1. Forex Market Insight

EUR/USD

Eurozone business activity fell for the fifth consecutive month in November, but a silver lining to weaker demand and easing supply was that manufacturing continued to lead the decline, with factory output falling for the sixth consecutive month.

Although the rate of decline in output has slowed, the latest drop is still the second largest decline on record over the past decade.

Service sector output also posted its fourth consecutive monthly decline. Price pressures have also cooled, particularly in the manufacturing sector.

The rate of increase in business costs was the lowest in 14 months, which in turn has led to a moderation in sales price inflation, although inflation remains high.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0275 line today. If the EUR runs below the 1.0275 line, then pay attention to the support strength of the two positions of 1.0088 and 0.9945. If the strength of EUR rises over the 1.0275 line, then pay attention to the suppression strength of the two positions of 1.0440 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound surged higher on Wednesday, 23rd November 2022 rising for a second day against the dollar after preliminary data on British economic activity was better than expected, although it still showed the economy was shrinking. The pound was up 1.43% at $1.2055 late in New York.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2106 -line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.1977 and 1.1898. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices held above the lows touched in the previous session on Tuesday 23rd November 2022 as the dollar and

Gold prices extended gains on Wednesday, 23rd November 2022 as minutes from the Federal Reserve’s November policy meeting showed “overwhelming” support from policymakers for slowing the pace of interest rate hikes.

According to the minutes of the Fed’s Nov. 1-2 meeting, a slower pace would better allow the Federal Open Market Committee (FOMC) to assess its progress toward its goals of maximizing employment and stabilizing prices.

Gold was also boosted by a nearly 1% decline in the dollar, making gold cheaper for investors holding other currencies, and a drop in the yield on index U.S. bonds.

In addition, U.S. business activity contracted for the fifth straight month in November, with a measure of new orders falling to its lowest level in two-and-a-half years as demand slowed due to rising interest rates.

Technical Analysis:

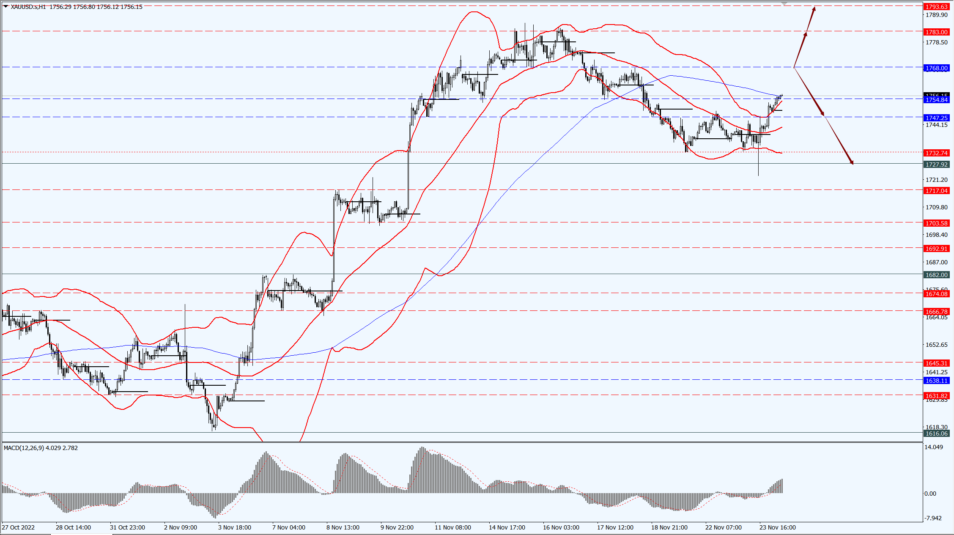

(Gold 1-hour Chart)

Gold pays attention to the 1768-line today. If the gold price runs below the 1768-line, then it will pay attention to the support strength of the 1747 and 1727 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of 1783 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell more than 4% on Wednesday 23rd November 2022 as the Group of Seven (G7) considered setting a price cap on Russian oil above current market levels, as well as an increase in U.S. gasoline inventories that exceeded market expectations.

Oil prices were further hit by reports that the G7’s price cap on Russian seaborne oil could be higher than current trading levels.

According to a European official on Wednesday, 23rd November 2022 the G7 is considering capping the price of Russian seaborne oil in the range of $65-70 per barrel.

Meanwhile, Urals crude delivered to Northwest Europe is trading at about $62-63 per barrel, although prices are higher in the Mediterranean at about $67-68 per barrel, according to Refinitiv data.

With production costs estimated at around $20 a barrel, the cap would still make it profitable for Russia to sell its oil and in that way prevent a supply shortage on the global market.

A senior U.S. Treasury official said Tuesday that the price cap could be adjusted several times a year. Oil prices found some support after minutes from the Federal Reserve’s November meeting showed most policymakers agreed to slow interest rate hikes soon.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 77.54 line today. If the oil price runs above the 77.54-line, then focus on the suppression strength of the two positions of 79.09 and 81.31. If the oil price runs below the 77.54-line, then pay attention to the support strength of the two positions of 79.07 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.