1. Forex Market Insight

EUR/USD

The euro fell 0.1% against the dollar to $1.04015. The euro has been climbing against the dollar this week on a shocking basis, mainly benefiting from a weaker dollar, with the European Central Bank maintaining its tightening views also supporting the euro; so far this year, the Federal Reserve has repeatedly raised interest rates on a mega scale to fight high inflation, pushing the dollar up sharply against all major currencies.

But recent U.S. consumer price data has been lower than expected, fueling investor bets that the dollar’s rally may be over. The minutes of the Fed’s November meeting released last Wednesday 23rd November 2022 showed that most policymakers agree that a slower pace of rate hikes would soon be appropriate on Nov. 30, Fed Chairman Jerome Powell will speak at the Brookings Institution on the economic outlook and changes in the labor market.

Technical Analysis:

(EUR/USD 1-hour Chart)

WWe focus on the 1.0440 line today. If the EUR runs below the 1.0440 line, then pay attention to the support strength of the two positions of 1.0275 and 1.0088. If the strength of EUR rises over the 1.0440 line, then pay attention to the suppression strength of the two positions of 1.0529 and 1.0586.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England still has strong expectations for rate hikes. The Bank of England has raised interest rates eight times in a row since December 2021 and has now raised its benchmark rate to 3.00%, a new high since November 2008.

However, for now, inflation is still not effectively suppressed. Data released by the UK Office for National Statistics showed that the UK Consumer Price Index (CPI) rose by 11.1% year-on-year in October, a further 41-year high.

High inflation and a major shift in fiscal policy have kept the Bank of England on an aggressive stance to raise interest rates. The pound climbed sharply against the dollar this week, benefiting from a weaker dollar, while the hawkish tone of the Bank of England supported the pound.

Technical Analysis:

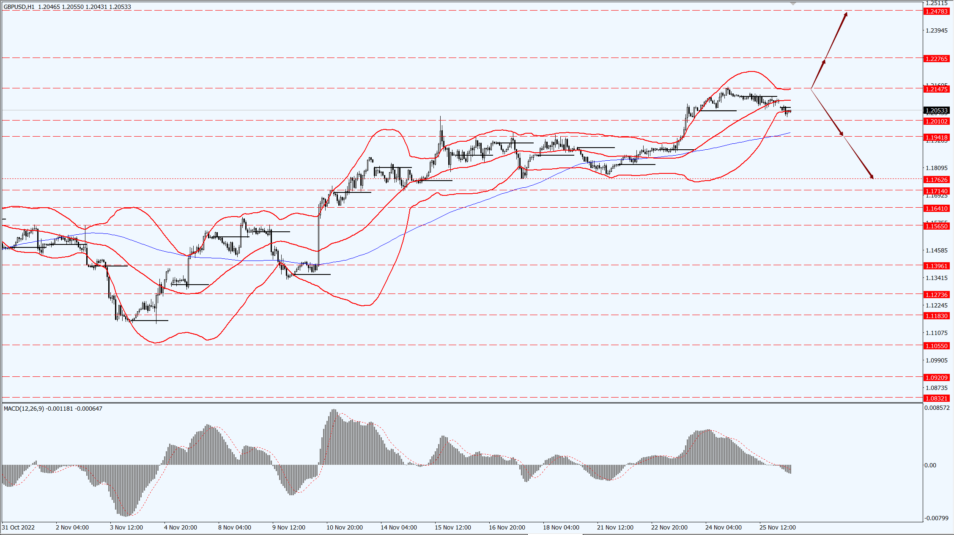

(GBP/USD 1-hour Chart)

GBP is mainly focused on the We focus on the 1.0440 line today. If the EUR runs below the 1.0440 line, then pay attention to the support strength of the two positions of 1.0275 and 1.0088. If the strength of EUR rises over the 1.0440 line, then pay attention to the suppression strength of the two positions of 1.0529 and 1.0586.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices held steady below one-week highs on Friday 25th November 2022 as the dollar strengthened but will rise only modestly this week on expectations that the Fed’s stance on rate hikes will weaken.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1768-line today. If the gold price runs below the 1768-line, then it will pay attention to the support strength of the 1747 and 1727 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of 1783 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell 2% on Friday, 25th November 2022 as the market traded lightly in a week of trading dominated by demand concerns and Western haggling over the issue of a Russian oil price cap.

The Group of Seven (G7) and EU diplomats have been discussing a proposal to cap Russian oil prices at between $65-70 a barrel, but have yet to agree.

EU diplomats said a meeting of EU government representatives scheduled for last Friday evening to discuss the proposal was canceled.

Trading is expected to remain cautious until an agreement is reached on the price cap, which will come into effect on Dec. 5, the same day the EU will ban imports of Russian crude.

Trading will also remain cautious until the next meeting of the Organization of Petroleum Exporting Countries (OPEC) and OPEC+, which consists of allies including Russia, is scheduled for Dec. 4.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 76.07 line today. If the oil price runs above the 76.07 -line, then focus on the suppression strength of the two positions of 77.54 and 79.07. If the oil price runs below the 76.07 -line, then pay attention to the support strength of the two positions of 73.52 and 72.77.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home