1. Forex Market Insight

EUR/USD

EUR/USD fell below $0.99 at one point, having touched $0.9864 on Tuesday, 6th September 2022, the lowest since October 2002.

It ended Wednesday’s, 7th September 2022, session up 0.8% at $0.9985.

It is expected that the European Central Bank (ECB) may raise interest rates sharply by 75 basis points on Thursday, 8th September 2022, but given the blow to the European economy and Russia’s decision to suspend gas deliveries through the Nord Stream 1 pipeline indefinitely, the expected rate hike will do little to support the euro.

In contrast, a report on Tuesday, 6th September 2022, showed that the U.S. service sector unexpectedly rebounded in August, supporting the view that the economy is not in recession.

Technical Analysis:

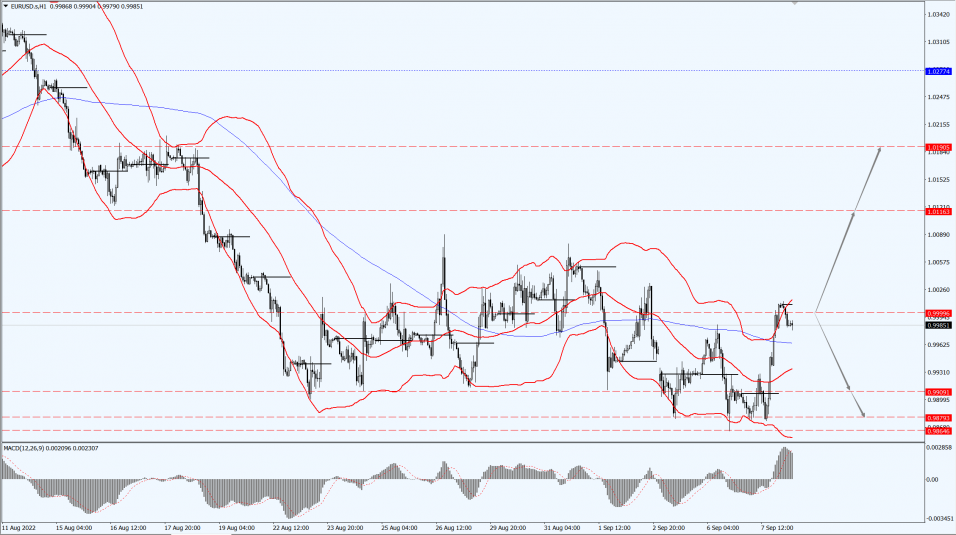

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9909 and 0.9879. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD touched $1.1407 at one point, the lowest since 1985, and ended the session down 0.1% at $1.1509.

The market is increasingly developing a growth theme, which is actually a crisis theme.

Europe and the UK look set for a challenging few months, with both economies likely to experience recession.

On the other hand, the U.S. looks resilient.

Technical Analysis:

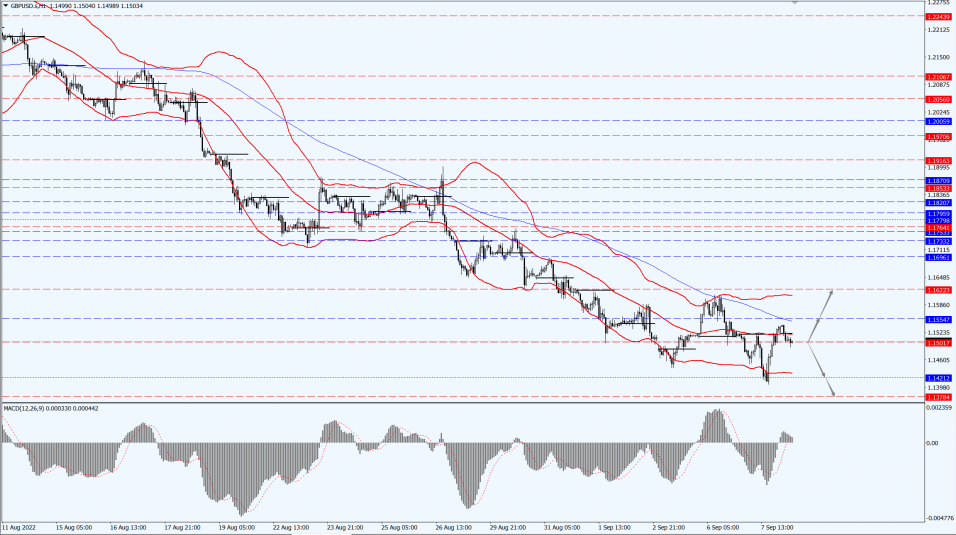

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two positions of 1.1421 and 1.378. If GBP runs above the 1.1501-line, then pay attention to the suppression strength of the two positions of 1.1622 and 1.1696.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rebounded Wednesday, 7th September 2022, with low-absorption buying emerging as the dollar retreated slightly from a 20-year high, but the outlook for gold remains clouded by expectations of aggressive interest rate hikes.

The dollar index hit a 20-year high at one point, but the dollar then retreated slightly, seemingly providing some respite for gold.

Technical Analysis:

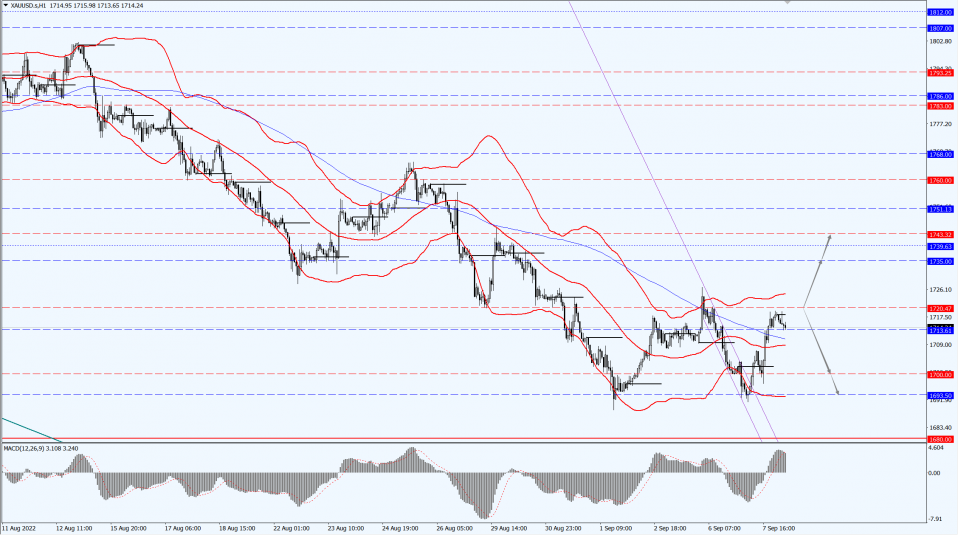

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1720-line today. If the gold price runs steadily below the 1720-line, then it will pay attention to the support strength of the 1700 and 1693 positions. If the gold price breaks above the 1720-line, then pay attention to the suppression strength of the two positions of the 1735 and 1743.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices moved sharply lower on Wednesday, 7th September 2022, falling below levels seen before the conflict between Russia and Ukraine, as sluggish economic data fueled investor concerns about the risk of a recession.

U.S. crude oil and distillate inventories rose in the latest week, while gasoline stocks fell, according to the American Petroleum Institute (API).

For the week ended on 2nd September, crude oil inventories increased by about 3.6 million barrels, gasoline inventories decreased by about 836,000 barrels and distillate inventories increased by about 1.8 million barrels.

Technical Analysis:

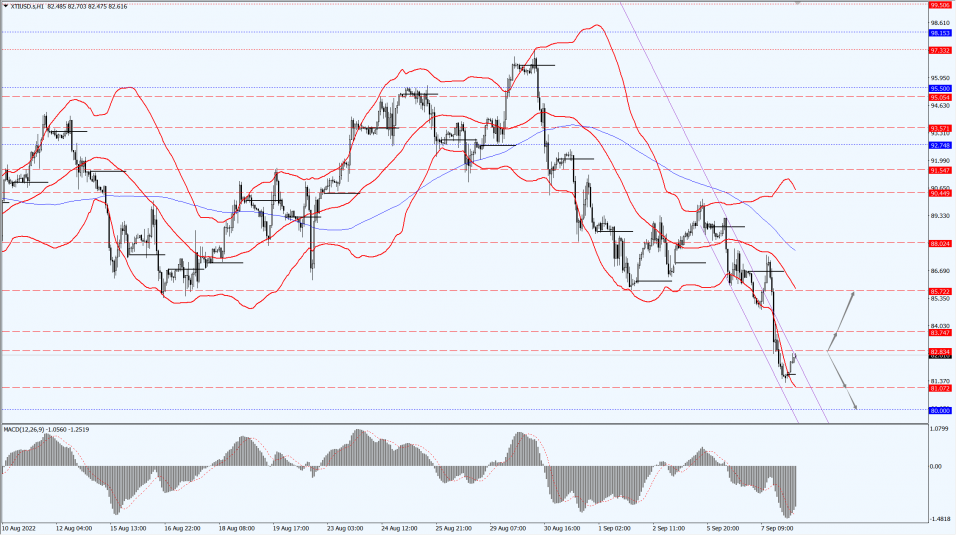

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 82.83-line today. If the oil price runs above the 82.83-line, then focus on the suppression strength of the two positions of 83.74 and 85.72. If the oil price runs below the 82.83-line, then pay attention to the support strength of the two positions of 81.07 and 80.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.