1. Forex Market Insight

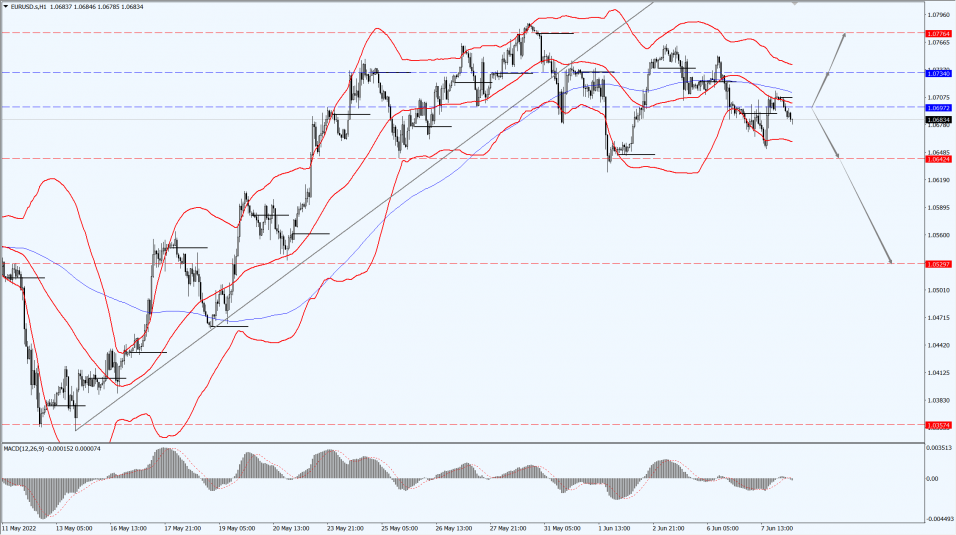

EUR/USD

The U.S. dollar index fell 0.176% on Tuesday, 7th June 2022, hitting a low of 102.26, and finally closed down 0.05% at 102.34.

EUR/USD climbed 0.14% at one point, hitting a high of 1.0713 before paring gains to end up 0.05% at 1.07.

The European Central Bank (ECB) will announce its interest rate resolution on 9th June 2022, while the Federal Reserve will announce its interest rate resolution on 15th June 2022, which investors need to keep an eye on.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0697-line today. If EUR runs steadily above the 1.0697-line, then pay attention to the support strength of the two positions of 1.0734 and 1.0776. If the strength of EUR breaks below the 1.0697-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0529.

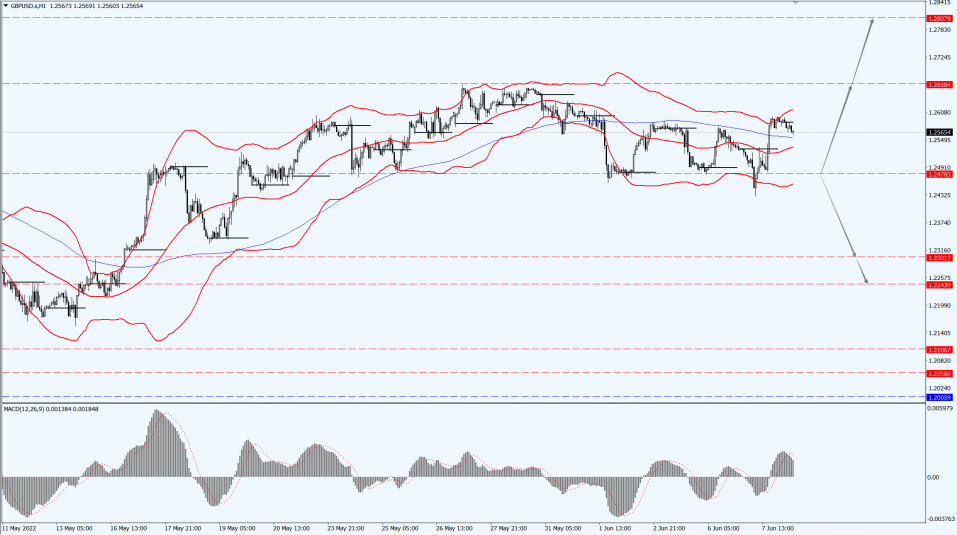

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP, which had previously fallen to its lowest in nearly three weeks, rose on Tuesday, 7th June 2022, and ended up 0.49% at 1.2589.

British Prime Minister Johnson waded through a confidence vote yesterday, 7th June 2022, weakening his political position.

Therefore, future central bank policy and economic issues have a greater impact on GBP than the political situation.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2301 and 1.2243. If GBP runs above the 1.2478-line, then pay attention to the suppression strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fluctuated slightly, and is currently trading around $1,849.

The World Bank lowered its global growth forecast to 2.9% this year.

Moreover, the war between Russia and Ukraine continues, giving gold prices some safe-heaven support. The rise and fall of the US dollar index also provided gold the opportunity to rally.

In addition, U.S. Treasury Secretary Yellen called U.S. inflation “unacceptable” and may remain high.

It has also increased investor interest in gold.

However, the market generally pays attention to the US May CPI data released this week.

With the U.S. trade deficit falling the most in nearly nine and a half years in April, the dollar is still relatively strong.

U.S. stocks are approaching near one-month high, which could put some pressure on gold prices.

There is more uncertainty about the short-term gold price trend.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily above the 1832-line, then it will pay attention to the support strength of the 1871 and 1880 positions. If the gold price breaks below the 1832-line, then pay attention to the suppression strength of the two positions of the 1820 and 1807.

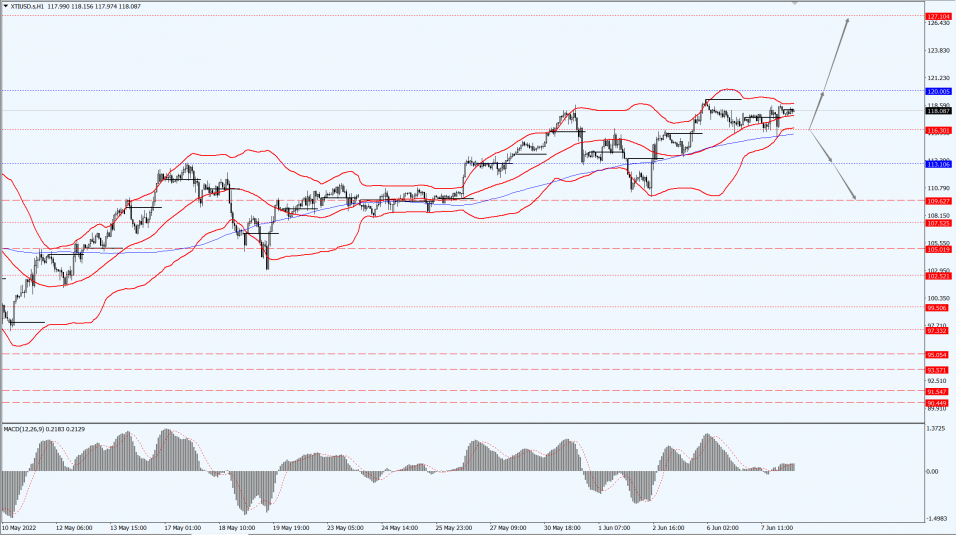

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil in a narrow range, now at $119.72/barrel.

Morning API data showed that the U.S. API crude oil inventories increased by 1.845 million barrels in the week ended 3rd June 2022.

In addition, Yellen said the United States is negotiating to limit the price of Russian oil, and the World Bank once again lowered its global growth forecast dragged down oil prices.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 116.30-line today. If the oil price runs above the 116.30-line, then focus on the suppression strength of the two positions of 120.06 and 127.10. If the oil price runs below the 116.30-line, then pay attention to the support strength of the two positions of 113.10 and 109.62.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.