1. Forex Market Insight

EUR/USD

The euro closed up 0.44% against the dollar on Wednesday, 16th November 2022 at $1.0393, but still below the four-and-a-half month high of $1.0481 touched on Tuesday, 15th November 2022 when lower-than-expected U.S. producer price inflation data was released.

Although well below the intraday high, the euro recovered Tuesday’s lost ground against the yen, ending the session 0.46% higher.

Two key ECB policy doves argued Wednesday that while the ECB must continue to raise rates, there is a growing case for more caution in policy tightening after a string of aggressive rate hikes.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0277 line today. If the EUR runs below the 1.0277 line, then pay attention to the support strength of the two positions of 1.0190 and 1.0116. If the strength of EUR rises over the 1.0277 line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound closed up 0.43% against the dollar on Wednesday, 16th November 2022 closing at 1.1913. The U.K. is set to release its latest budget statement on Thursday, 15th November 2022 which is expected to include tax hikes and spending cuts.

The pound fell to a record low of $1.0327 in September after Chancellor of the Exchequer David Hunt’s predecessor, Kwarteng, announced a package of unfunded tax cuts.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1723-line today. If GBP runs below the 1.1723-line, it will pay attention to the GBP is mainly focused on the 1.1723-line today. If GBP runs below the 1.1723-line, it will pay attention to the suppression strength of the two positions of 1.1641 and 1.1565. If GBP runs above the 1.1723-line, then pay attention to the suppression strength of the two positions of 1.1898 and 1.1977.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold hovered near a three-month high Wednesday, 16th November 2022 influenced by a modestly stronger dollar and sliding index U.S. bond yields, as the market’s focus shifted from global tensions to the Federal Reserve’s interest rate strategy.

Spot gold fell 0.3% to $1,773.13 an ounce. Gold gave back some of its gains after U.S. President Joe Biden said the missile that landed in Poland was probably not fired from Russia, easing fears of a major escalation in the war.

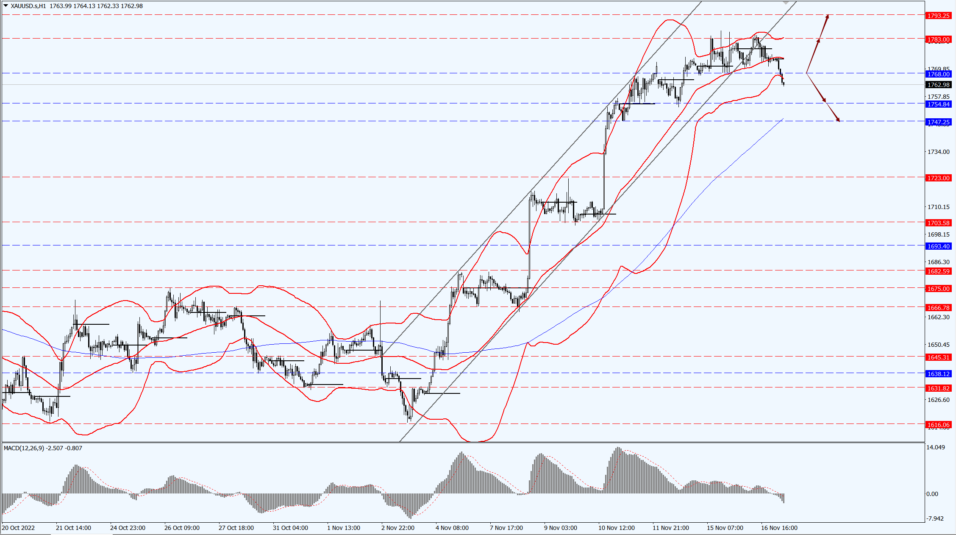

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1768-line today. If the gold price runs below the 1768-line, then it will pay attention to the support strength of the 1754 and 1747 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of the 1783 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. crude oil inventories fell by more than 5 million barrels last week, while fuel stocks rose as refineries boosted output to cope with high demand and low inventories.

The U.S. Energy Information Administration (EIA) said Wednesday, 16th November 2022 that crude oil inventories fell by 5.4 million barrels to 435.4 million barrels in the week ended Nov. 11, compared with expectations for a 440,000-barrel drop. Oil prices then pared losses.

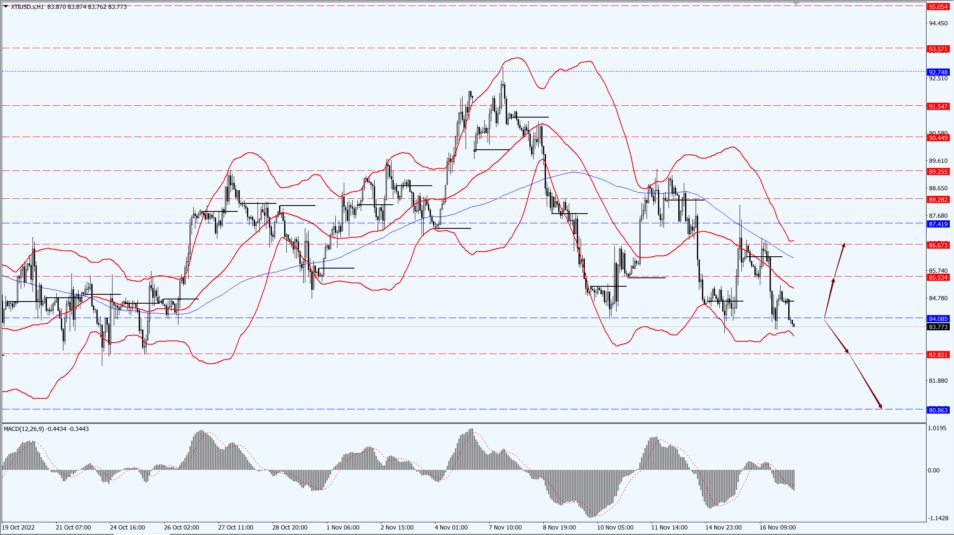

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 84.08 line today. If the oil price runs above the 84.08-line, then focus on the suppression strength of the two positions of 85.53 and 86.67. If the oil price runs below the 85.53-line, then pay attention to the support strength of the two positions of 82.82 and 80.86.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.