1. Forex Market Insight

EUR/USD

EUR/USD fell nearly 1% on Tuesday, 3rd August 2022, after JPMorgan Chase changed its previous expectation that the European Central Bank would raise interest rates by 25 basis points in September and 25 basis points in October, respectively.

It is now thought that the European Central Bank (ECB) will raise rates again by 50 basis points in September and then pause in October, as by then it may become clear that the eurozone economy is heading for a full-blown contraction.

In addition, the ECB is expected to raise its inflation expectations significantly at its next meeting, but is unlikely to change its growth expectations significantly as it does not have enough information to change its growth expectations other than a gas supply shock.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0277-line today. If EUR runs steadily below the 1.0277-line, then pay attention to the support strength of the two positions of 1.0190 and 1.0116. If the strength of EUR breaks above the 1.0277-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD fell 0.73%, the Bank of England (BoE) will release its interest rate resolution on Thursday, the pound will move with a bit of a wait-and-see attitude before the Bank of England announces interest rates on Thursday, 4th August 2022.

Interest rate expectations suggest that the market is now fully digesting the possibility of a 50 basis point rate rise, however, there is some risk of a pullback in the hawkish pricing of the market that cannot be ignored, which could trigger some weakness in the pound.

Technical Analysis:

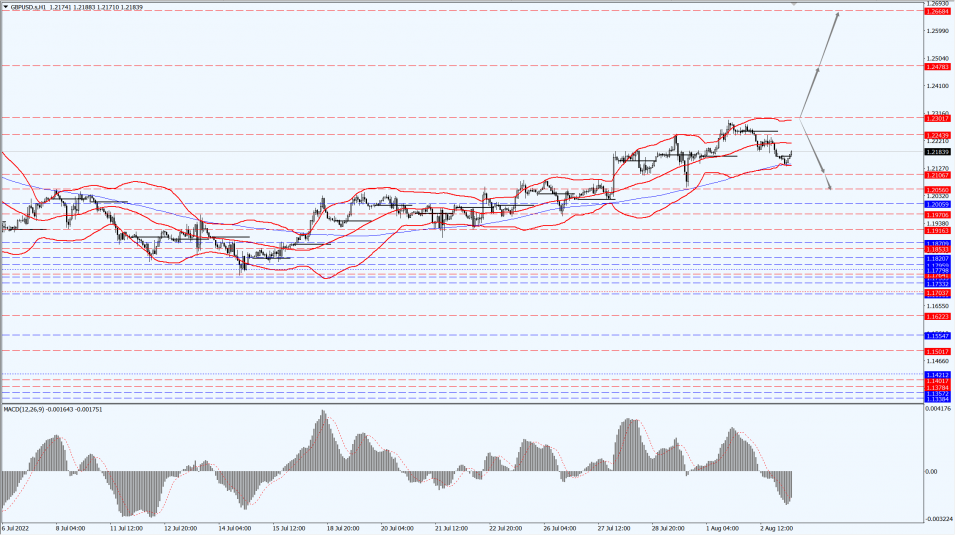

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2301-line today. If GBP runs below the 1.2301-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2301-line, then pay attention to the suppression strength of the two positions of 1.2478 and 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices touched about a one-month high on Tuesday, 2nd August 2022, as expectations of a slower pace of interest rate hikes and a significant slowdown in the U.S. economy greatly supported gold.

Meanwhile, geopolitical tensions are another factor supporting gold.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1768-line today. If the gold price runs steadily below the 1768-line, then it will pay attention to the support strength of the 1760 and 1751 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of the 1786 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Crude oil edged up less than 1% on Tuesday, 2nd August 2022, with this week’s meeting of OPEC+ producers likely not to lead to further increases in crude supplies amid concerns that the global recession could limit energy demand.

U.S. crude oil inventories rose last week, while gasoline and distillate stocks fell, according to data from the American Petroleum Institute (API).

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 93.57-line today. If the oil price runs above the 93.57-line, then focus on the suppression strength of the two positions of 95.05 and 97.33. If the oil price runs below the 93.57-line, then pay attention to the support strength of the two positions of 91.54 and 90.44.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.