1. Forex Market Insight

EUR/USD

The euro rose 0.75% against the dollar on Wednesday, 30th November 2022 to $1.0405. It accumulated a 5.34% gain in November, the biggest monthly gain since September 2010.

A European survey on Wednesday, 30th November 2022 showed that inflation in the euro zone fell much more than expected in November, raising market hopes that record-high price growth across the bloc has peaked and the European Central Bank will slow down interest rate hikes next month.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0440 line today. If the EUR runs below the 1.0440 line, then pay attention to the support strength of the two positions of 1.0275 and 1.0088. If the strength of EUR rises over the 1.0440 line, then pay attention to the suppression strength of the two positions of 1.0529 and 1.0586.

GBP Intraday Trend Analysis

Fundamental Analysis:

The recent market disagreement over the size of the next interest rate hike. This hints at a degree of uncertainty that could bring some excitement to the FX markets when the Bank of England makes its next rate hike decision in the middle of next month. The Bank of England tends to undercut market expectations when it comes to rate hikes, an outcome that has been causing the pound to weaken.

If the Monetary Policy Committee agrees with Mann’s assessment, the BoE could raise interest rates by another 75 basis points in December, raising the Bank Rate to 3.75%. However, if the central bank raises rates by only 50 basis points, a lower-than-expected margin, the pound will weaken.

Technical Analysis:

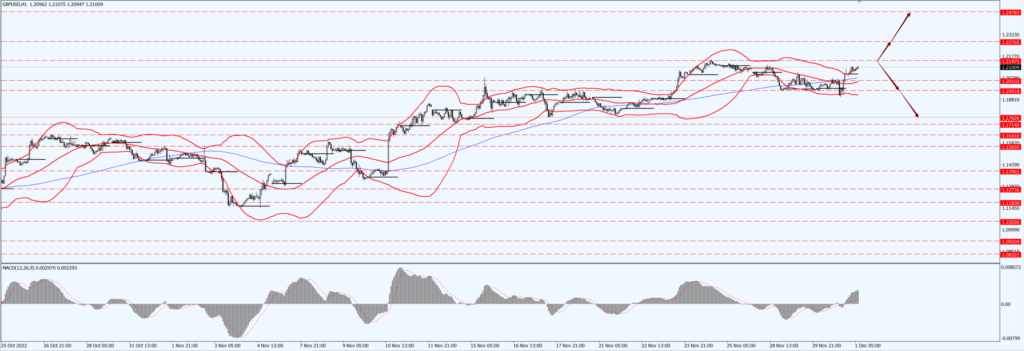

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1941-line today. If GBP runs below the 1.1941-line, it will pay attention to the suppression strength of the two positions of 1.1762 and 1.1641. If GBP runs above the 1.1941-line, then pay attention to the suppression strength of the two positions of 1.2147 and 1.2276.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose more than 1% on Wednesday, 30th November 2022 with November poised for its best monthly performance since mid-2020, as a statement from the Fed chairman further cemented expectations of a slower pace of interest rate hikes in the United States.

The market now awaits the much-anticipated non-farm payrolls data to be released by the U.S. Labor Department on Friday for clues on the strength of the job market, which could influence further policy decisions by the Federal Reserve.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1768-line today. If the gold price runs below the 1768-line, then it will pay attention to the support strength of the 1747 and 1727 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of 1783 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed more than $2 higher on Wednesday, 30th November 2022 helped by signs of tightening supply, a weaker dollar and optimism about a recovery in demand. OPEC+’s decision to meet online on Dec. 4 pretty much signals that a policy change is unlikely.

Expectations of tightening crude oil supplies are providing support. U.S. crude inventories plunged nearly 13 million barrels last week, the biggest drop since 2019, the U.S. Energy Information Administration (EIA) said on Wednesday. But heating oil demand fell for a second straight week as we entered winter, limiting support for oil prices.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 81.12 line today. If the oil price runs above the 81.12 -line, then focus on the suppression strength of the two positions of 82.78 and 84.06. If the oil price runs below the 81.12 -line, then pay attention to the support strength of the two positions of 79.07 and 77.54.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home