1. Forex Market Insight

EUR/USD

EUR/USD fell 1.1% at one point to 1.0506, and the recent top of the ECB-driven euro strength has been reached.

The reasons include clear ECB guidance for the next two meetings, and the relatively dovish pricing of the Fed by the market relative to the ECB.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0642-line today. If EUR runs steadily above the 1.0642-line, then pay attention to the support strength of the two positions of 1.0697 and 1.0776. If the strength of EUR breaks below the 1.0642-line, then pay attention to the suppression strength of the two positions of 1.0529 and 1.0357.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD fell 1.43% to $1.2310.

The weekly line fell for the second week in a row as the gloomy economic outlook for the U.K. made investors nervous.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2243 and 1.2106. If GBP runs above the 1.2478-line, then pay attention to the suppression strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices bounced back on Friday, 10th June 2022, amid shaky trading, as the focus shifted to economic risks after rising U.S. inflation data bolstered bets on aggressive rate hikes.

U.S. consumer prices accelerated in May, suggesting that the Fed may continue to raise rates by 50 basis points until September.

As a result, gold fell to an intraday low of $1,824.92 since 19th May 2022, but safe-haven gold quickly erased losses as investors assessed the impact of the data on the economy.

According to a survey at the University of Michigan, gold prices were further boosted after U.S. consumer confidence fell to a record low in early June.

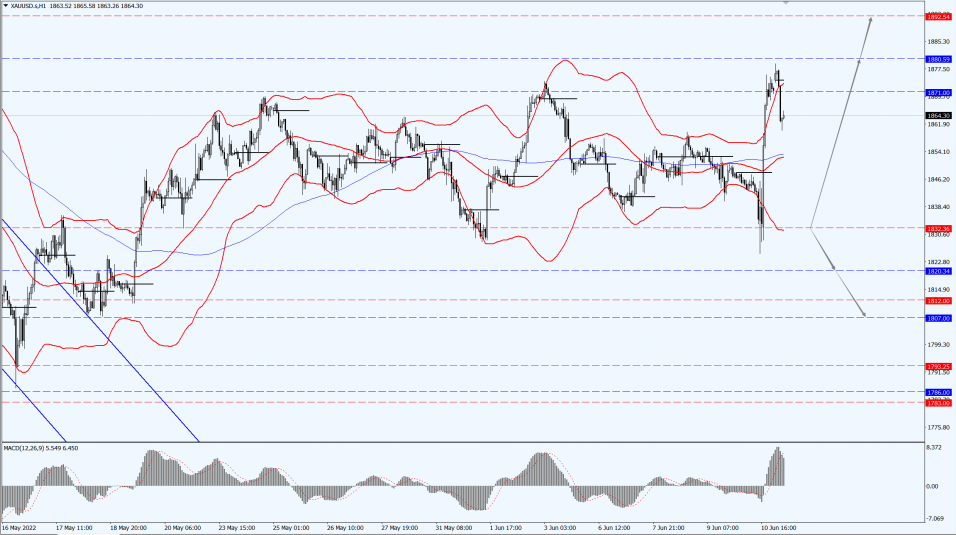

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily above the 1832-line, then it will pay attention to the support strength of the 1880 and 1892 positions. If the gold price breaks below the 1832-line, then pay attention to the suppression strength of the two positions of the 1820 and 1807.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

International oil prices hit a three-month high this week and are on track to close higher for the fourth consecutive week.

Saudi Arabia raises prices to cut supply, hinting that OPEC+’s goal of expanding production increases will be difficult to achieve.

Europe is hardly free from its dependence on Russian oil.

In addition, with the northern hemisphere summer driving season in full swing.

The demand for fuel has surged, and the market supply and demand situation remains tight.

At press time, NYMEX crude oil futures rose 1.74% to $122.35 per barrel

ICE Brent crude futures rose 2.47% to $124.07 a barrel

Both markets hit new highs this week, since 9th March 2022, to $123.18 a barrel and $124.40 a barrel, respectively.

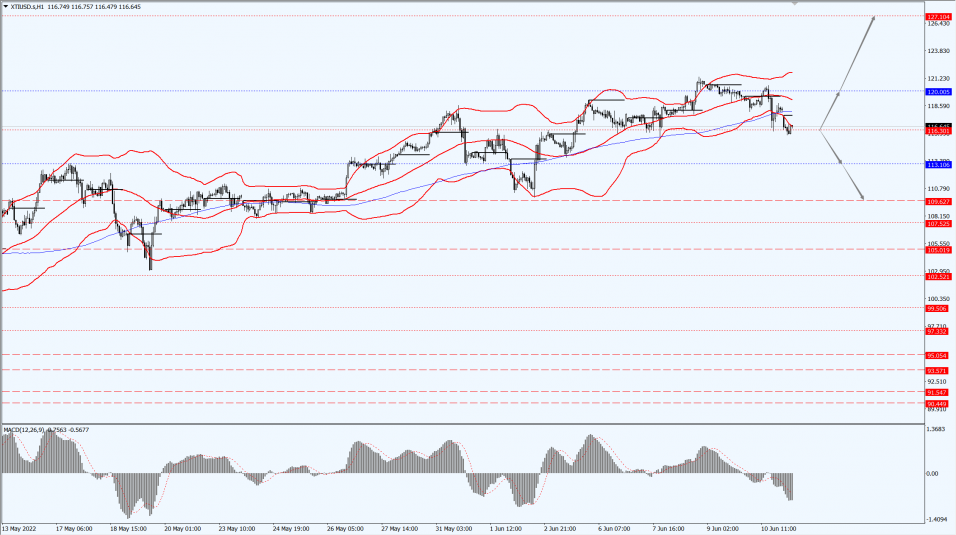

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 116.30-line today. If the oil price runs above the 116.30-line, then focus on the suppression strength of the two positions of 120.06 and 127.10. If the oil price runs below the 116.30-line, then pay attention to the support strength of the two positions of 113.10 and 109.62.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.