Gold pays attention to the 1866-line today. If the gold price runs below the 1866-line, then it will pay attention to the support strength of the 1847 and 1832 positions. If the gold price breaks above the 1866-line, then pay attention to the suppression strength of the two positions of 1880 and 1892.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices climbed in shock trading Monday, 6th February 2023, as the market weighed a rebound in Chinese demand against supply concerns and worries about slowing growth in major economies curbing consumption.

Oil prices were boosted by the prospect of a recovery after China eased restrictions on new crowns.

Technical Analysis:

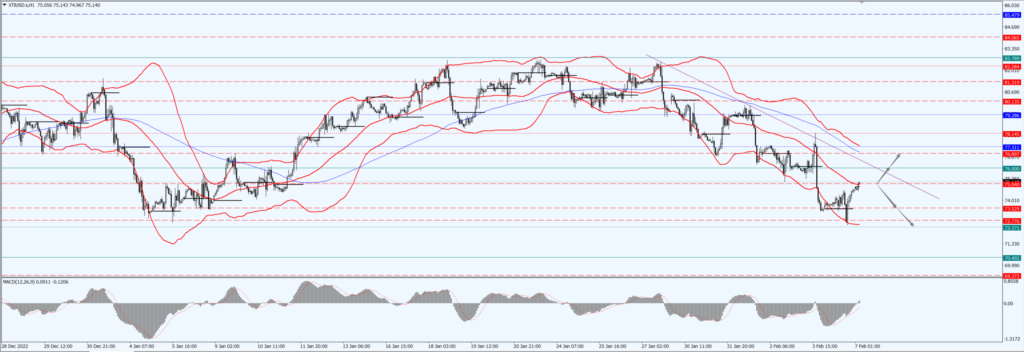

(Crude Oil 1-hour Chart)

Oil prices focus on the 75.04 – line today. If the oil price runs above the 75.04 -line, then focus on the suppression strength of the two positions of 76.00 and 76.89. If the oil price runs below the 75.04 -line, then pay attention to the support strength of the two positions of 73.52 and 72.37.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.