1. Forex Market Insight

EUR/USD

EUR/USD down 0.99%, falling back below parity at $0.9953.

GDP/USD hit a new two-and-a-half-year low of $1.1501 and ended the session down about 0.69%.

Manufacturing activity across the eurozone contracted for the second consecutive month in August, a survey showed.

European energy prices eased slightly this week, but remain at high levels.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9909 and 09864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD experienced its worst month in August since the EU referendum, as political uncertainty in the U.K. and the cost-of-living crisis put the pound under enormous pressure.

GBP/USD fell 4.5% cumulatively in August, and on Thursday, 1st September, GBP continued to fall and once fell below the 1.15 handle to hit a low of 1.1498, closing down 0.66% at 1.1543.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1554-line today. If GBP runs below the 1.1554-line, it will pay attention to the suppression strength of the two positions of 1.1501 and 1.1421. If GBP runs above the 1.1554-line, then pay attention to the suppression strength of the two positions of 1.1622 and 1.1696.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell below the key $1,700 level on Thursday, 1st September 2022, for the first time since July as a rising dollar and expectations of aggressive interest rate hikes weakened gold’s appeal.

The dollar index rose to a 20-year high after data showed U.S. manufacturing grew in August.

And initial jobless claims fell last week, which gives the Fed more room for aggressive rate hikes.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1700-line today. If the gold price runs steadily below the 1700-line, then it will pay attention to the support strength of the 1693 and 1680 positions. If the gold price breaks above the 1700-line, then pay attention to the suppression strength of the two positions of the 1713 and 1720.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices plunged nearly 3% on Thursday, 1st September 2022, as concerns about high inflation and interest rate hikes weakening fuel demand intensified.

According to the Organization of Petroleum Exporting Countries (OPEC) and the OPEC+ coalition of its allies, the oil market will still see a small surplus of just 400,000 barrels per day in 2022, well below previous forecasts, due to insufficient production from member countries.

OPEC+ also predicts a shortage of 300,000 barrels per day in the oil market in 2023.

Technical Analysis:

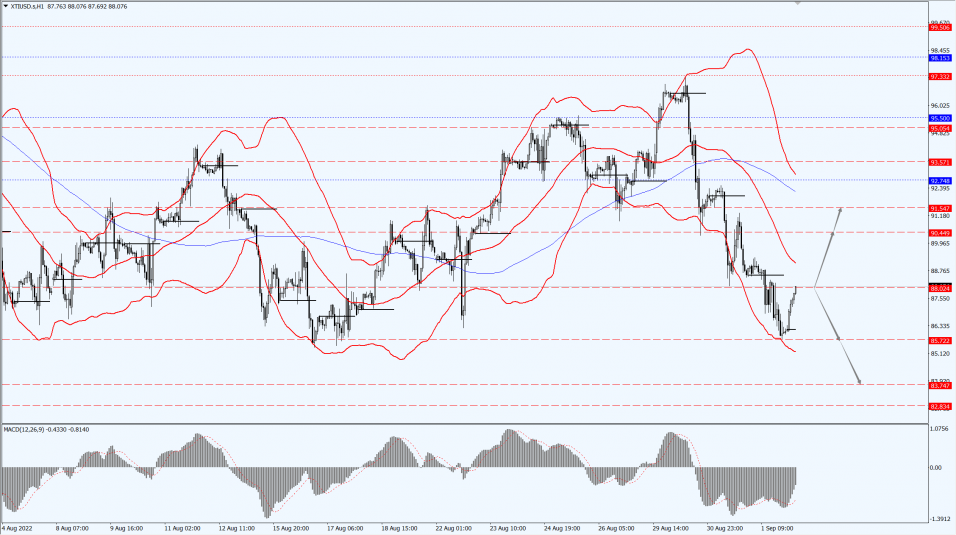

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 88.02-line today. If the oil price runs above the 88.02-line, then focus on the suppression strength of the two positions of 90.44 and 91.54. If the oil price runs below the 88.02-line, then pay attention to the support strength of the two positions of 85.72 and 83.74.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.