1. Forex Market Insight

EUR/USD

The euro fell 0.8% against the dollar to 0.9887. Eurozone inflation rose to 10.7% from 9.9% a month ago, exceeding the expectation in a Reuters poll for 10.2%, according to Eurostat data. But the euro barely reacted.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9999 line today. If the EUR runs below the 0.9999 line, then pay attention to the support strength of the two positions of 0.9952 and 0.9810. If the strength of EUR rises over the 0.9999 line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose against the dollar, extending gains recorded earlier last The British pound fell 1.2% against the dollar to $1.1476. The Bank of England is likely to raise interest rates by 75 basis points at Thursday’s, 3rd November 2022 meeting, and Deputy Governor Ben Broadbent recently said that market-digested interest rate levels would hit the U.K. economy, noting that he doubts the U.K. will achieve a “soft landing”.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two positions of 1.1396 and 1.1273. If GBP runs above the 1.1501 -line, then pay attention to the suppression strength of the two positions of 1.1607 and 1.1756.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell on Monday, 31st October 2022 and posted the longest streak of monthly losses on record, weighed down by a stronger dollar, climbing U.S. Treasury yields and the prospect that the Federal Reserve will raise interest rates further.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1638-line today. If the gold price runs below the 1638-line, then it will pay attention to the support strength of the 1627 and 1616 positions. If the gold price breaks above the 1638-line, then pay attention to the suppression strength of the two positions of the 1645 and 1654.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell Monday, 31st October 2022 on expectations that U.S. production could increase and that the spread of the epidemic is affecting demand.

Both major indicator crude futures posted their first monthly gains since May. U.S. oil production climbed to nearly 12 million barrels per day in August, the highest since the COVID outbreak, monthly government data showed.

President Joe Biden will call on oil and gas companies to invest a portion of their record profits in lowering costs for American families, a White House official said.

China’s crude oil imports in the first three quarters of this year totaled about 370.4 million tons, or about 9.9 million barrels per day, 4.3% lower than the corresponding period last year. This marked the first annual decline in the same period since at least 2014.

The Organization of Petroleum Exporting Countries (OPEC) raised its medium- to long-term world oil demand forecast in its annual outlook released Monday and said that despite the ongoing energy transition, $12.1 trillion in investment is still needed to meet oil demand.

Technical Analysis:

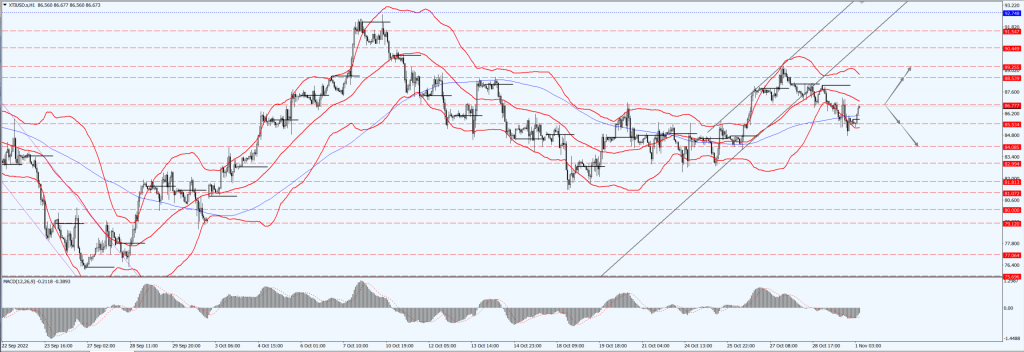

(Crude Oil 1-hour Chart)

Oil prices focus on the 86.77 line today. If the oil price runs above the 86.77-line, then focus on the suppression strength of the two positions of 88.53 and 89.25. If the oil price runs below the 86.77-line, then pay attention to the support strength of the two positions of 85.53 and 84.08.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.