1. Forex Market Insight

EUR/USD

EUR/USD closed up 0.09% on Monday, 19th September 2022, at 1.0021. Eurozone economic weakness concerns do not dissipate and still limit the euro’s gains.

Economists surveyed now believe that the likelihood of the eurozone economy contracting for two consecutive quarters in the next 12 months is 80%, up from 60% in the previous survey.

Germany, the eurozone’s largest economy and one of the countries most affected by gas supply cuts, could see its economy contract from as early as this quarter.

Business surveys show that economic activity in the eurozone has been contracting since July, with little sign of improvement in the near term.

In addition, eurozone inflation is expected to peak at 9.6% in the last three months of the year.

Economists now believe that the European Central Bank (ECB) will pause the rate hike cycle early, but will raise the deposit rate to a peak of 2% by next February.

More than half of economists expect the ECB to raise interest rates by 75 basis points at its October meeting.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9909 and 0.9879. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD closed up 0.08% at 1.1431 on Monday, 19th September 2022.

British retail sales fell sharply in August, as British consumers struggled to cope with soaring prices and high energy costs.

Between July and August of this year, the volume of goods purchased in the UK fell by 1.6%, reversing a small increase in the previous month.

The UK Office for National Statistics says rising prices and the cost of living are affecting sales.

Since the reopening of the UK economy in the summer of 2021, sales have continued to trend downwards.

Technical Analysis:

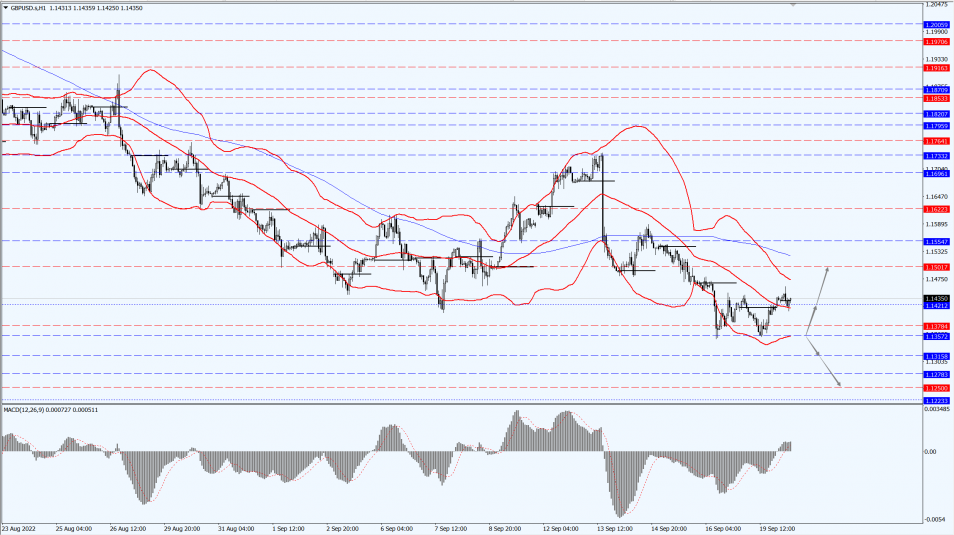

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1357-line today. If GBP runs below the 1.1357-line, it will pay attention to the suppression strength of the two positions of 1.1315 and 1.1250. If GBP runs above the 1.1357-line, then pay attention to the suppression strength of the two positions of 1.1421 and 1.1501.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

While geopolitical tensions, Europe facing an energy crisis and a higher risk of global recession, market expectations of a 100 basis point Fed rate hike this week have cooled slightly, providing safe-haven support and low-buying support to gold prices.

But the prospect of interest rate hikes by most central banks around the world, especially the expectation that the Fed will raise rates by at least 75 basis points this week, still makes bulls wary, and U.S. bond yields continue to climb higher, limiting the room for a rally in gold prices.

Near the Federal Reserve interest rate resolution, the market wait-and-see mood heated up, the overall trading is expected to be some restrictions, gold prices short term bias oscillating operation.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1680-line today. If the gold price runs steadily below the 1680-line, then it will pay attention to the support strength of the 1671 and 1660 positions. If the gold price breaks above the 1680-line, then pay attention to the suppression strength of the two positions of the 1686 and 1693.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

International oil prices rebounded slightly as concerns about tight supply outweighed worries about global demand slowing due to a stronger dollar and the possibility of a sharp increase in dollar interest rates.

OPEC+ oil production in August was 3.583 million barrels per day below its target daily output, Reuters showed, citing an internal document.

Surveys of OPEC+ crude oil production show that crude oil production is well below the August quota, leaving the market feeling that they simply cannot increase production if there is demand in the market.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 84.02-line today. If the oil price runs above the 84.02-line, then focus on the suppression strength of the two positions of 85.72 and 81.07. If the oil price runs below the 84.02-line, then pay attention to the support strength of the two positions of 82.72 and 81.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.