The dollar index posted its biggest quarterly gain last week, since the first quarter of 2015. Yet, it fell on a weekly basis for the first time in three weeks.

USD/EUR rose on Friday, 30th September, but narrowed its gains in late trading, with the trend influenced by the end-of-quarter trading.

Meanwhile, riskier commodity-related currencies fell sharply after European inflation hit a record high and U.S. consumer spending grew faster than expected.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9701-line today. If EUR runs steadily below the 0.9701-line, then pay attention to the support strength of the two positions of 0.9597 and 0.9559. If the strength of EUR breaks above the 0.9701-line, then pay attention to the suppression strength of the two positions of 0.9810 and 0.9879

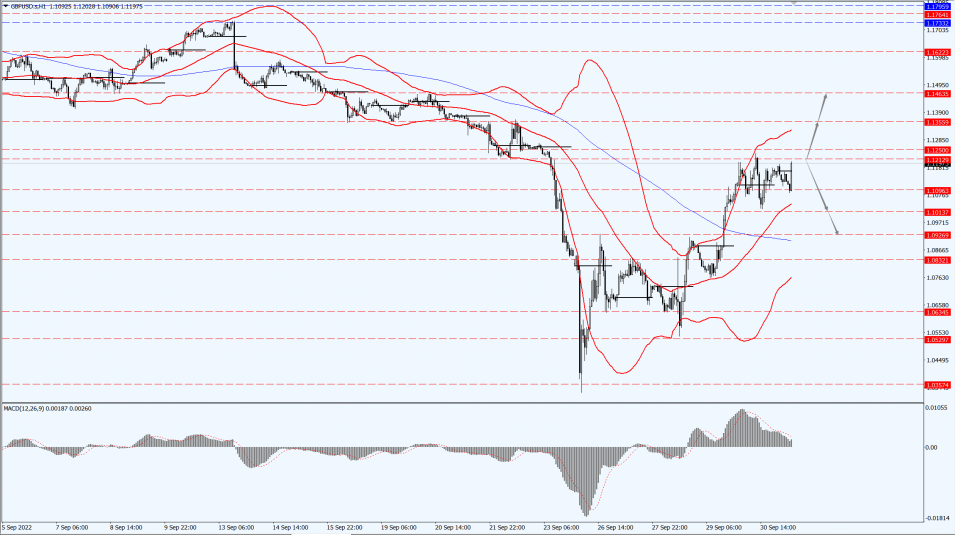

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD rose, having fallen earlier in the session.

GBP rose for a fourth straight session after a wild fall as markets worried about the U.K.’s plans to cut taxes and increase borrowing.

After hitting a record low on Monday, the pound is poised to rise on a weekly basis, with the Bank of England buying British government treasury bonds on Wednesday, Thursday and Friday.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1212-line today. If GBP runs below the 1.1212-line, it will pay attention to the suppression strength of the two positions of 1.1013 and 1.0926. If GBP runs above the 1.1212-line, then pay attention to the suppression strength of the two positions of 1.1355 and 1.1463.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold rose to a one-week high on Friday, 30th September 2022, as the dollar retreated from recent highs, but the price is poised to record its worst quarterly performance since last March, with fears of an imminent massive Federal Reserve rate hike weighing on it.

So far this quarter, gold is down 8%. This will also be the sixth consecutive month of gold price declines, the longest monthly streak in four years.

Rising interest rates reduce the attractiveness of gold as they increase the opportunity cost of holding a non-yielding asset.

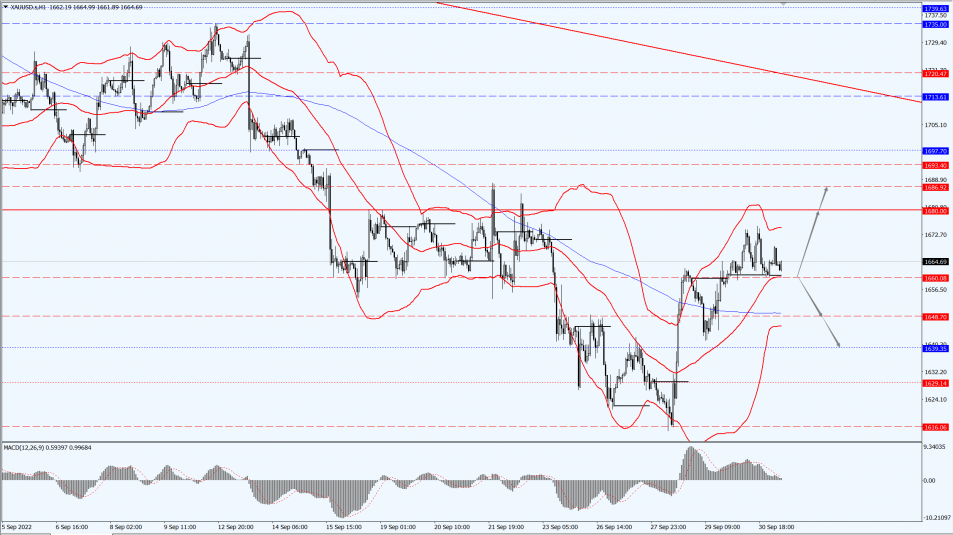

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1660-line today. If the gold price runs steadily below the 1660-line, then it will pay attention to the support strength of the 1648 and 1639 positions. If the gold price breaks above the 1660-line, then pay attention to the suppression strength of the two positions of the 1680 and 1686.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell in choppy trade on Friday, 30th September 2022, but posted their first weekly gain in five weeks, helped by the possibility that OPEC+ will agree to cut crude output when it meets on 5th Oct 2022.

Both contracts were up more than $1 at the beginning of the session, but then turned lower.

OPEC’s oil production rose in September to its highest level since 2020, exceeding its commitment to increase production that month, a Reuters survey found.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 81.07-line today. If the oil price runs above the 81.07-line, then focus on the suppression strength of the two positions of 82.41 and 79.12. If the oil price runs below the 81.07-line, then pay attention to the support strength of the two positions of 80.00 and 79.12.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.