1. Forex Market Insight

EUR/USD

German bond yields steadily climbed on expectations of further ECB tightening, weakening the dollar and cut the spread with Treasury yields. The two-year German bond yield rose to 2.196%, 25 basis points higher than a week ago.

And a survey released Monday, 7th November 2022, showed that investor morale in the euro zone improved in November, the first rise in three months, reflecting hopes that the recent rise in temperatures and falling energy prices will prevent the introduction of gas rationing in Europe this winter. The euro rose 0.48% against the dollar to $1.0067.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0116 line today. If the EUR runs below the 1.0116 line, then pay attention to the support strength of the two positions of 0.9999 and 0.9909. If the strength of EUR rises over the 1.0116 line, then pay attention to the suppression strength of the two positions of 1.0190 and 1.0277.

GBP Intraday Trend Analysis

Fundamental Analysis:

Yesterday, 8th November 2022, the British pound rose against the U.S. dollar, slightly up 0.12% on the day. During yesterday’s European session, strikes and demonstrations in the UK hit the pound at one point.

Later, as the dollar in the foreign exchange market across the board down to give some support to the pound, following a cadre of non-US currencies upward.

The subsequent trend is expected to depend mainly on dollar movement, the U.S. midterm election situation and the CPI data released this week will be the focus of market attention.

Technical Analysis:

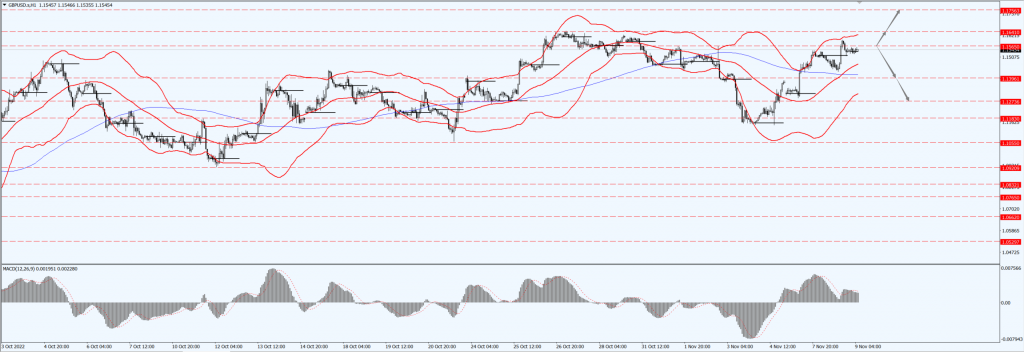

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1565-line today. If GBP runs below the 1.1565-line, it will pay attention to the suppression strength of the two positions of 1.1396 and 1.273. If GBP runs above the 1.1565-line, then pay attention to the suppression strength of the two positions of 1.1641 and 1.1756.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose more than 2% on Tuesday, 8th November 2022, breaking above the key $1,700 per ounce level, after a fall in the dollar and bond yields as well as some technical buying, while market remained focusing on U.S. inflation data later this week.

The U.S. Consumer Price Index (CPI) data will be released on Thursday, with economists predicting that core CPI will fall to 0.5% YoY and 6.5% YoY, respectively. Market participants are also watching the U.S. midterm elections.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1713 -line today. If the gold price runs below the 1713 -line, then it will pay attention to the support strength of the 1700 and 1693 positions. If the gold price breaks above the 1713-line, then pay attention to the suppression strength of the two positions of the 1725 and 1735.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell more than $2 in oscillating trading on Tuesday, 8th November 2022, as concerns about fuel demand deepened, along with nervousness about the outcome of the U.S. midterm elections.

The Intercontinental Exchange (ICE) raised the initial margin rate for front-month Brent crude oil futures by 4.92%, making it more expensive to maintain futures positions from Tuesday’s close.

Market participants are concerned that high inflation and rising interest rates could trigger a global recession and are highly concerned about the U.S. consumer price data to be released on Thursday.

The EIA on Tuesday cut its forecast for U.S. crude production growth next year by 21%, days after the head of oil producers warned that inflation and supply chains will continue to pose constraints. A preliminary Reuters survey on Monday, 7th November 2022, showed that U.S. crude inventories were expected to rise by about 1.1 million barrels last week.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 86.77 line today. If the oil price runs above the 86.77-line, then focus on the suppression strength of the two positions of 88.53 and 90.44. If the oil price runs below the 86.77-line, then pay attention to the support strength of the two positions of 85.53 and 84.08.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.