1. Forex Market Insight

EUR/USD

EUR/USD fell sharply last week, closing up 0.13% at 1.0190 on Monday, 8th August 2022.

Preliminary data released by Eurostat showed that, on a seasonally adjusted basis, eurozone gross domestic product (GDP) grew 0.7% in the second quarter of this year and EU GDP grew 0.6% sequentially.

However, the reality of achieving growth in the second quarter did not diminish the fears of recession in Europe.

The European economy will continue to face serious challenges due to the impact of multiple pressures.

In addition, energy supply risks in Germany and some other European countries seem to be growing, and the euro rally space remains blocked.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0190-line today. If EUR runs steadily below the 1.0190-line, then pay attention to the support strength of the two positions of 1.0116 and 0.9999. If the strength of EUR breaks above the 1.0190-line, then pay attention to the suppression strength of the two positions of 1.0277 and 1.0357.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD fell on Monday, 8th August 2022, and finally closed up 0.02% at 1.2075.

British Foreign Secretary Alexis Tlas said she plans to review the Bank of England’s mandate.

She is expected to replace Johnson as British Prime Minister next month.

The U.K. economy could see its first contraction since the epidemic blockade in early 2021, increasing pressure on the prime minister’s successor to take action.

The UK will release its latest GDP data this Friday, 12th August 2022. Economists expect that the UK’s GDP may have contracted by 0.2% in the second quarter.

The data will likely show that in June alone, the U.K. economy contracted by 1.2 percent, partly due to a public holiday established to mark the 70th anniversary of Queen Elizabeth II’s accession to the throne.

The Bank of England warned last week that the U.K. economy could enter recession in the fourth quarter of this year and continue to contract throughout next year. The Bank of England also expects inflation to reach more than 13 percent this year, setting a new 40-year high and severely affecting consumer purchasing power.

Technical Analysis:

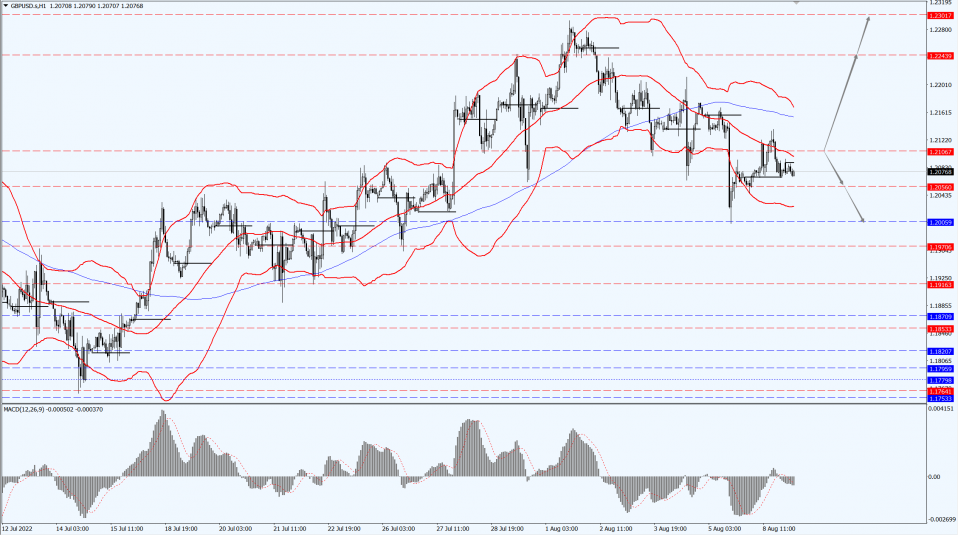

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose on Monday, 9th August 2022, after the dollar and U.S. Treasury yields retreated and investors’ attention shifted to U.S. inflation data for clues about the U.S. Federal Reserve’s plans to raise interest rates.

Gold prices fell on Friday, 5th August 2022, after strong U.S. job growth reinforced expectations that the Federal Reserve will continue to raise interest rates in the next few meetings to slow inflation.

The U.S. Consumer Price Index (CPI) report to be released on Wednesday, 6th August 2022, could provide clues to the Fed’s next move.

U.S. consumers’ inflation expectations for the next year and three years fell sharply in July, a survey released Monday, 8th August 2022, by the New York Fed showed, suggesting Fed officials are winning the battle to anchor price growth expectations in the fight to curb high inflation.

Median expectations for inflation after one year fell 0.6 percentage points to 6.2% and expectations for prices after three years fell 0.4 percentage points to 3.2%, the lowest levels since February and April of last year, respectively.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1783-line today. If the gold price runs steadily below the 1783-line, then it will pay attention to the support strength of the 1768 and 1760 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of the 1793 and 1807.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose more than 2% in shaky trading Monday, 8th August 2022, rebounding from multi-month lows touched last week as positive economic data offered hope for demand despite lingering recession fears.

Technical Analysis:

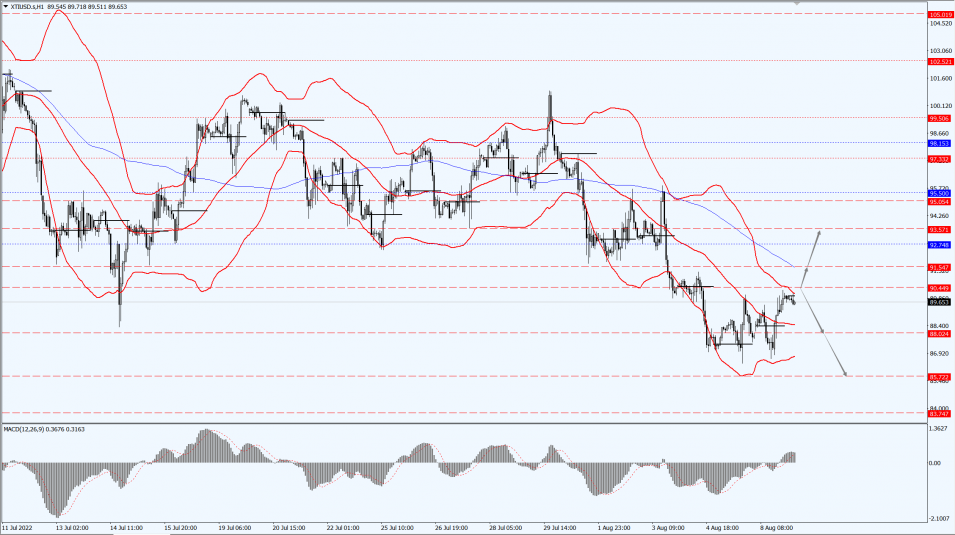

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 90.44-line today. If the oil price runs above the 90.44-line, then focus on the suppression strength of the two positions of 91.54 and 93.57. If the oil price runs below the 90.44-line, then pay attention to the support strength of the two positions of 88.02 and 85.72.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.