EUR/USD rose 0.7% to 0.9804.

Data showed that economic sentiment in the eurozone fell sharply in September and by more than expected, as business and consumer confidence fell and they were pessimistic about the inflation trend in the coming months.

The biggest focus, however, was on German inflation, which jumped to 10.9% this month, well above expectations of 10%.

This suggests that the broader 19-country eurozone figure to be released on Friday could also exceed forecasts of 9.6%, strengthening the case for another 75 bps rate hike at the next ECB policy meeting.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9701-line today. If EUR runs steadily below the 0.9701-line, then pay attention to the support strength of the two positions of 0.9597 and 0.9559. If the strength of EUR breaks above the 0.9701-line, then pay attention to the suppression strength of the two positions of 0.9810 and 0.9879

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound posted its biggest one-day percentage gain since March 2020.

The pound extended gains to end New York trading at $1.1084, up 1.8%, after reports that British Prime Minister Donald Truss will meet urgently with the head of the Office for Budget Responsibility (OBR) on Friday, 20th September 2022.

After hitting an all-time low of $1.0327 three days ago, the pound has rallied more than 7% against the dollar.

The pound rallied partly because of the action taken by the Bank of England.

On Thursday, 29th September 2022, the Bank of England bought 1.415 billion pounds ($1.55 billion) of British government bonds with maturities of more than 20 years, two days into a tens of billions of pounds program aimed at stabilizing markets.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1212-line today. If GBP runs below the 1.1212-line, it will pay attention to the suppression strength of the two positions of 1.1013 and 1.0926. If GBP runs above the 1.1212-line, then pay attention to the suppression strength of the two positions of 1.1355 and 1.1463.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices held steady Thursday, 29th September 2022, as a falling dollar offset the impact of rising U.S. bond yields and heightened concerns about the Federal Reserve’s aggressive monetary policy.

Data released Thursday, 29th September 2022, showed that the U.S. gross domestic product (GDP) contracted at a 0.6% annualized rate in the second quarter from a year earlier.

Gold prices fell after the data was released. Investors also assessed a U.S. employment data, which showed that initial jobless claims fell to 193,000 last week, compared to expectations of 215,000.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1648-line today. If the gold price runs steadily below the 1660-line, then it will pay attention to the support strength of the 1639 and 1629 positions. If the gold price breaks above the 1648-line, then pay attention to the suppression strength of the two positions of the 1660 and 1680.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed lower in shaky trading Thursday, 29th September 2022, rising once above $90 a barrel before retreating as traders weighed a worsening economic outlook and a possible announcement of production cuts by the OPEC+ alliance next week.

Three sources told Reuters that key OPEC+ members have started discussions to announce oil output cuts at their next meeting on 5th Oct 2022.

One OPEC source told Reuters that a production cut is “possible,” and two other OPEC+ sources said key members have talked about the issue. Reuters reported this week that Russia may propose that OPEC+ cut oil production by about 1 million barrels per day.

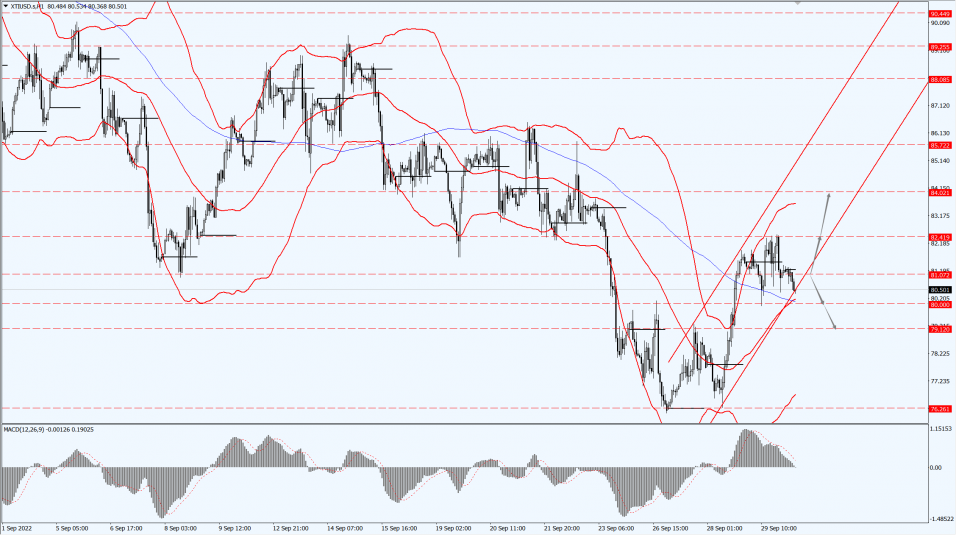

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 81.07-line today. If the oil price runs above the 81.07-line, then focus on the suppression strength of the two positions of 82.41 and 79.12. If the oil price runs below the 81.07-line, then pay attention to the support strength of the two positions of 80.00 and 79.12.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.