1. Forex Market Insight

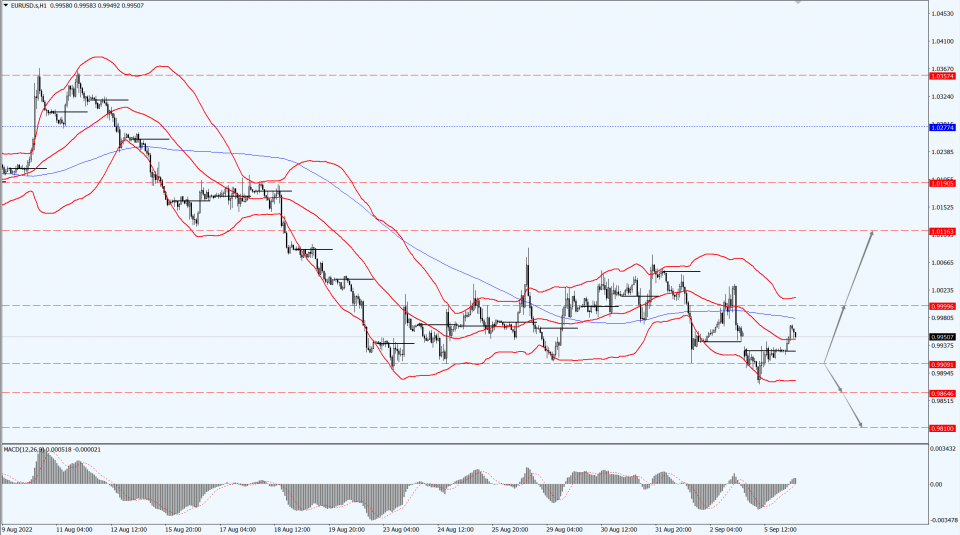

EUR/USD

EUR/USD dropped below 0.99 at one point, hitting a new low since December 2002.

The European Central Bank will usher in the interest rate meeting on this Thursday, 8th September 2022. The market is widely expected, the ECB at least 50 basis points, and may even raise rates by 75 basis points.

However, the probability of a recession in the euro zone has soared, which has always led to pressure on the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9864 and 0.9810. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 0.9999 and 1.0116.

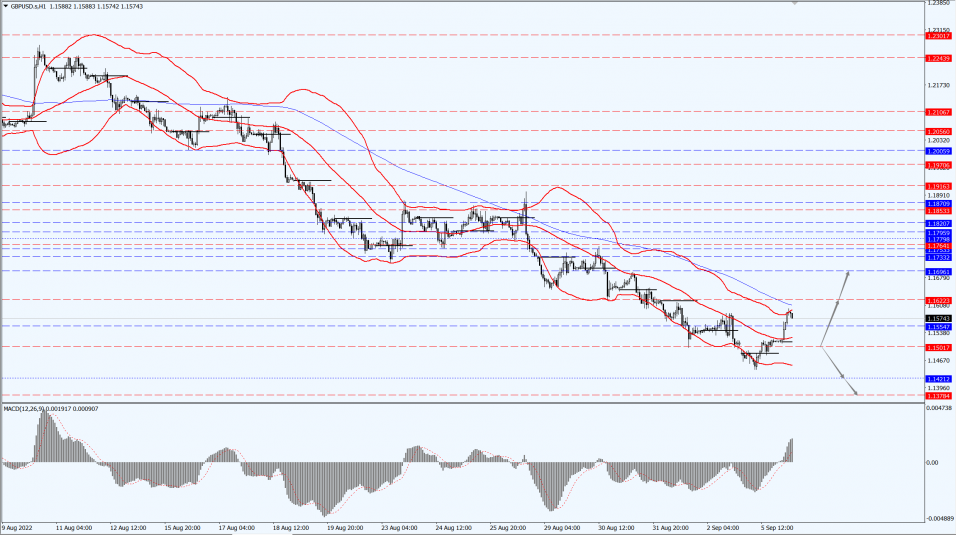

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD hovered near a two-and-half-year low on Monday, 5th September 2022, amid a deteriorating economy and the victory of British Foreign Minister Tony Truss in the Conservative leadership race to become Britain’s next prime minister.

GBP/USD fell to 1.1443 before turning higher and finally closing up 0.05% at 1.1517 because of news that Russia will continue to shut down a major gas supply pipeline to Europe, fueling fears of a recession in the U.K.

The new prime minister will inherit an economy that threatens to fall into recession, and the pound is one of the worst-performing major currencies in 2022.

With inflation soaring into double digits and economic growth stagnating, GBP/USD has slid 15%.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two positions of 1.1421 and 1.378. If GBP runs above the 1.1501-line, then pay attention to the suppression strength of the two positions of 1.1622 and 1.1696.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices edged lower on Monday, 5th September 2022, with a stronger dollar limiting the momentum of the rally.

And Monday coincided with the Labor Day holiday in the U.S., making market liquidity relatively light.

Gold prices closed 0.84% higher on Friday, 2nd September 2022, the best one-day performance in a month, as the U.S. jobs report for August showed a rise in the unemployment rate, suggesting the Federal Reserve may slow the pace of interest rate hikes.

Economic downturn concerns dampen optimism.

The latest “Fed Watch” tool from Chicagoland shows that the likelihood of a third consecutive 75 basis point rate hike by the Fed this month is about 60%.

And at one point it was as high as 75% before the August nonfarm payrolls data was released.

The Federal Reserve raised interest rates by a cumulative 225 basis points in March this year, aiming to control consumer demand, cool inflation and rebalance supply and demand.

Nonetheless, there is a growing belief that the Fed will stick to its aggressive course of policy tightening, which continues to support the dollar.

These best have been reaffirmed by recent strong statements from several Fed officials.

These comments suggest that interest rates will likely continue to rise until inflation is significantly closer to the 2% target.

The market is focusing on the monetary policy-related conference held by the Cato Institute.

At that time, Fed Chairman Jerome Powell will deliver his first speech since the conclusion of the annual Jackson Hole Global Central Bank Conference.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1720-line today. If the gold price runs steadily below the 1720-line, then it will pay attention to the support strength of the 1700 and 1693 positions. If the gold price breaks above the 1720-line, then pay attention to the suppression strength of the two positions of the 1735 and 1743.

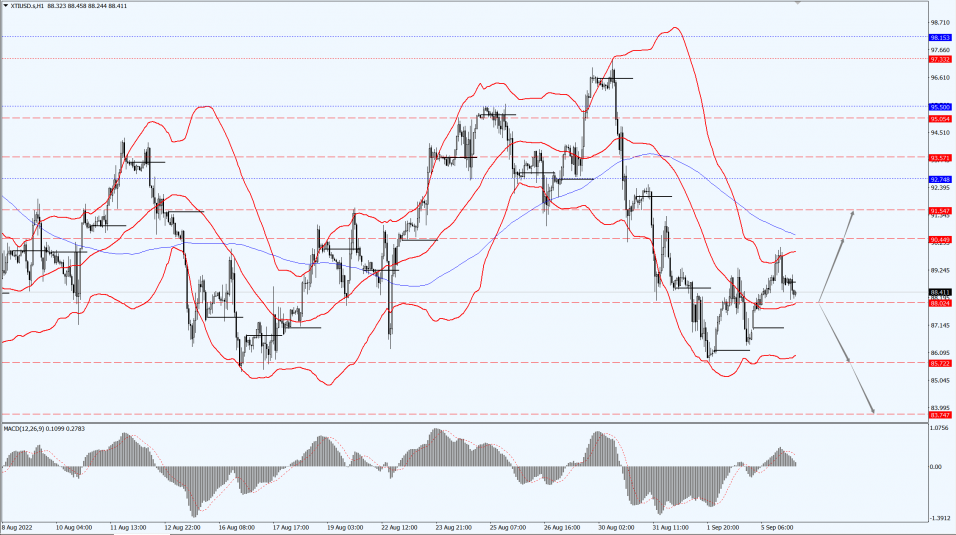

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil rose more than 2% on Monday, 5th September 2022, once breaking the 90 mark during the day, benefiting from Russia’s closure of the Nord Stream-1 pipeline, exacerbating the European energy crisis, while the Kremlin warned the West on Monday that it would take “retaliatory measures” against the Group of Seven (G7) proposal to set a ceiling on Russian oil prices.

On Monday, 5th September 2022, OPEC+ agreed to cut production by 100,000 bpd in October.

Saudi Energy Minister Abdul Aziz said: “This decision expresses our willingness that we will use all tools. This move also shows that we will remain focused, pre-emptive and proactive in supporting the stability and efficient functioning of the market.”

The decision to cut production came as a surprise to markets, which had expected OPEC and its partners to keep oil production steady as oil prices above $90 per barrel squeeze consumer demand.

With the EU imposing sanctions on Russian exports, the market looks set to become even tighter in the coming months.

In addition, the Iranian Foreign Ministry spokesman Kanani said on 5, Iran has abundant oil and gas resources, European countries are currently facing problems in energy supply.

Iran “could meet a large part of Europe’s needs” if negotiations to resume compliance with the comprehensive Iran nuclear deal are successful and unilateral sanctions against Iran are lifted.

He said the complete lifting of sanctions against Iran is Iran’s main goal in the current negotiations.

If the U.S. side has the political will and acts constructively, it will be possible to reach an agreement on resuming the implementation of the Iran nuclear deal.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 88.02-line today. If the oil price runs above the 88.02-line, then focus on the suppression strength of the two positions of 90.44 and 91.54. If the oil price runs below the 88.02-line, then pay attention to the support strength of the two positions of 85.72 and 83.74.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.