1. Forex Market Insight

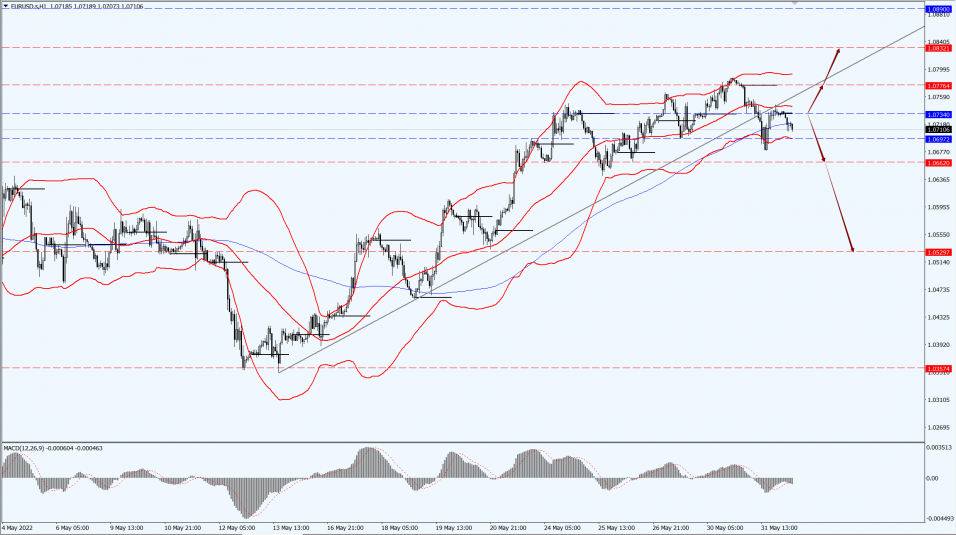

EUR/USD

EUR remains weak currently after data on Tuesday, 31st May 2022, showed eurozone inflation hit a record high in May.

This has increased pressure on the European Central Bank, which is now fending off recession while seeking to curb high prices by gradually raising interest rates in the coming months.

Inflation in the 19-nation eurozone accelerated to 8.1% in May from 7.4% in April, beating expectations of 7.7%.

The continuous rise in goods prices suggests that energy is no longer the only factor that is driving the overall data.

EUR/USD fell nearly 0.9%, hitting a three-day low of $1.0678 and closing at $1.0731, down about 0.4%.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0734-line today. If EUR runs steadily above the 1.0734-line, then pay attention to the support strength of the two positions of 1.0776 and 1.0832. If the strength of EUR breaks below the 1.0734-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

Recently, GBP/USD has risen slightly, but USD has remained largely flat.

In fact, there were few exceptional movements in the main exchange rates of GBP.

The future movement of GBP will now be largely influenced by the movement of USD

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2668-line today. If GBP runs below the 1.2668-line, it will pay attention to the suppression strength of the two positions of 1.2478 and 1.2301. If GBP runs above the 1.2668-line, then pay attention to the suppression strength of the two positions of 1.2807 and 1.2872.

2. Precious Metals Market Insight

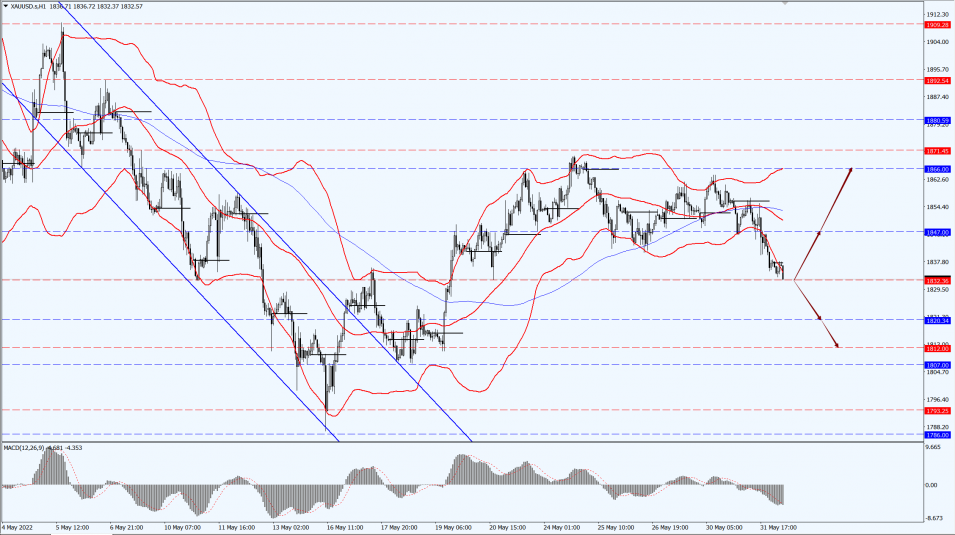

Gold

Fundamental Analysis:

Gold prices are facing resistance from “a stronger dollar and sharply higher bond yields.

A stronger dollar is detrimental to dollar-denominated commodities, making them more expensive for users of other currencies.

In contrast, rising U.S. Treasury yields raise the opportunity cost of holding non-yielding assets.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily above the 1832-line, then it will pay attention to the support strength of the 1847 and 1866 positions. If the gold price breaks below the 1832-line, then pay attention to the suppression strength of the two positions of the 1820 and 1812.

3. Commodities Market Insight

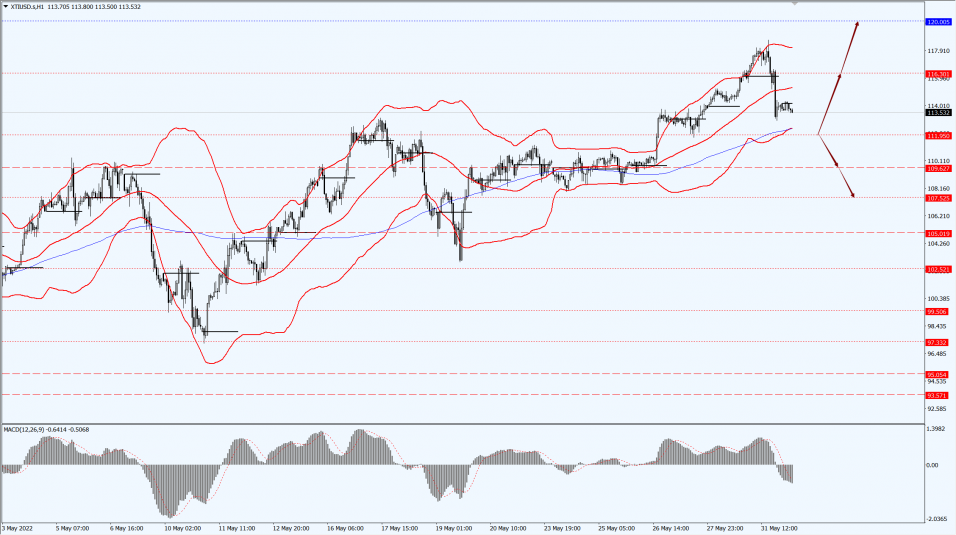

WTI Crude Oil

Fundamental Analysis:

Oil prices surged on Tuesday, 31st May 2022, following reports that some oil-producing countries are exploring the idea of suspending Russia’s participation in the OPEC+ oil production deal.

OPEC+ consists of the Organization of Petroleum Exporting Countries (OPEC) and oil-producing allies led by Russia.

OPEC representatives said that while there is no formal push for OPEC to increase oil production to make up for a possible Russian oil shortfall, some Gulf countries have started planning to increase production sometime in the next few months.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 111.95-line today. If the oil price runs above the 111.95-line, then focus on the suppression strength of the two positions of 116.30 and 120.00. If the oil price runs below the 111.95-line, then pay attention to the support strength of the two positions of 109.62 and 107.52.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.