1. Forex Market Insight

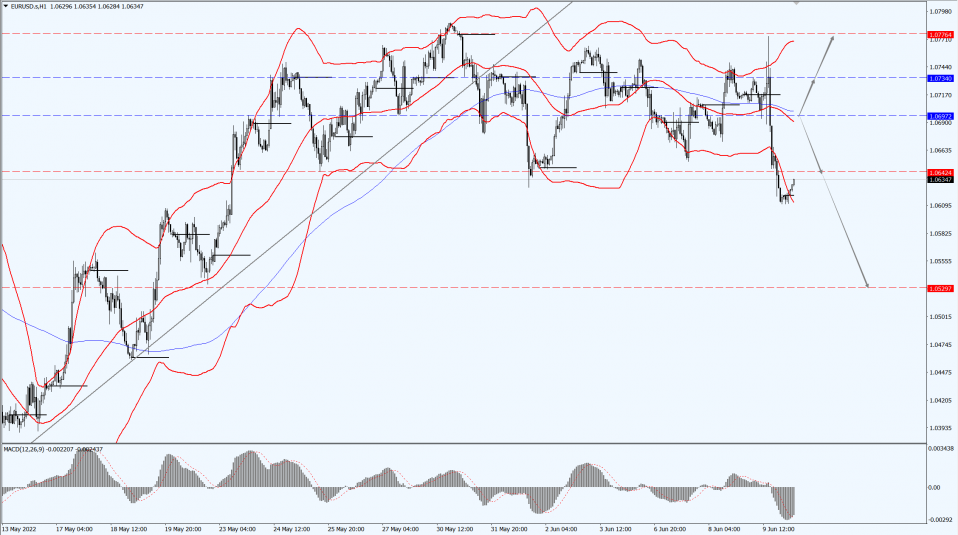

EUR/USD

EUR/USD fell 0.9% to 1.0616 on Thursday, 9th June 2022.

The European Central Bank (ECB) announced on Thursday, 9th June 2022, that it will end a long-term stimulus program and said it will raise interest rates in July for the first time since 2011.

There could be a bigger move in September.

The central bank is seeking to curb rising inflation.

However, the lack of any details on plans to deal with the fragmented financing environment led the euro to weaken against the dollar.

The European Central Bank said differences in borrowing costs among European countries hindered the execution of its monetary policy.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0697-line today. If EUR runs steadily above the 1.0697-line, then pay attention to the support strength of the two positions of 1.0734 and 1.0776. If the strength of EUR breaks below the 1.0697-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

British Prime Minister Johnson suffered a no-confidence vote.

Although he narrowly won in the end, some analysts suggested that his prime minister status still faces challenges.

Political risks in the UK and concerns about an economic slowdown are putting pressure on the pound.

According to sources, Johnson plans to advance legislation that would give him the power to overturn parts of the Britain’s Brexit deal.

Such a move could anger some Members of Parliament (MPS) from the party and the European Union (EU).

This is potentially bearish for the pound.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2301 and 1.2243. If GBP runs above the 1.2478-line, then pay attention to the suppression strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

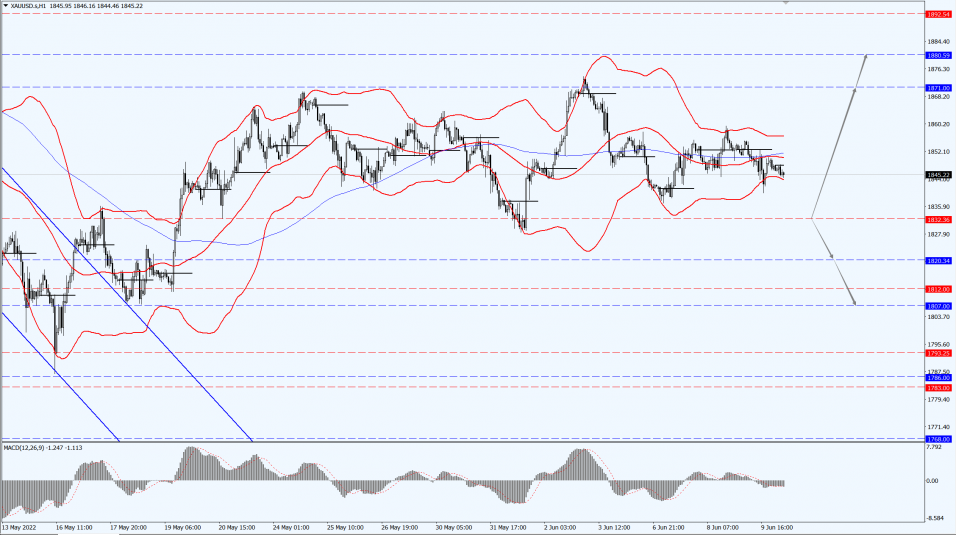

Gold

Fundamental Analysis:

Gold prices shocked down on Thursday, 9th June 2022, once falling to the 1840 mark during the day to close at $1847.96 an ounce.

Climbing U.S. Treasury yields and a stronger U.S. dollar have weakened the appeal of gold.

U.S. inflation data to be released on Friday, 10th June 2022, could strengthen the case for aggressive Fed policy tightening.

U.S. gold futures were down 0.2% at $1,852.80.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily above the 1832-line, then it will pay attention to the support strength of the 1871 and 1880 positions. If the gold price breaks below the 1832-line, then pay attention to the suppression strength of the two positions of the 1820 and 1807.

3. Commodities Market Insight

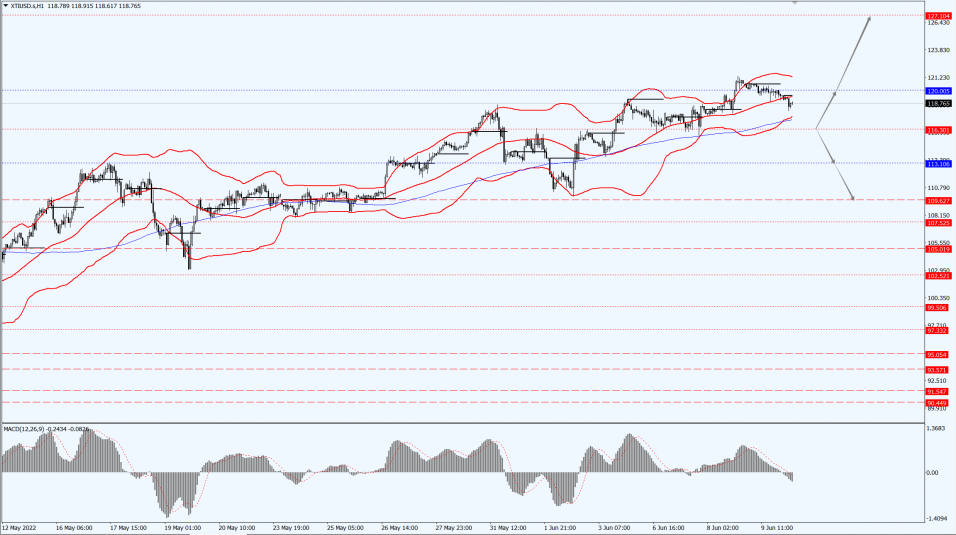

WTI Crude Oil

Fundamental Analysis:

Oil Prices fell on Thursday, 9th June 2022.

This comes after a recurrence of the Asian outbreak added some concern, but oil prices are still hovering near three-month highs.

A strong rally in refined oil products provided a continued bullish environment for the oil market.

August Brent crude futures settled down $0.51, or 0.4%, at $123.07 a barrel.

U.S. crude oil futures for July delivery settled down 60 cents, or 0.5%, at $121.51 a barrel.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 116.30-line today. If the oil price runs above the 116.30-line, then focus on the suppression strength of the two positions of 120.06 and 127.10. If the oil price runs below the 116.30-line, then pay attention to the support strength of the two positions of 113.10 and 109.62.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.