1. Forex Market Insight

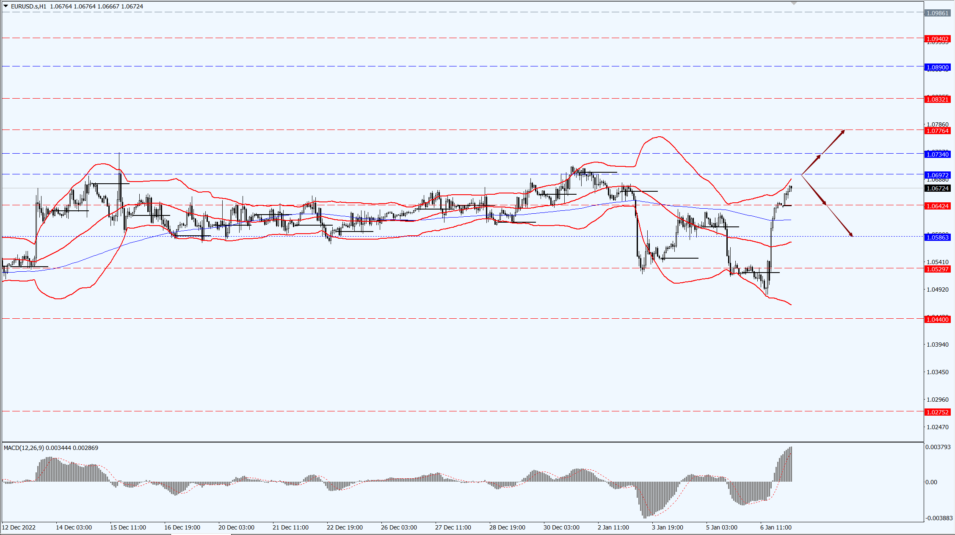

EUR/USD

Eurozone inflation has fallen back, making the ECB’s hawkish tone slightly weaker pressuring the euro. Inflation in the European region may have peaked, boosting hopes that the ECB may adopt a less hawkish policy, which in turn would support a stronger economy.

On Friday, 6th January 2023 the euro rose 1.19% to $1.0645, on track for its biggest one-day percentage gain since Nov. 11.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0697 line today. If the EUR runs below the 1.0697 line, then pay attention to the support strength of the two positions of 1.0642 and 1.0586. If the strength of EUR rises over the 1.0697 line, then pay attention to the suppression strength of the two positions of 1.0734 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

UK inflation and wages may continue to climb, supporting the Bank of England’s hawkish tone. The Bank of England said business leaders expect inflation to accelerate and wage growth to strengthen in coming years, adding to concerns about upward price pressures.

The BoE said its monthly survey of business policymakers showed expectations for the U.K. consumer price index (CPI) rose to 7.4% last month in the coming year from 7.2% in November; wage expectations rose 0.5 percentage points to 6.3%.

Policymakers said they are concerned about the persistence of inflation expectations in the economy after CPI soared to a 40-year high last year. Although the Bank of England expects interest rates to fall sharply later this year, persistent price pressures could cause this outlook to deviate from the central bank’s 2% target.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2111-line today. If GBP runs below the 1.12111-line, it will pay attention to the suppression strength of the two positions of 1.2010 and 1.1902. If GBP runs above the 1.2111-line, then pay attention to the suppression strength of the two positions of 1.2147 and 1.2222.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices surged more than 1% on Friday, 6th January 2023 hitting a seven-month high, with the weekly trend set for a third straight week of gains after U.S. economic data cemented expectations that the Federal Reserve will be less hawkish and U.S. bond yields and the dollar fell.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1880-line today. If the gold price runs below the 1880-line, then it will pay attention to the support strength of the 1866 and 1847 positions. If the gold price breaks above the 1880-line, then pay attention to the suppression strength of the two positions of 1892 and 1909.

3. Commodities Market Insight

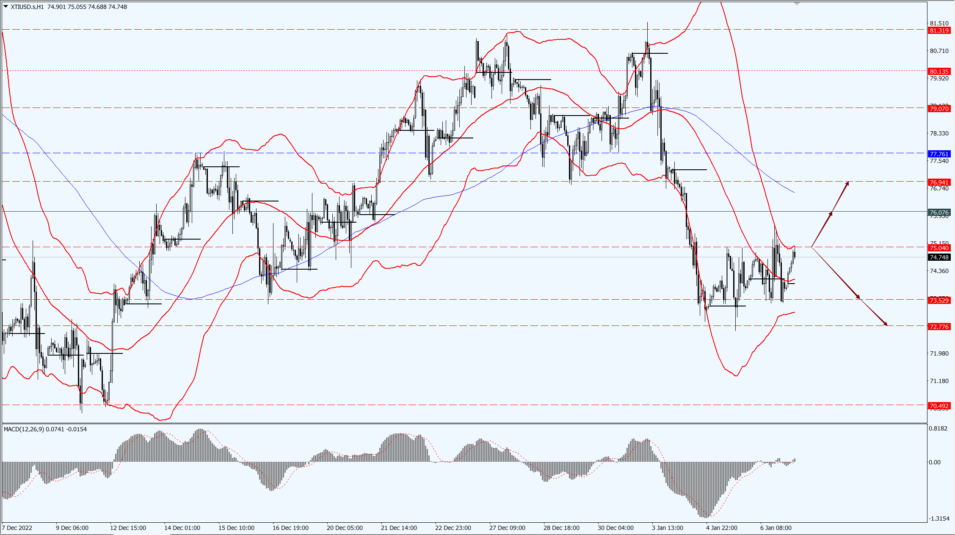

WTI Crude Oil

Fundamental Analysis:

Oil prices were little changed on Friday 6th January 2023 as the market balanced a weaker dollar and a mixed U.S. jobs report, but both major indicators of crude oil plunged in the first week of the year on fears of a global recession.

Both Brent and U.S. crude futures plunged more than 8% last week, the worst start to the year since 2016. In the previous three weeks, both indicator crudes were up about 13%.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 75.04- line today. If the oil price runs above the 75.04 -line, then focus on the suppression strength of the two positions of 76.07 and 76.94. If the oil price runs below the 75.04 -line, then pay attention to the support strength of the two positions of 73.52 and 72.77.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.