1. Forex Market Insight

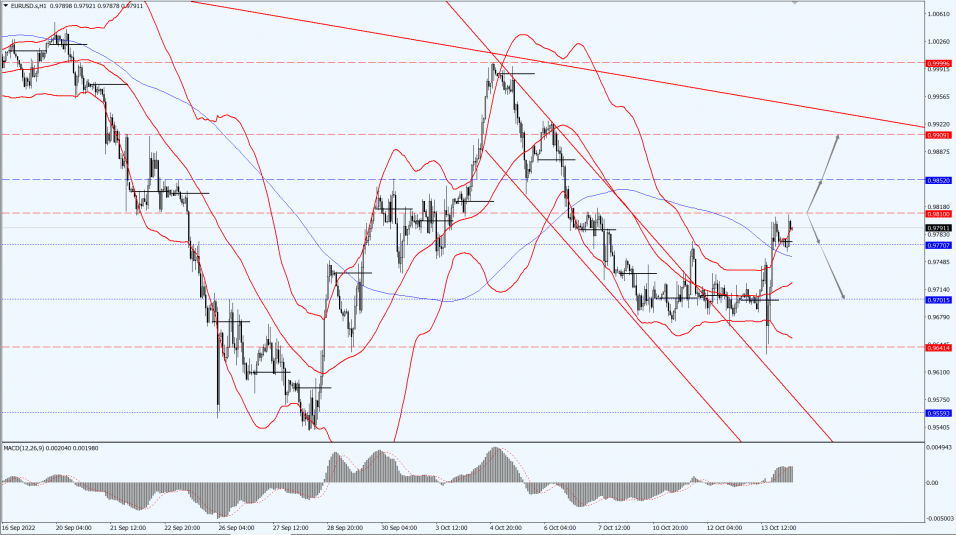

EUR/USD

EUR/USD rebounded on Thursday, 13th October 2022, closing up 0.77% at 0.9777.

It is possible that the recent rally is a position squeeze caused by premature hopes for a Fed policy adjustment, rather than a proxy for a change in trend.

The Russian-Ukrainian conflict, the uneven recovery of the pandemic, and the drought across much of the continent have combined to create severe energy shortages, high inflation, supply disruptions, and great uncertainty about the future of the European economy.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9810-line today. If EUR runs steadily below the 0.9810-line, then pay attention to the support strength of the two positions of 0.9770 and 0.9701. If the strength of EUR breaks above the 0.9810-line, then pay attention to the suppression strength of the two positions of 0.9852 and 0.9909.

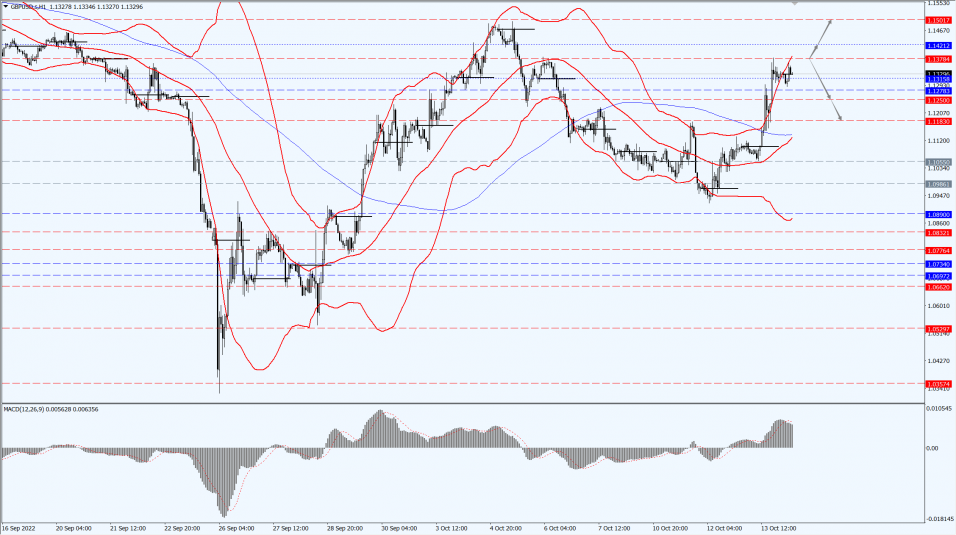

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rallied big on Thursday, 13th October 2022, closing up 2.04% at 1.1325 on reports that the British government may make changes in its fiscal plans.

The main reasons why the pound should continue to fall in the future are declining global growth expectations, unfavorable risk sentiment, and a large current account deficit in the U.K. as it faces the risk of energy disruptions over the winter.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1378-line today. If GBP runs below the 1.1378-line, it will pay attention to the suppression strength of the two positions of 1.1250 and 1.1183. If GBP runs above the 1.1378-line, then pay attention to the suppression strength of the two positions of 1.1421 and 1.1501.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell yesterday, 13th October 2022, as a higher-than-expected rise in U.S. consumer prices in September cemented bets that the Federal Reserve will stick to aggressive rate hikes.

The U.S. Consumer Price Index (CPI) rose 0.4% in September after increasing 0.1% in August, the Labor Department said.

In the 12 months ending in September, the CPI rose 8.2% after increasing 8.3% in August.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1660-line today. If the gold price runs steadily below the 1660-line, then it will pay attention to the support strength of the 1642 and 1627 positions. If the gold price breaks above the 1660-line, then pay attention to the suppression strength of the two positions of the 1680 and 1686.

3. Commodities Market Insight

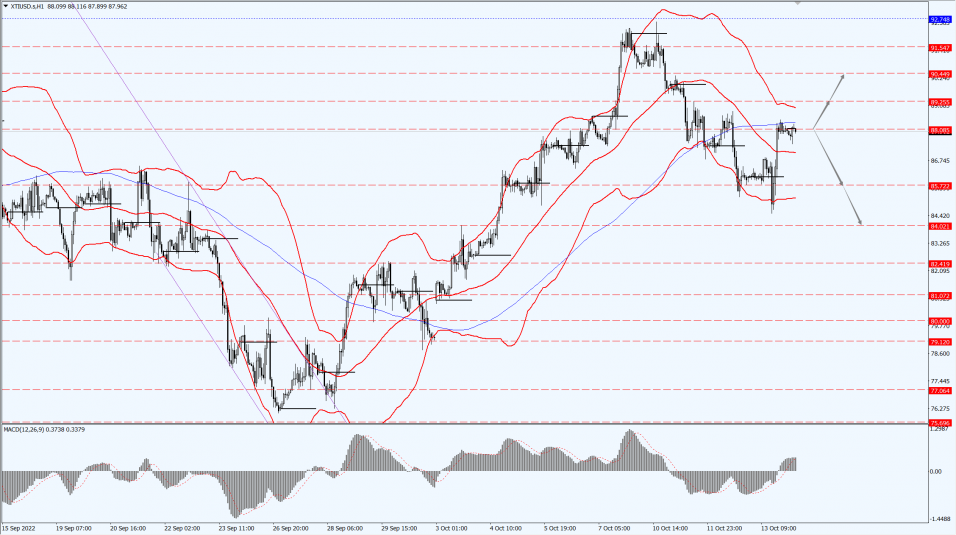

WTI Crude Oil

Fundamental Analysis:

Oil prices closed about 2% higher Thursday, 13th October 2022, as lower levels of pre-winter diesel stocks sparked buying and reversed losses after higher-than-expected crude and gasoline inventories.

The U.S. Energy Information Administration (EIA) said distillate stocks, including diesel and heating oil, fell by 4.9 million barrels to 106.1 million barrels in the week ended 7th Oct 2022, the lowest since May, compared with expectations for a 2 million barrel decline.

This prompted investors to take a dim view of the unexpected 2 million barrel increase in gasoline inventories and the larger-than-expected increase in crude oil inventories, which reached nearly 10 million barrels.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 88.08-line today. If the oil price runs above the 88.08-line, then focus on the suppression strength of the two positions of 89.25 and 90.44. If the oil price runs below the 88.08-line, then pay attention to the support strength of the two positions of 85.72 and 84.02.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.