1. Forex Market Insight

EUR/USD

The euro fell 0.44% to $1.0339, after rising to 1.0496 earlier in the session, a nearly five-month high.

The euro zone faces different economic challenges than the United States. Supply-side shocks have laid the groundwork for a prolonged period of high inflation and sluggish growth. A recession seems inevitable, with eurozone GDP expected to fall 0.9% in 2023 before stagnating in 2024.

Rising inflationary pressures, combined with the risk of runaway inflation expectations, will keep the ECB firmly in tightening mode. interest rates may be cut in 2024, but uncertainty remains high.

Europe’s greatest vulnerability comes from geopolitics, and a renewed energy crisis or a new winter epidemic of new crowns. The epidemic-related private savings cushion, fiscal measures and accelerated investment spending pose upside risks to the growth outlook.

“Stagflation” is not necessarily the new normal, but structural reforms to address low productivity and unfavorable demographic trends, as well as staying ahead in the green transition race, remain key.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0440 line today. If the EUR runs below the 1.0440 line, then pay attention to the support strength of the two positions of 1.0275 and 1.0088. If the strength of EUR rises over the 1.0440 line, then pay attention to the suppression strength of the two positions of 1.0529 and 1.0586.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound fell 1.02% against the U.S. dollar on Monday 28th November 2022 to close at 1.1960. The U.K.’s third-quarter GDP data marked the official start of the recession, and the economy is likely to weaken further on top of that.

UK GDP is expected to grow negatively for the fourth consecutive quarter. It will take until the fourth quarter of 2023 for positive growth to return. The unemployment rate will rise to 5% by the end of the forecast period.

Mortgage rates will be pushed up by rising central bank rates, and the UK political situation is likely to remain volatile. The housing market has been strong during the epidemic, but house prices are expected to fall about 8% from their highs due to rising interest rates and a weakening economy.

Inflation will remain high during 2023, forcing the Bank of England to raise interest rates further. However, terminal rates are well below market pricing and the first-rate cut is expected to be implemented in 2024.

Technical Analysis:

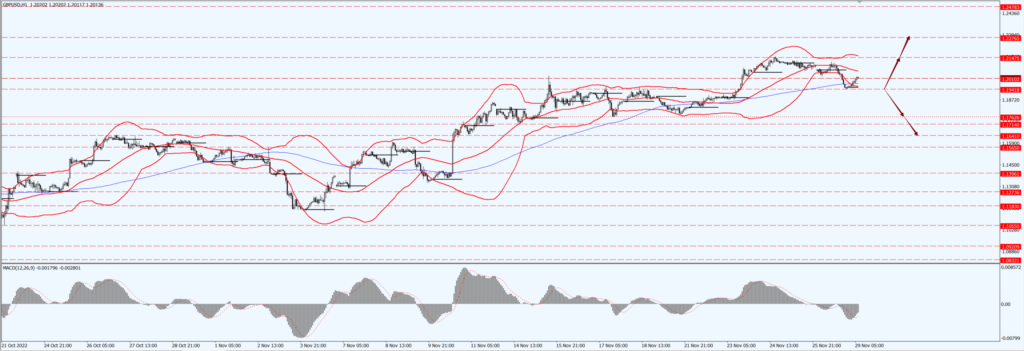

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1941-line today. If GBP runs below the 1.1941-line, it will pay attention to the suppression strength of the two positions of 1.1762 and 1.1641. If GBP runs above the 1.1941-line, then pay attention to the suppression strength of the two positions of 1.2147 and 1.2276.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices retreated from more than a week high on Monday 28th November 2022 as the dollar recovered from intraday lows and Federal Reserve officials made hawkish statements reiterating their commitment to fighting inflation.

Spot gold was down 0.8% at $1,741.35 an ounce, after touching its highest since Nov. 18 earlier in the session.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1768-line today. If the gold price runs below the 1768-line, then it will pay attention to the support strength of the 1747 and 1727 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of 1783 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Global index oil contracts recovered from their lowest levels in nearly a year on Monday, 28th November 2022 with U.S. crude closing higher as rumors of an OPEC+ production cut offset concerns about demand.

Weaker demand could spur the Organization of the Petroleum Exporting Countries and allies, including Russia, to cut output after the alliance already reduced supply in October. OPEC+ will meet on Dec. 4. in October, OPEC+ agreed to reduce its production target by 2 million barrels per day by 2023.

EU governments failed to agree Monday on a price cap on Russian seaborne crude, diplomats said, as Poland insisted the cap must be set lower than the Group of Seven (G7) proposed to undermine Russia’s ability to fund its invasion of Ukraine.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 77.54 line today. If the oil price runs above the 77.54 -line, then focus on the suppression strength of the two positions of 79.09 and 81.12. If the oil price runs below the 77.54 -line, then pay attention to the support strength of the two positions of 76.07 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.