1. Forex Market Insight

EUR/USD

On Monday, 18th October 2022, euro gained 1.19% against the greenback to $0.9838. However, the risk of recession remains a headwind for the upside of the exchange rate.

European Central Bank Vice President Luis de Guindos stated that the ECB can’t exclude the possibility of a technical recession hitting the euro area. The ECB doesn’t target forex rate, but considers it.

Technical Analysis:

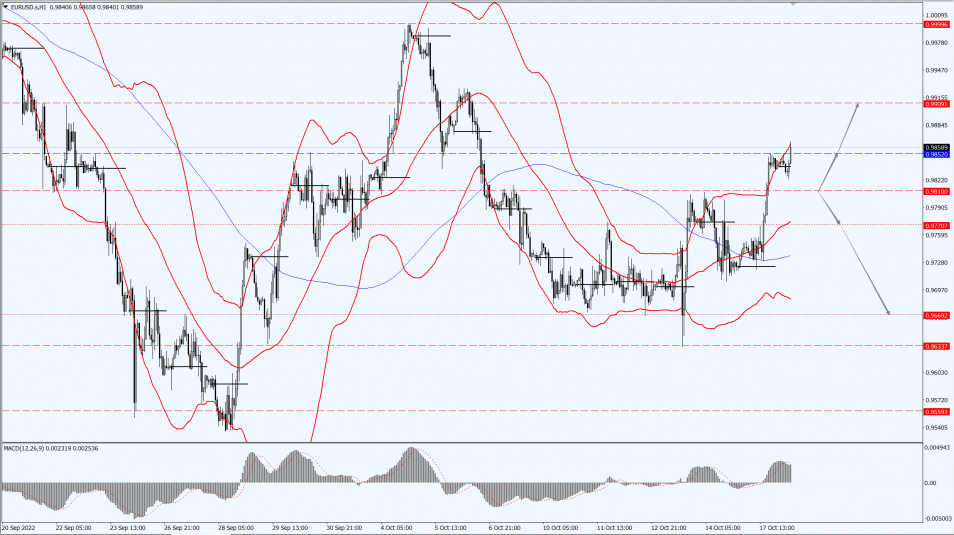

(EUR/USD 1-hour Chart)

We focus on the 0.9810 line today. If the EUR runs below the 0.9810 line, then pay attention to the support strength of the two positions of 0.9770 and 0.9669. If the strength of EUR rise over the 0.9810 line, then pay attention to the suppression strength of the two positions of 0.9852 and 0.9909.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rebounded against the dollar on Monday, 18th October 2022 but remain limited, closing up 1.63% at 1.1358.

Bank of England (BoE) rate hike, political turmoil and recession are the downsides to the pound.

Traders reduced their bets on the BoE’s interest rate hike, and expected that the BoE’s key interest rate will reach a peak of 5.36% by May next year.

Britain’s new Chancellor of the Exchequer, Jeremy Hunt, said in a statement yesterday, 18th October 2022, that he is scrapping “almost all” the tax cuts announced by the government in September this year.

This measurement is to deliver long-term economic stability and enhance public confidence towards the government’s fiscal policy.

Technical Analysis:

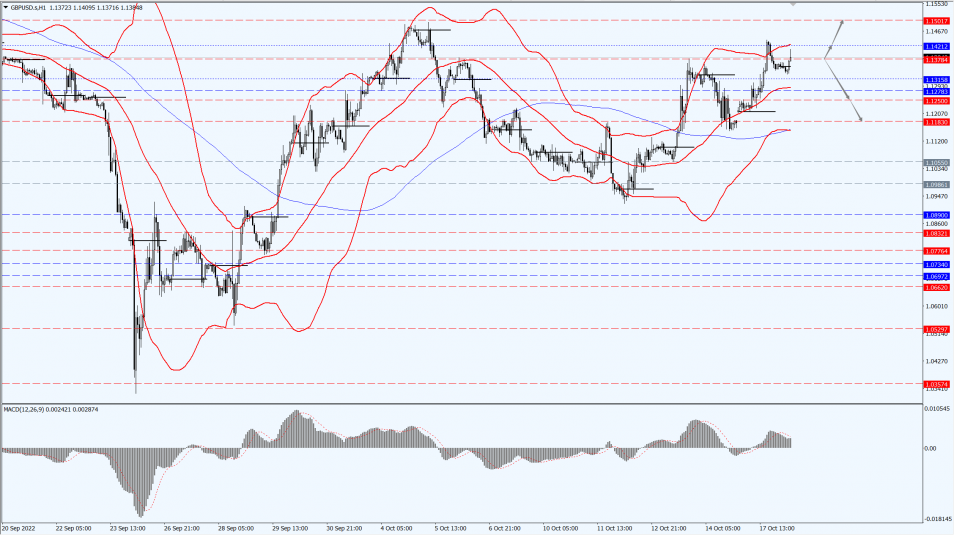

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1378-line today. If GBP runs below the 1.1378 -line, it will pay attention to the suppression strength of the two positions of 1.1250 and 1.1183. If GBP runs above the 1.1378 -line, then pay attention to the suppression strength of the two positions of 1.1421 and 1.1501.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices on Monday , 18th October 2022 rose more than 1% after falling in the previous two sessions as the U.S. dollar and Treasury yields faltered, although risks from looming Federal Reserve interest rate hikes persisted.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1642-line today. If the gold price runs below the 1642-line, then it will pay attention to the support strength of the 1627 and 1616 positions. If the gold price breaks above the 1642-line, then pay attention to the suppression strength of the two positions of the 1671 and 1682.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices held steady on Monday, 18th October 2022 in choppy trading as fears that high inflation and energy costs could drag the global economy into recession.

Brent crude futures were down 0.01%, to US$91.62 a barrel, recovering from a 6.4% fall last week. U.S. crude oil futures settled 0.2% lower at $85.46 a barrel, after a 7.6% decline last week.

Technical Analysis:

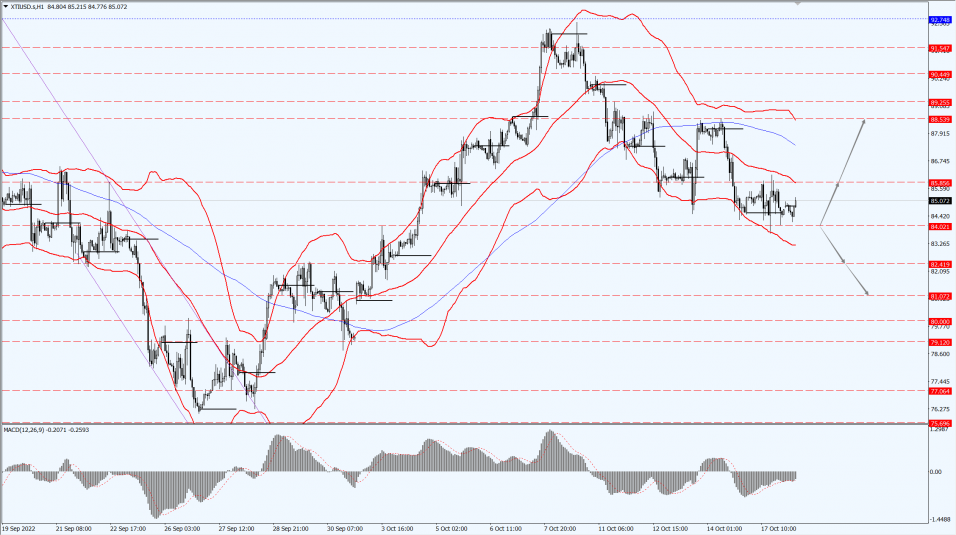

(Crude Oil 1-hour Chart)

Oil prices focus on the 84.02-line today. If the oil price runs above the 84.02-line, then focus on the suppression strength of the two positions of 85.72 and 88.08. If the oil price runs below the 84.02-line, then pay attention to the support strength of the two positions of 82.41 and 81.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.