1. Forex Market Insight

EUR/USD

EUR/USD rose more than 1%, extending the momentum of the rebound after hitting a five-year low last week and further distancing EUR from parity against USD.

EUR strengthened after hawkish comments from Dutch Central Bank governor and European Central Bank governing council member Knott.

Knott said the ECB will not only raise interest rates by 25 basis points in July, but is also prepared to consider a larger rate hike if inflation is higher than expected.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily above the 1.0529-line, then pay attention to the support strength of the two positions of 1.0662 and 1.0776. If the strength of EUR breaks below the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0184.

GBP Intraday Trend Analysis

Fundamental Analysis:

GDP took advantage of a weaker dollar to jump 1.4% to its highest level since 5th May 2022.

Previously, strong UK labor market data reinforced expectations that the Bank of England will continue to raise interest rates to fight inflation.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2243 and 1.2106. If GBP runs above the 1.2478-line, then pay attention to the suppression strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold edged lower yesterday, 17th May 2022, as strong U.S. retail sales data and expectations of an aggressive rate hike overshadowed support from a retreating dollar.

Rising stock markets in Europe and the U.S. also weighed on gold prices.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1830-line today. If the gold price runs steadily below the 1830-line, then it will pay attention to the support strength of the 1812 and 1793 positions. If the gold price breaks above the 1830-line, then pay attention to the suppression strength of the two positions of the 1844 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices retreated yesterday, 17th May 2022, after setting a new high since 9th March 2022, to 115.56 during the session.

There is news that the United States will ease some restrictions on the Venezuelan government.

Expectations of a possible increase in Venezuelan crude oil supply dragged down oil prices.

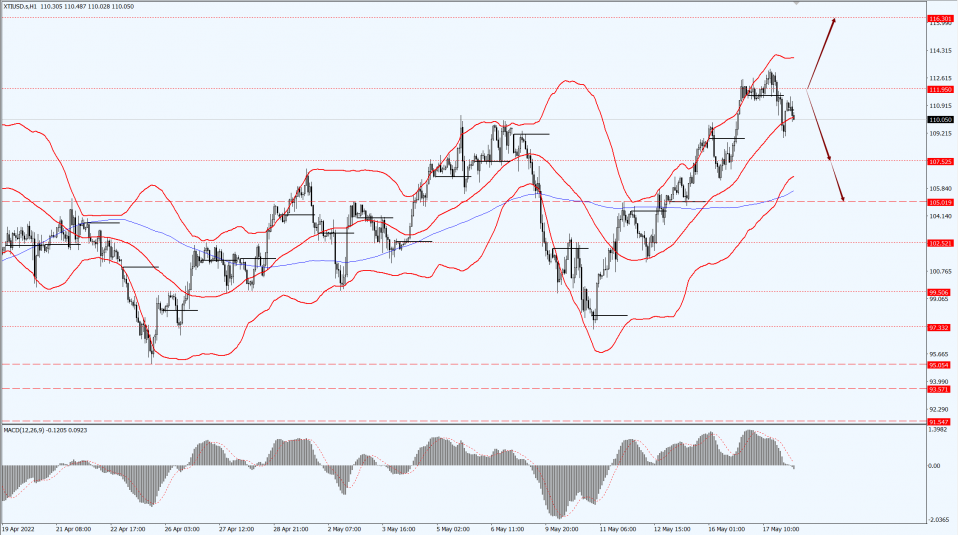

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 111.95-line today. If the oil price runs below the 111.95-line, then focus on the suppression strength of the two positions of 107.52 and 105.01. If the oil price runs above the 111.95-line, then pay attention to the support strength of 116.30.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.