1. Forex Market Insight

EUR/USD

Lagarde’s comments implied an increase of at least 50 basis points to the European Central Bank (ECB) deposit rate and kept speculation alive of bigger rate hikes this summer to fight record-high inflation, partly due to rising energy prices over Russia’s war against Ukraine as well as massive public-sector stimulus the pandemic.

EUR/USD rose 0.4% at $1.0747, after rallying a cumulative 3.7% in the past seven trading days.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0697-line today. If EUR runs steadily above the 1.0697-line, then pay attention to the support strength of the two positions of 1.0734 and 1.0776. If the strength of EUR breaks below the 1.0697-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD fell 0.39%.

A business survey released earlier shows that the U.K. economic momentum has slowed much more than expected this month.

Recession fears grow due to rising inflation.

Technical Analysis:

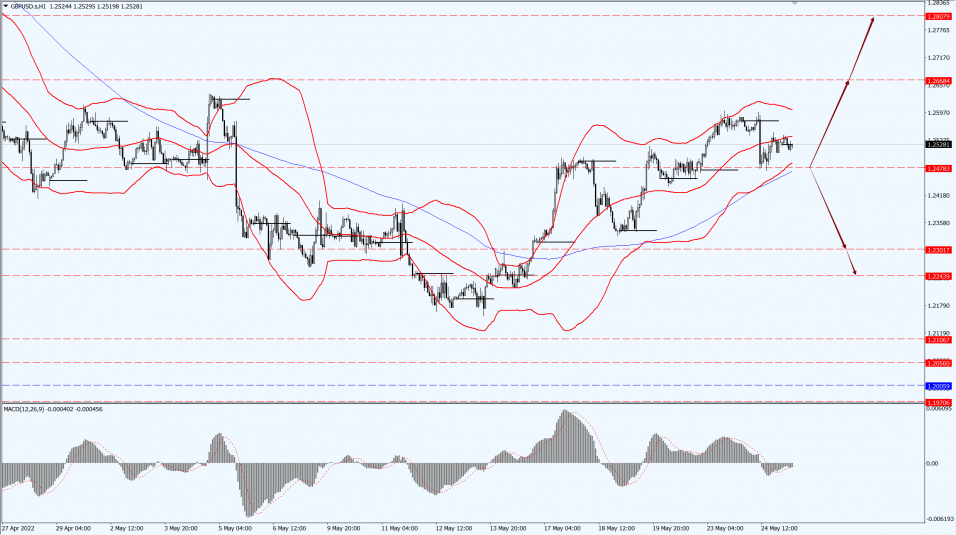

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2301 and 1.2243. If GBP runs above the 1.2478-line, then pay attention to the suppression strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

As U.S. new home sales data fell to a two-year low yesterday, 24th May 2022.

ECB President Lagarde reinforced expectations of a July rate hike and the dollar index hit a fresh nearly one-month low, giving gold prices momentum to rally.

In addition, Russia attempted to encircle the Ukrainian army in a full-scale offensive in eastern Ukraine, and Canada provided Ukraine with another 20,000 artillery shells.

Geopolitical tensions also provided support to gold prices. Spot gold closed up 0.7% yesterday, 24th May 2022.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1866-line today. If the gold price runs steadily below the 1866-line, then it will pay attention to the support strength of the 1853 and 1844 positions. If the gold price breaks above the 1866-line, then pay attention to the suppression strength of the two positions of the 1880 and 1892.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. crude oil fell 52 cents to settle at $109.77 a barrel, its lowest level in nearly a week, closing lower for the second day in a row.

Following the announcement made by the U.S. Department of Energy, no more than 40.1 million barrels of crude oil will be sold under President Biden’s plan, of which to release 1 million barrels per day of oil reserves over a six-month period.

The U.S. Department of Energy said it would release no more than 39 million barrels of sour crude oil between 1st July 2022 and 15th August 2022, and another 1.1 million barrels of sweet crude from 21st June 2022 to 30th June 2022.

Oil prices have traded in a narrow range around $110 a barrel over the past two weeks, as investors weigh the impact of the Ukraine war, including Hungary’s opposition to the EU embargo on Russian oil, and the prospects for global economic growth.

While U.S. oil consumption is expected to rise further during the busy summer driving season, the pandemic prevention and control have limited energy usage.

Markets were volatile in early trade as comments from the Saudi foreign minister suggested the kingdom would not supply more oil, underscoring a tight market,

The coronavirus lockdown has hit the outlook for global demand.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 109.62-line today. If the oil price runs below the 109.62-line, then focus on the suppression strength of the two positions of 107.52 and 105.52. If the oil price runs above the 109.62-line, then pay attention to the support strength of the two positions of 111.95 and 116.30.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.