1. Forex Market Insight

EUR/USD

The European Central Bank (ECB) said on Wednesday, 15th June 2022, that the Bank will reinvest maturing debt to help more indebted member countries, and will design a new tool to stop fragmentation.

The so-called fragmentation risk refers to concerns that monetary policy actions by the ECB may affect the 19 countries of the euro area in different ways.

Bond yields in some countries will rise sharply, disconnected from economic fundamentals.

With the dollar under renewed selling pressure, the euro rose 1.05% against the dollar at one point on Wednesday, hitting a high of 1.0507.

It ended up 0.27% at 1.0442.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD recovered from lowest level since March 2020,

At one point, it expanded to 1.71%, touching a high of 1.2203.

The exchange rate then narrowed its gains and finally closed up 1.48% at 1.2174.

The market currently expects the Bank of England to raise interest rates by 25 basis points on Thursday’s, 16th June 2022, interest rate decision, which is expected to support the pound in the short term.

However, as the slowdown in UK economic growth and a possible trade conflict with the EU put pressure on the currency, the pound may only be taking a breather for the time being.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2005 and 1.1916. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold oscillated narrowly above 1830, holding on to most of its overnight gains.

Although the Federal Reserve raised interest rates by 75 basis points on Wednesday, 16th June 2022, which once put pressure on gold prices, the Fed expects economic growth to slow in the coming months,

Moreover, Fed Chairman Powell downplayed expectations of a 75 basis point rate hike in July, sending the dollar and U.S. bond yields sharply lower.

Coupled with poor retail sales data and geopolitical tensions between Russia and Ukraine, gold bulls made a big comeback, with gold prices touching a high of $1841.69 an ounce.

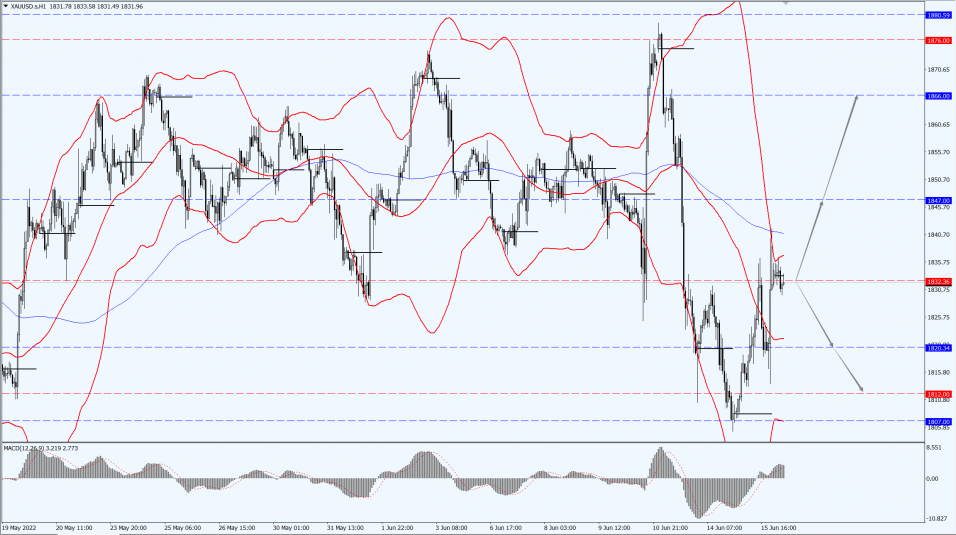

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily below the 1832-line, then it will pay attention to the support strength of the 1820 and 1812 positions. If the gold price breaks above the 183e2-line, then pay attention to the suppression strength of the two positions of the 1847 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil is now at $116.64 per barrel, with oil prices down more than 2.7% on Wednesday, 15th June 2022.

The Fed’s interest rate hike and the expected slowdown in economic growth added resistance to crude oil’s recent gains, combined with an unexpected build in U.S. crude inventories last week, oil prices fell.

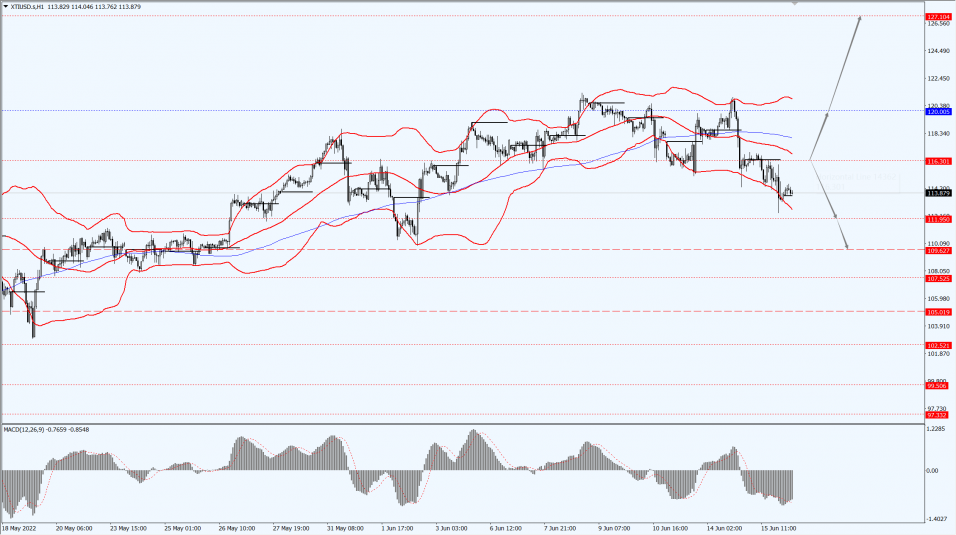

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 116.30-line today. If the oil price runs above the 116.30-line, then focus on the suppression strength of the two positions of 120.06 and 127.10. If the oil price runs below the 116.30-line, then pay attention to the support strength of the two positions of 113.10 and 109.62.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.